- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

A Look at CareTrust REIT’s Valuation After UK Care Home Acquisition Expands Its International Healthcare Portfolio

Reviewed by Kshitija Bhandaru

CareTrust REIT (NYSE:CTRE) just took a meaningful step in its international strategy by acquiring two UK care homes for $27 million. This move locks in long-term, escalating leases that support consistent revenue streams.

See our latest analysis for CareTrust REIT.

This move comes on the heels of CareTrust REIT’s recent U.K. acquisition and May’s Care REIT deal, along with a planned CFO transition next year. While the company’s one-year total shareholder return of 22% underscores strengthening momentum, its latest share price of $35.49 points to investors recognizing growth potential across its expanding U.S. and U.K. healthcare portfolio.

If global expansion stories like CareTrust REIT’s have your attention, it could be the right moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares up over 22% in the past year and trading less than 6% below analyst targets, is CareTrust REIT undervalued, or is the market already factoring in its next phase of international growth?

Most Popular Narrative: 5.5% Undervalued

With the most widely tracked narrative fair value landing at $37.56, CareTrust REIT’s last close of $35.49 suggests room for further upside. This is despite the share price already reflecting recent growth momentum. Market participants are evaluating whether expanding margins and significant revenue growth forecasts can push the stock higher from this point.

“The expanded investment pipeline of approximately $600 million, mainly in skilled nursing, seniors housing, and U.K. care homes, gives strong visibility into continued external growth, bolstering FFO and supporting durable, long-term dividend increases.”

Want to know the secret behind this value premium? The narrative features bold financial projections, aggressive portfolio moves, and a path to higher margins. Which assumptions drive this optimistic outlook, and what future performance benchmarks are embedded in the consensus? Only by reading the full analysis can you uncover the numbers and logic behind this forecast.

Result: Fair Value of $37.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including challenges integrating new acquisitions and potential regulatory shifts in care home markets. Both of these factors could impact future returns.

Find out about the key risks to this CareTrust REIT narrative.

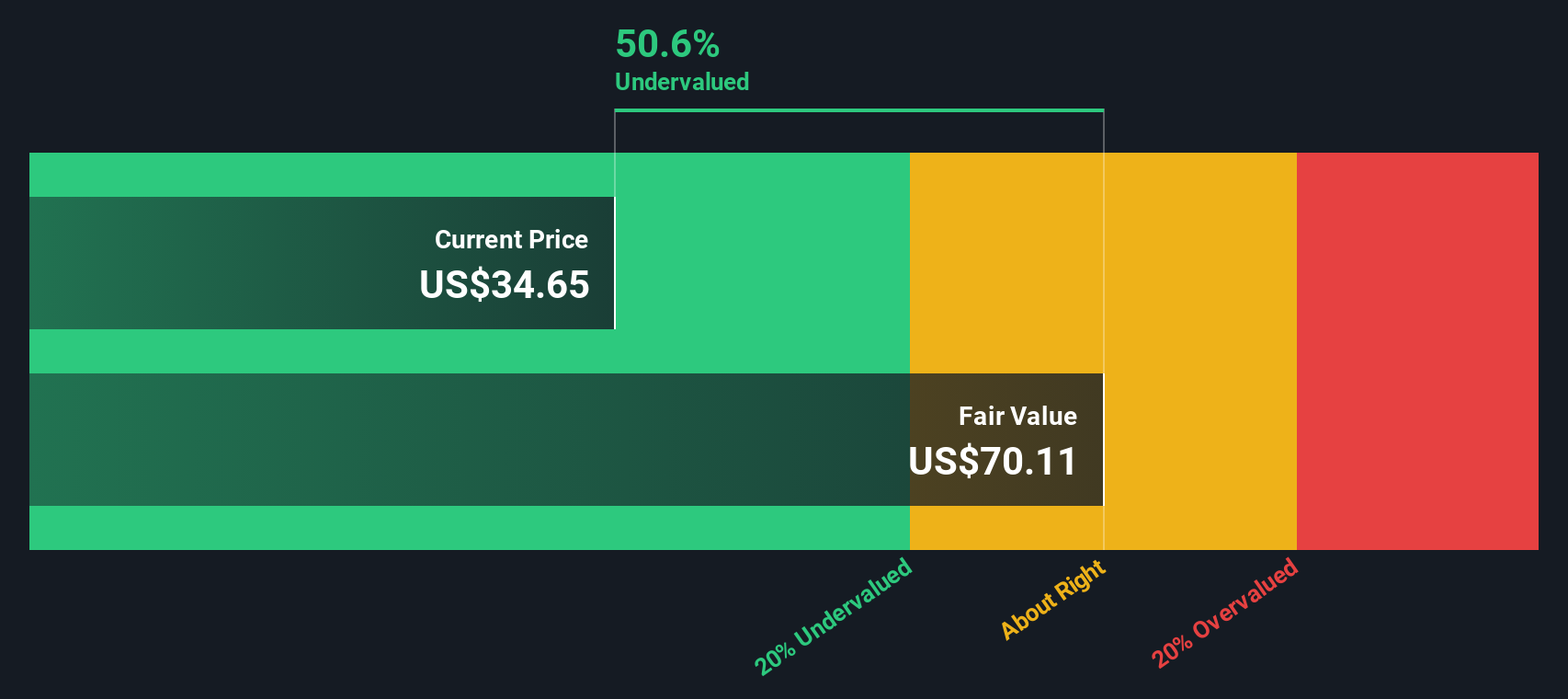

Another View: DCF Model Suggests Even Greater Upside

While analyst targets see modest upside, the SWS DCF model tells a different story. It values CareTrust REIT at $57.95 per share, which is nearly 63% above the current market price. This signals substantial undervaluation if long-term cash flow forecasts play out. However, how reliable are these growth assumptions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CareTrust REIT Narrative

If you have a different perspective or would rather dive into the numbers on your own, it’s quick and easy to craft your own interpretation. Do it your way

A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your full investing potential and give yourself an edge by acting on opportunities others might miss. Don’t stop at one stock when many others are primed for growth.

- Accelerate your search for unbeatable bargains by targeting these 896 undervalued stocks based on cash flows with strong fundamentals and room for big upside.

- Capture income potential right now by tapping into these 19 dividend stocks with yields > 3% and gain exposure to reliable yield beyond the usual suspects.

- Lead the transformation in healthcare by considering these 32 healthcare AI stocks, where innovation and artificial intelligence are changing patient outcomes and reshaping the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives