- United States

- /

- Specialized REITs

- /

- NYSE:CCI

Will Crown Castle’s (CCI) New TowerX Venture Strengthen Its Pure-Play Tower Strategy?

Reviewed by Sasha Jovanovic

- In recent days, Crown Castle filed a shelf registration to offer approximately 1.02 million shares of its common stock valued at over US$95 million, primarily related to an ESOP, while Anterix and Crown Castle unveiled TowerX, a new turnkey tower service designed to accelerate 900 MHz private LTE deployments for utilities across the U.S.

- This collaboration leverages Crown Castle’s national tower footprint and Anterix’s ecosystem to offer utilities a streamlined, scalable approach for grid modernization and operational resilience.

- We'll explore how Crown Castle’s continued transformation into a pure-play tower company shapes the outlook for its long-term financial performance.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Crown Castle Investment Narrative Recap

For shareholders, the key thesis centers on Crown Castle’s transformation into a pure-play U.S. tower operator, relying on the recurring revenue potential from 5G and ongoing wireless infrastructure demand. The recent ESOP-related shelf registration and TowerX initiative with Anterix are not expected to materially impact the most important near-term catalyst: the divestment of the fiber segment or the primary risk around protracted regulatory approvals or execution setbacks in that process.

Among the latest news, the TowerX venture stands out for its relevance to the company’s strategy. By enhancing private LTE network deployments for utilities, Crown Castle leverages its extensive tower portfolio to potentially broaden customer reach and support grid modernization, aligning with the catalysts of improved focus and operational efficiency tied to its core tower business.

On the other hand, investors should not overlook the risk that if regulatory or state approvals for the fiber sale are delayed, the impact on revenue and cash flow could...

Read the full narrative on Crown Castle (it's free!)

Crown Castle's narrative projects $4.6 billion in revenue and $1.6 billion in earnings by 2028. This requires a 10.7% annual revenue decline and an earnings increase of $5.5 billion from current earnings of -$3.9 billion.

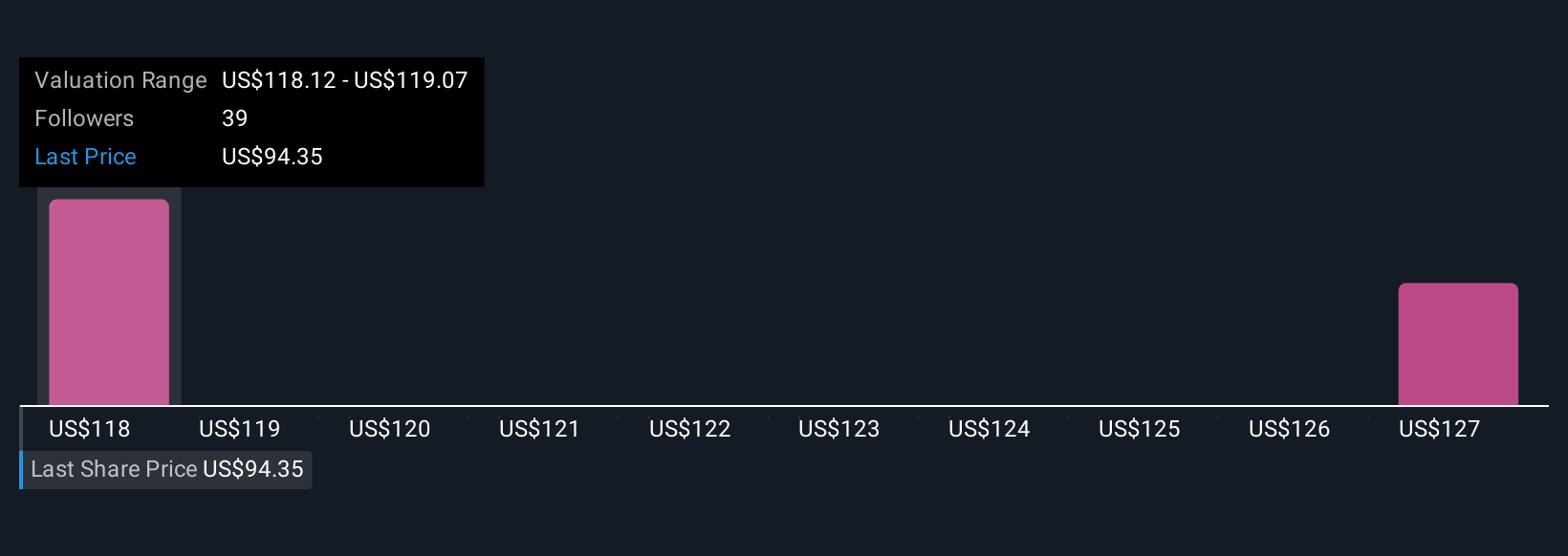

Uncover how Crown Castle's forecasts yield a $116.06 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$102.56 to US$130.39, with three distinct analyses informing this range. Amidst these differing views, keep in mind that operational execution remains crucial to Crown Castle’s future performance.

Explore 3 other fair value estimates on Crown Castle - why the stock might be worth as much as 43% more than the current price!

Build Your Own Crown Castle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Castle research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crown Castle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Castle's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives