- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

CareTrust REIT (CTRE): Evaluating Valuation After Major Stake Increase by Institutional Investor

Reviewed by Simply Wall St

On September 30, 2025, COHEN & STEERS, INC. made a major move by acquiring over 10 million shares of CareTrust REIT (CTRE), raising its total stake to 8% of the company. This sizable investment signals a vote of confidence in CareTrust REIT’s healthcare real estate strategy and future outlook.

See our latest analysis for CareTrust REIT.

CareTrust REIT’s share price has surged 37.75% year-to-date, with strong momentum building since the start of the year and a remarkable 125.62% total shareholder return over three years. Recent buying from institutional investors such as COHEN & STEERS appears to be fueling optimism about the company’s long-term trajectory.

If CareTrust’s run and institutional attention have you curious, now is a great time to see which other healthcare stocks are gaining steam with our See the full list for free.

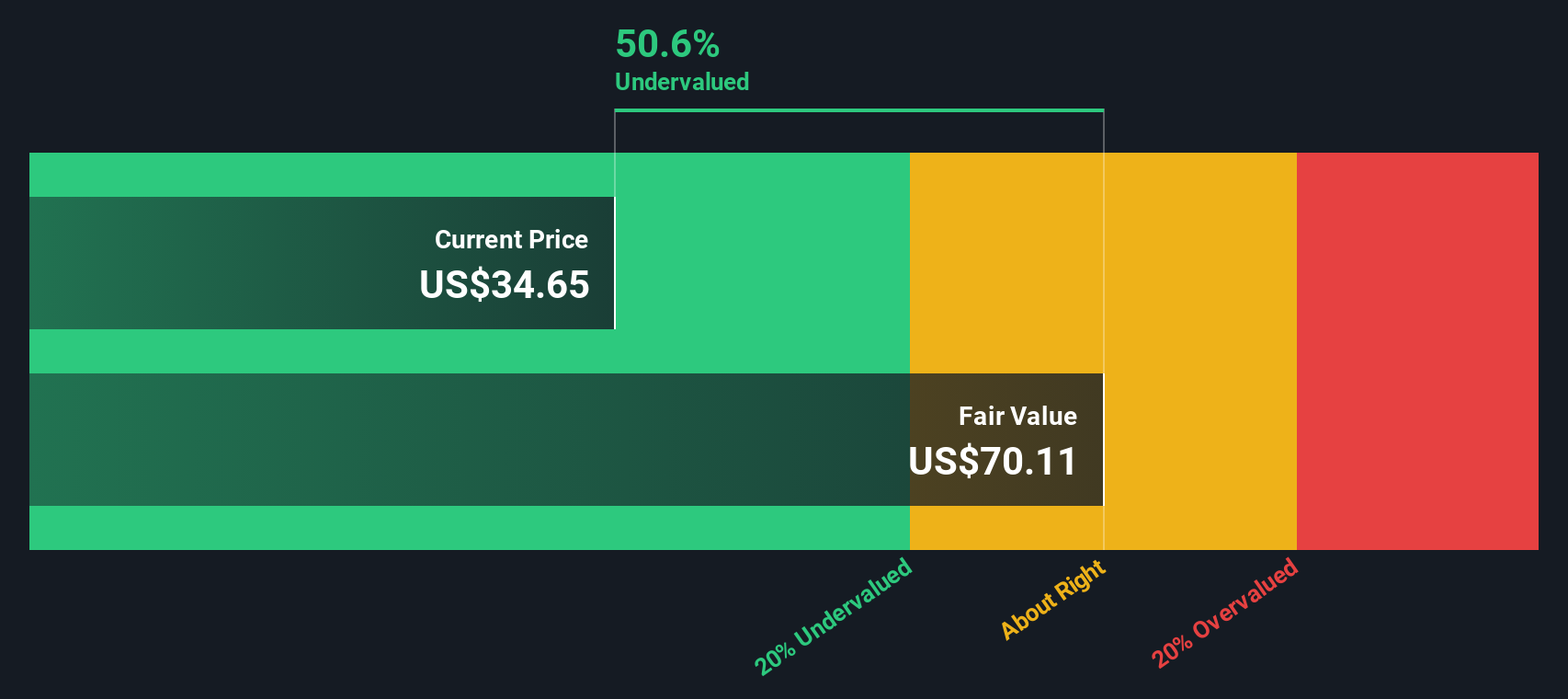

With shares up over 37% this year and institutional money flowing in, is CareTrust REIT still undervalued at current prices, or has the market already factored in its future growth potential as a healthcare REIT leader?

Most Popular Narrative: 5% Undervalued

With CareTrust REIT closing at $36.53 and the most widely followed narrative suggesting a fair value of $38.44, sentiment is leaning toward further room for upside. Investors are weighing today’s price against optimistic long-term expectations grounded in expansion and resilience.

"The expanded investment pipeline of approximately $600 million, mainly in skilled nursing, seniors housing, and U.K. care homes, gives strong visibility into continued external growth. This bolsters FFO and supports durable, long-term dividend increases."

Curious what ambitious financial forecasts and bold international moves are shaping this valuation? The full narrative reveals the high-stakes expansion strategy and the financial bets supporting that price target. Dive in to discover the quantitative levers behind analyst confidence and see what’s fueling the next chapter of CareTrust’s growth story.

Result: Fair Value of $38.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges and rising expenses may dampen profit margins. As a result, the bullish case depends on management executing its ambitious strategy smoothly.

Find out about the key risks to this CareTrust REIT narrative.

Another View: What Does Our DCF Model Say?

While the most popular narrative and price targets rely on analyst forecasts and peer comparisons, the SWS DCF model offers a different perspective. According to our DCF, CareTrust REIT is trading at a steep 36.7% discount to its estimated fair value of $57.67. This suggests the market may be underestimating its long-term cash flow potential. Does this mean a larger opportunity is hiding beneath the surface, or are there risks the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CareTrust REIT Narrative

If you see the story differently or would rather dig into the numbers yourself, it only takes a few minutes to build your own analysis and outlook. Do it your way

A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Look Beyond: Fresh Investing Opportunities Await

Don’t limit yourself to just one winner. Level up your strategy and surface unexpected stocks making waves in today’s market with targeted ideas from our screener.

- Spot tomorrow’s trending AI companies and jump on momentum early using these 26 AI penny stocks for potential market-beating innovations.

- Capture steady income streams and strong yields by checking out these 14 dividend stocks with yields > 3% handpicked for reliable dividend performance.

- Capitalize on overlooked growth by hunting for hidden bargains with these 924 undervalued stocks based on cash flows that trade below their estimated value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing, senior housing and other healthcare-related properties located in the United States and the United Kingdom.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success