- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

How Might Gregory Stapley’s Board Return Shape CareTrust REIT’s (CTRE) Leadership and Expansion Strategy?

Reviewed by Sasha Jovanovic

- On October 21, 2025, CareTrust REIT’s Board of Directors increased its size from five to six members and appointed Gregory K. Stapley, former President and CEO, to rejoin the board effective January 1, 2026, with no current plans for committee assignments.

- His return brings decades of industry experience and deep institutional knowledge to CareTrust, potentially enhancing its leadership strength as the company expands its geographic and asset footprint.

- We'll explore how the appointment of Gregory K. Stapley could influence CareTrust REIT's investment narrative amid analyst optimism and growth plans.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CareTrust REIT Investment Narrative Recap

CareTrust REIT shareholders generally back a narrative of strong growth through skilled nursing and senior housing real estate, underpinned by a diversified US and UK asset base. While the appointment of Gregory Stapley reinforces board expertise, it is unlikely to alter the most immediate catalyst, earnings momentum from recent acquisitions, or reduce current risks such as integration challenges or higher general and administrative expenses linked to expansion and new market entry.

Among recent company updates, CareTrust’s acquisition of two UK care homes for about US$27 million stands out, as it closely aligns with the REIT’s international growth strategy and comes just ahead of Stapley rejoining the board. This move builds on the pipeline of external growth and earnings catalysts investors are watching, especially with the upcoming earnings release in focus.

Yet, despite the recent headline appointment, investors should not overlook the risks tied to rapid portfolio expansion and asset integration as...

Read the full narrative on CareTrust REIT (it's free!)

CareTrust REIT is projected to reach $649.2 million in revenue and $460.9 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 20.2% and a $241.6 million increase in earnings from the current $219.3 million.

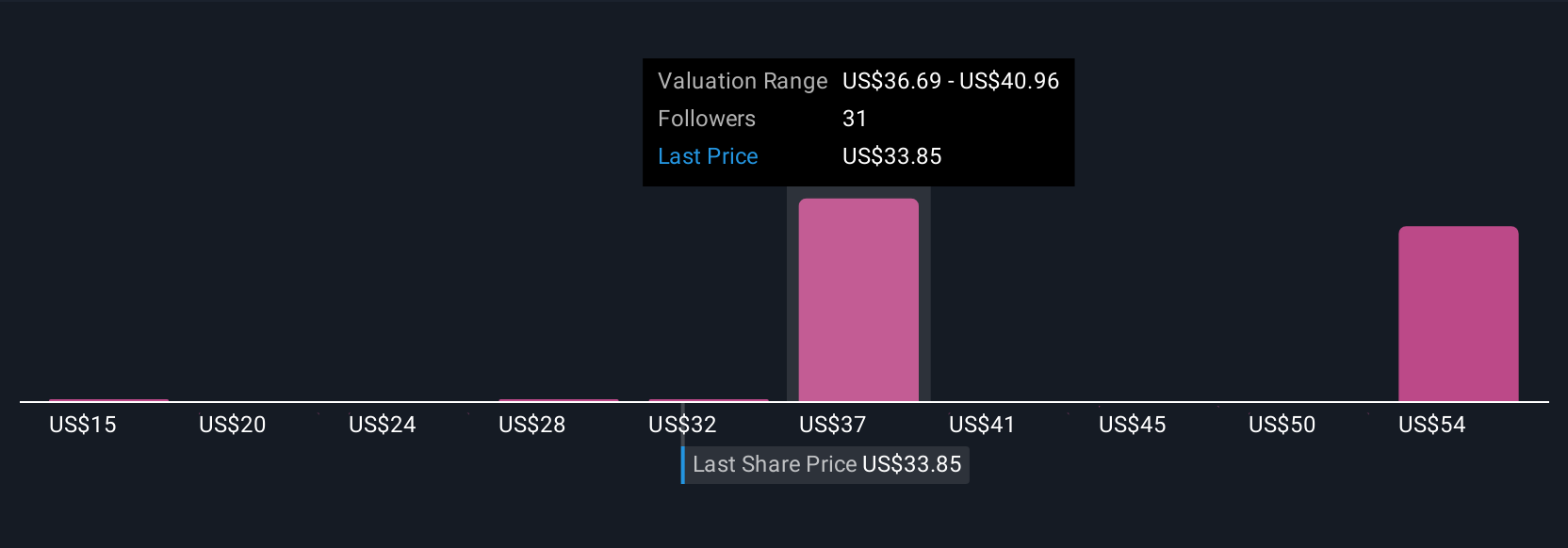

Uncover how CareTrust REIT's forecasts yield a $37.89 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 9 Simply Wall St Community members span from US$15.35 to US$73.54 per share, reflecting dramatically different views on CareTrust’s prospects. Integration risks related to rapid expansion and cross-border acquisitions remain a central factor that could sway actual outcomes, so you may want to review multiple approaches before forming your own outlook.

Explore 9 other fair value estimates on CareTrust REIT - why the stock might be worth less than half the current price!

Build Your Own CareTrust REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CareTrust REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CareTrust REIT's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives