- United States

- /

- Hotel and Resort REITs

- /

- NYSE:CLDT

Chatham Lodging Trust (CLDT) Profit Relies on $8.8M One-Off Gain, Challenging Earnings Narratives

Reviewed by Simply Wall St

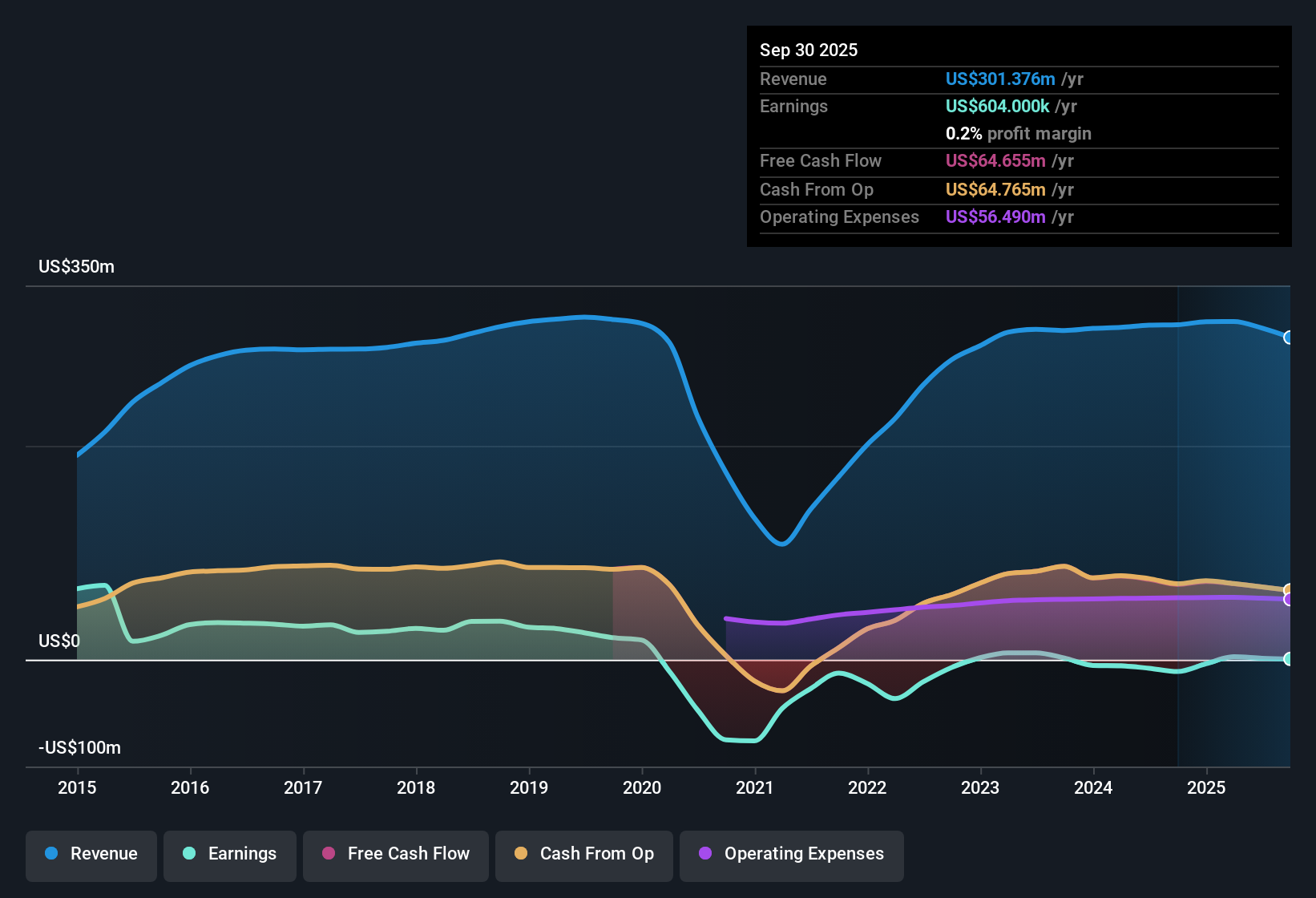

Chatham Lodging Trust (CLDT) recently turned profitable, with net profit margins moving higher over the past year and earnings growing 66.8% annually over the past five years as the company made its transition. However, this year's numbers are clouded by a one-off gain of $8.8 million, making it hard to get a clear read on the underlying trend in recurring earnings. While investors have reason to watch for continued momentum, the recurring quality of these gains remains a central point for scrutiny heading into future quarters.

See our full analysis for Chatham Lodging Trust.The next section dives deeper, putting these headline results side by side with the current market narratives to see what holds up and what might surprise investors.

See what the community is saying about Chatham Lodging Trust

Profit Margins Lean on One-Off Gain

- This year’s net income was inflated by an $8.8 million one-off gain, making it tricky to gauge true recurring profitability going forward.

- According to analysts’ consensus view, while portfolio upgrades and operational efficiencies are credited for supporting stronger long-term margins,

- Heavy reliance on non-recurring items like this gain means future margin stability depends on genuine operational improvements rather than financial windfalls.

- Persistent cost pressures, including a 15% jump in commission expenses this quarter and ongoing labor inflation, stand in the way of replicating recent margin levels on a sustainable basis.

To see how narrative thinking stacks up against the numbers, compare what the data says to the range of recent perspectives on Chatham.

📊 Read the full Chatham Lodging Trust Consensus Narrative.Revenue Growth Lags Sector Benchmarks

- CLDT is projected to grow revenue at just 2.1% annually, trailing well behind the US market average of 10.5% for comparable companies.

- Analysts' consensus view highlights that even with upgrades to the hotel portfolio and demographic trends aiding occupancy rates,

- Chatham’s concentrated geographic focus and high dependence on business travel leave it more exposed to cyclical downturns and muted RevPAR growth than more diversified peers.

- Steady asset recycling supports property quality, but without bolder topline growth, upside is likely capped by both competition and current travel demand dynamics.

Valuation Discount Masks Peer Premium

- At a Price-To-Sales ratio of 1x and trading at $6.47, CLDT appears inexpensive compared to the hotel and resort REIT industry’s 3.8x average and sits 24% below its DCF fair value of $11.20. Still, its multiple is higher than select peers averaging 0.5x.

- Consensus narrative notes that, despite current price levels sitting below the $8.50 analyst target and DCF fair value,

- The premium against peer group sales multiples suggests caution. Investors are paying more per unit of revenue for Chatham than for many competitors.

- This tension complicates the case for upside, especially if recurring profitability falls short of expectations or share issuance increases in future periods.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Chatham Lodging Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh angle on the figures? Take just a few minutes to craft your own perspective and share your take on the story. Do it your way

A great starting point for your Chatham Lodging Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Chatham Lodging Trust’s growth outlook lags peers, with recurring earnings still questionable and revenue expansion noticeably behind sector benchmarks.

To target more consistent performers, use stable growth stocks screener (2074 results) and uncover companies delivering reliable earnings and revenue growth even when others struggle to keep pace.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLDT

Chatham Lodging Trust

A self-advised, publicly traded real estate investment trust (REIT) focused primarily on investing in upscale, extended-stay hotels and premium-branded, select-service hotels.

Undervalued average dividend payer.

Market Insights

Community Narratives