- United States

- /

- Specialized REITs

- /

- NYSE:CCI

Crown Castle Shares Slide 8% as Investors Weigh Latest Infrastructure Partnerships and Valuation

Reviewed by Bailey Pemberton

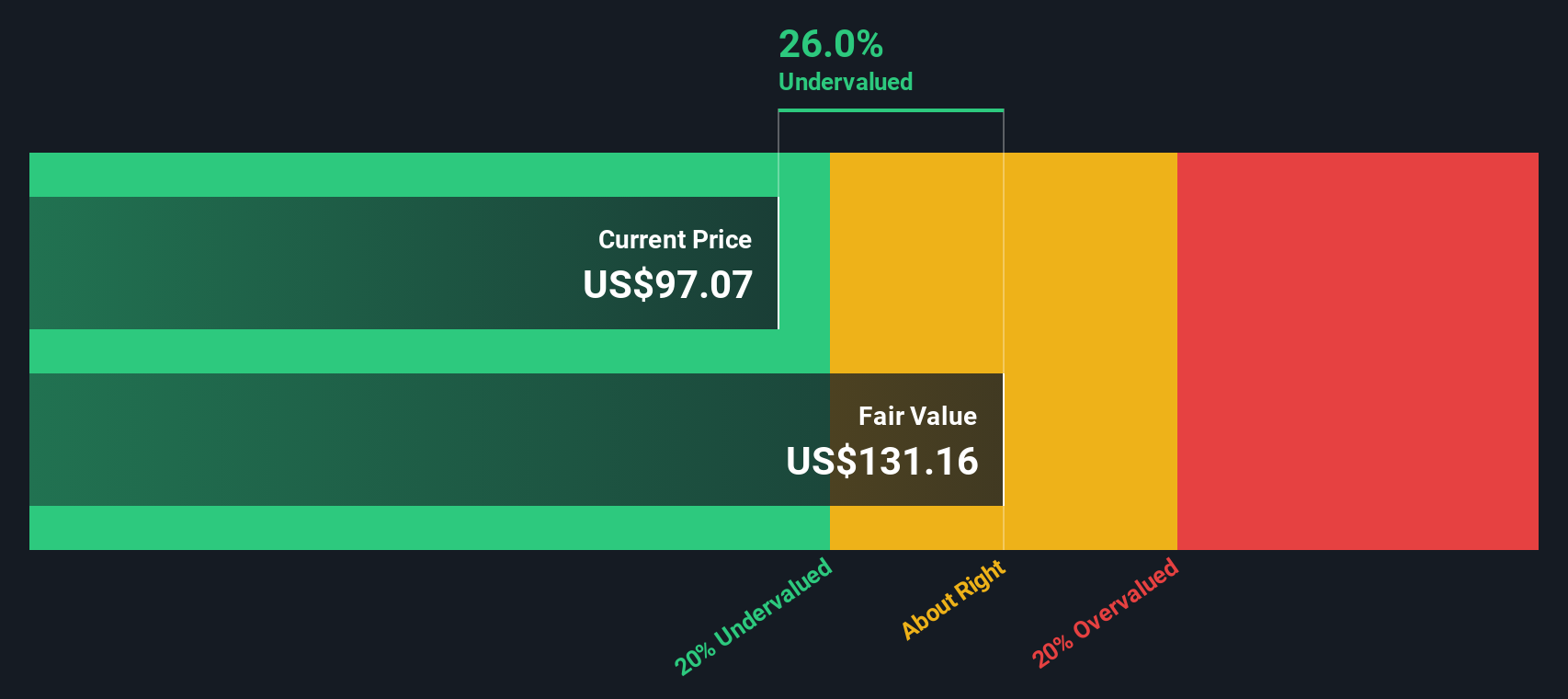

- Wondering whether Crown Castle might be undervalued right now? You are not alone; the stock's valuation has a lot of investors curious about its true worth and future upside.

- Despite some notable swings, Crown Castle is down 8.3% over the past week and 6.2% over the last month, though it has managed to eke out a small gain of 0.3% this year so far.

- Recent headlines have spotlighted Crown Castle’s strategic moves in infrastructure and telecom partnerships, fueling speculation over how industry changes could drive future returns. This added attention has made many investors reassess the risks and potential for a rebound.

- On a pure numbers basis, Crown Castle racks up a perfect 6/6 valuation score, passing every major undervaluation check. But does that tell the whole story? Let’s dig into how these numbers come together and why there might be an even smarter perspective on value by the end of this article.

Find out why Crown Castle's -12.8% return over the last year is lagging behind its peers.

Approach 1: Crown Castle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future adjusted funds from operations and discounting those expected cash flows back to their value today. For Crown Castle, this approach focuses on adjusted free cash flow as a key measure of value.

According to analyst estimates, Crown Castle is expected to generate cash flows in the billions of dollars each year moving forward. Specifically, projections suggest free cash flow reaching $3.04 billion by 2029, with the first five years based on direct analyst forecasts and later years extrapolated by Simply Wall St. Cash flows are discounted annually to reflect today's dollars, which helps account for future uncertainty and opportunity cost.

Based on this analysis, the DCF model calculates an intrinsic fair value of $134.15 per share for Crown Castle. This is roughly 33.3% higher than the current trading price and signals the stock is significantly undervalued by the market according to the cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crown Castle is undervalued by 33.3%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Crown Castle Price vs Sales

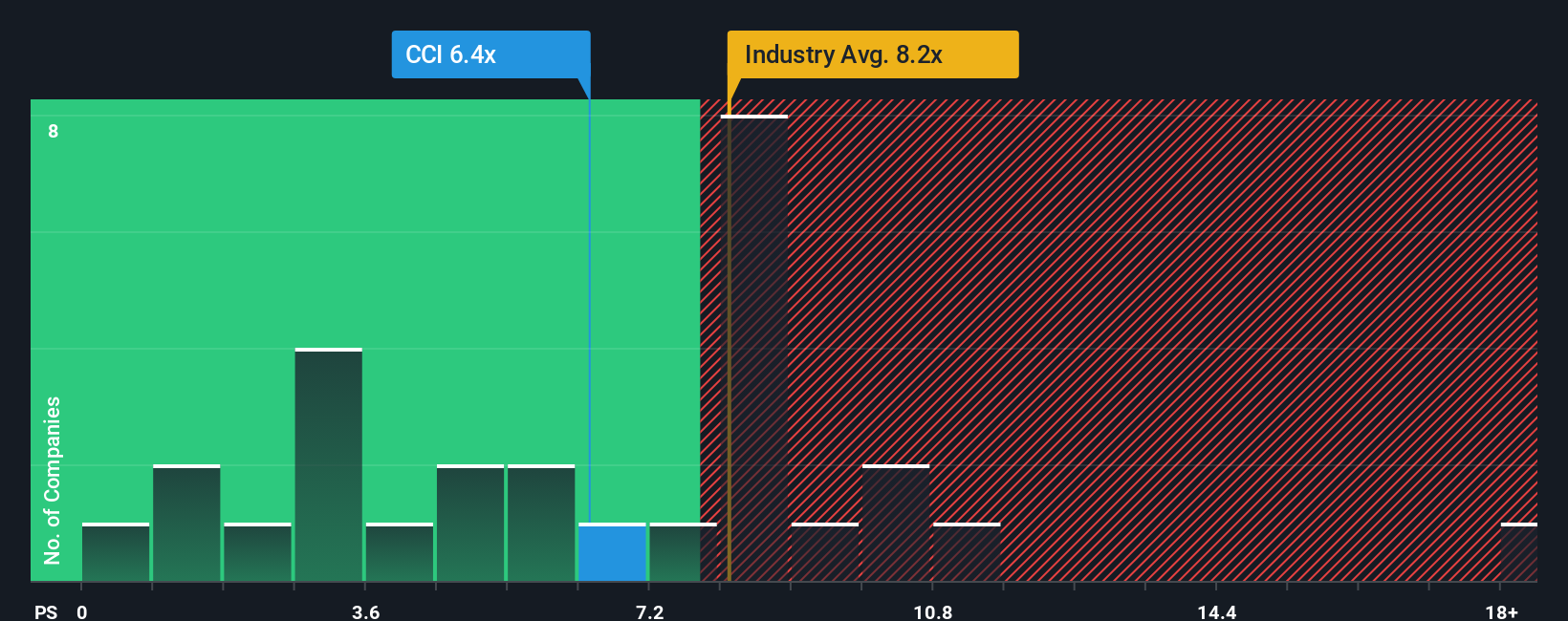

The price-to-sales (P/S) ratio is often a preferred metric for companies like Crown Castle, especially when traditional profit-based multiples such as price-to-earnings are less reliable due to fluctuating earnings or negative net income. The P/S ratio is useful in this context because it evaluates the market’s valuation of each dollar the company brings in, regardless of bottom-line profitability, and smooths out volatility tied to non-cash charges or one-off expenses.

Market expectations for growth and risk are central when setting a fair multiple. Higher expected growth or lower perceived risk typically support a higher ratio, while slower growth or greater uncertainty generally result in a lower figure. That serves as the baseline for determining if a stock is trading at a premium or discount relative to its long-term prospects.

Crown Castle currently trades at a P/S ratio of 6.07x. To add perspective, the Specialized REITs industry averages 7.60x, and similar peers cluster around 7.61x. Meanwhile, Simply Wall St's proprietary "Fair Ratio" for Crown Castle stands at 6.53x, calculated using a blend of the company’s growth outlook, industry, margins, size, and risk profile.

Unlike basic comparisons to industry or peer averages, the Fair Ratio offers a tailored benchmark based on Crown Castle’s unique situation. It factors in not just what other companies are doing, but also what makes Crown Castle distinct, considering its growth trajectory, profitability, industry context, and specific risks. This holistic view helps investors avoid overestimating or underestimating value based only on the broad market.

Comparing the company’s current 6.07x P/S with the Fair Ratio of 6.53x, Crown Castle appears to be undervalued based on this analysis, as the stock trades below what would be expected given its fundamentals and risk profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Crown Castle Narrative

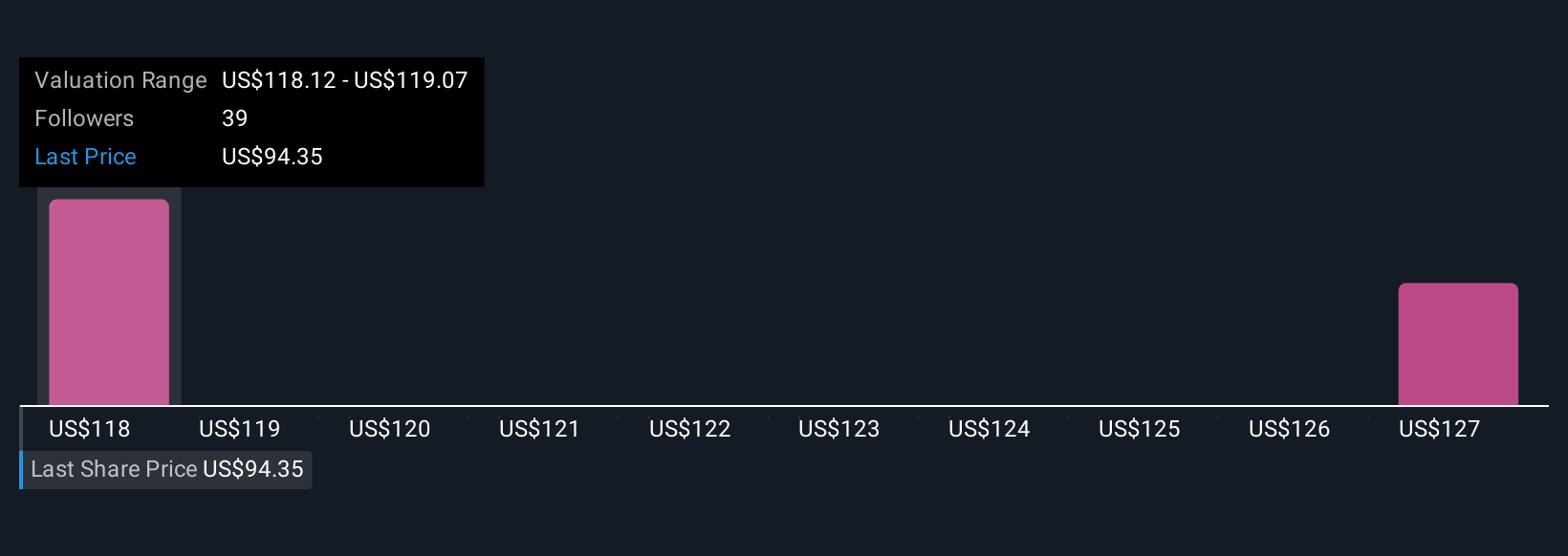

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a concise story or perspective that links your view of a company, such as its strategy, growth, and risks, to a set of assumptions about its future revenue, margins, and profits. Narratives act as a bridge between what you believe is happening with Crown Castle and how those beliefs translate into financial forecasts and a fair value estimate.

On Simply Wall St’s platform, Narratives are easy to access from the Community page and used by millions of investors to help clarify their decision making. Each Narrative distills the main business or market drivers, quantifies how those drivers could shape future performance, and lets you compare your outlook to others, all without needing to build a spreadsheet or financial model yourself. If new information hits the news or earnings come out, Narratives are updated dynamically, ensuring your investment thesis stays relevant.

For Crown Castle, for example, one bullish Narrative forecasts $1.9 billion in earnings and a fair value of $127 per share, while a bearish Narrative projects just $892 million in earnings and a fair value of $100 per share. By seeing these different perspectives side by side and comparing them to the current share price, you can make smarter, more personalized decisions about buying or selling.

Do you think there's more to the story for Crown Castle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives