- United States

- /

- Retail REITs

- /

- NYSE:CURB

Curbline Properties (CURB): Valuation in Focus After Turn to Profit and Lowered 2025 Outlook

Reviewed by Simply Wall St

Curbline Properties (CURB) just released its third quarter numbers. The company turned a net loss last year into a net profit this time around. However, it also trimmed its 2025 earnings forecast, signaling a more measured outlook ahead.

See our latest analysis for Curbline Properties.

Shares of Curbline Properties have seen some ups and downs this year, with a recent 1-day share price return of 1.21% after the latest results. The total shareholder return over the past year has landed at 5.05%. The stronger quarterly turnaround has caught investors’ attention, but the lowered 2025 forecast suggests some are dialing back expectations for near-term momentum.

If Curbline's earnings shift has you thinking about your next opportunity, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock trading at a 13% discount to analyst price targets and management dialing down its forecasts, investors are left to wonder if this is a buying window or if the market already expects slower growth ahead.

Price-to-Earnings of 59.9x: Is it justified?

Curbline Properties trades at a lofty price-to-earnings (P/E) multiple of 59.9x, noticeably above its US Retail REITs peers and its own fair value range. With shares closing at $23.34, investors are paying a premium compared to both the industry average and what the company’s underlying earnings might support.

The P/E ratio measures how much investors are willing to pay for each dollar of the company’s earnings, providing a snapshot of the market’s growth and profitability expectations. For the real estate sector, especially REITs, it offers a clear lens to judge market sentiment on future performance relative to peers.

Despite surging earnings growth over the past year, Curbline’s P/E stands well above the US Retail REITs industry average of 26x and its own estimated fair P/E of 31.2x. This premium suggests investors may be expecting outsized growth. However, the current multiple is difficult to justify against these benchmarks. If the market begins to align more closely with the sector or Curbline’s fair value, its P/E ratio could experience meaningful compression.

Explore the SWS fair ratio for Curbline Properties

Result: Price-to-Earnings of 59.9x (OVERVALUED)

However, unexpected shifts in revenue growth or further downward earnings revisions could present challenges to the current valuation and negatively affect investor sentiment.

Find out about the key risks to this Curbline Properties narrative.

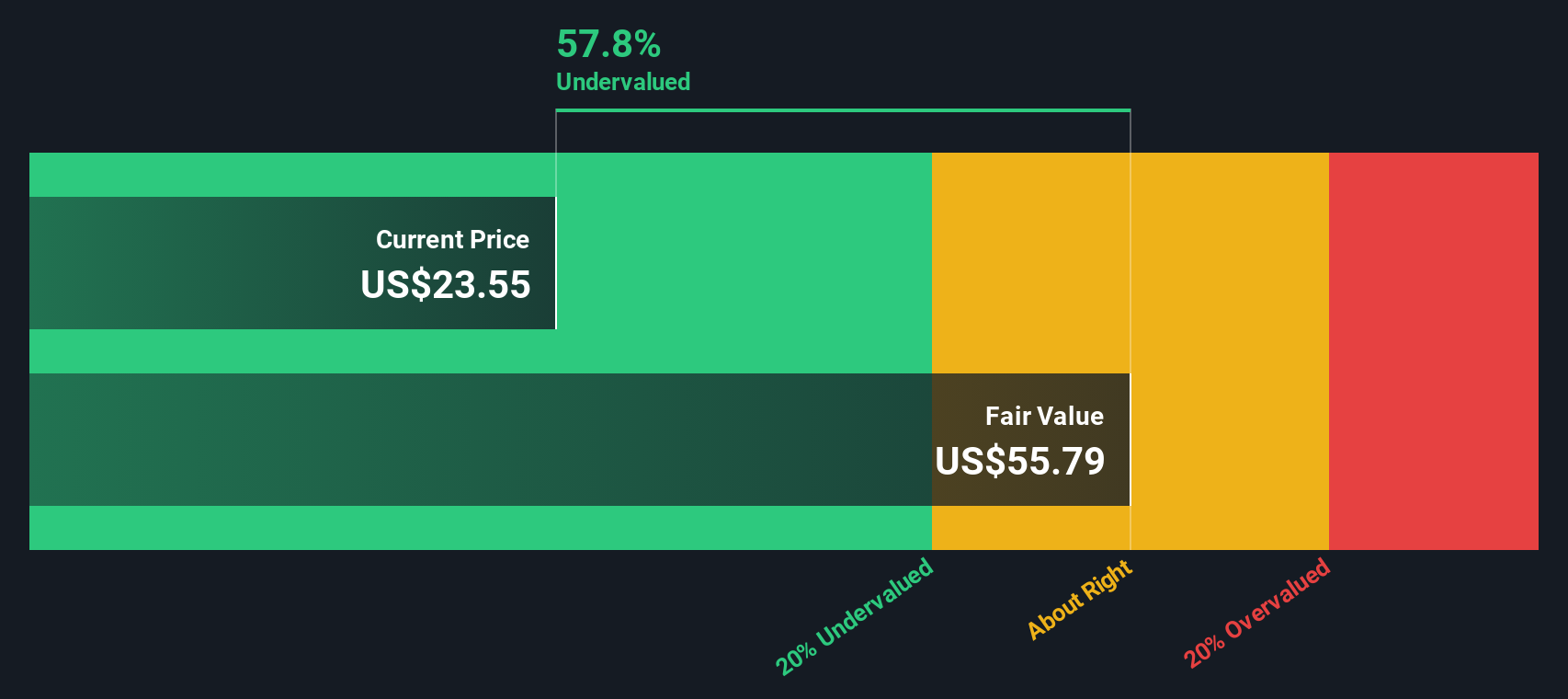

Another View: DCF Model Shows Deep Undervaluation

While the high earnings multiple suggests the stock is expensive, our DCF model presents a strikingly different perspective. According to this method, Curbline Properties is trading at a steep 56% discount to its estimated fair value of $53.35, which indicates strong potential upside. Does the market see risks the DCF overlooks, or is there an opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Curbline Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Curbline Properties Narrative

If you think the market’s story about Curbline Properties misses important details, dive into the fundamentals yourself and shape your perspective in just a few minutes. Do it your way

A great starting point for your Curbline Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don't let the best opportunities pass you by. Use the Simply Wall Street Screener to target your next winning investment before the crowd catches on.

- Unlock potential early-stage growth by targeting these 3590 penny stocks with strong financials with strong financials and a proven track record.

- Boost your passive income with these 18 dividend stocks with yields > 3% offering yields greater than 3% and strong fundamentals.

- Ride the wave of digital transformation and track market leaders in artificial intelligence by harnessing these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CURB

Curbline Properties

Curbline Properties is an owner and manager of convenience shopping centers positioned on the curbline of well-trafficked intersections and major vehicular corridors in suburban, high household income communities.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives