- United States

- /

- Retail REITs

- /

- NYSE:CBL

How Investors May Respond To CBL (CBL) Stock Buyback Amid Rising Revenues and Director Share Purchase

Reviewed by Sasha Jovanovic

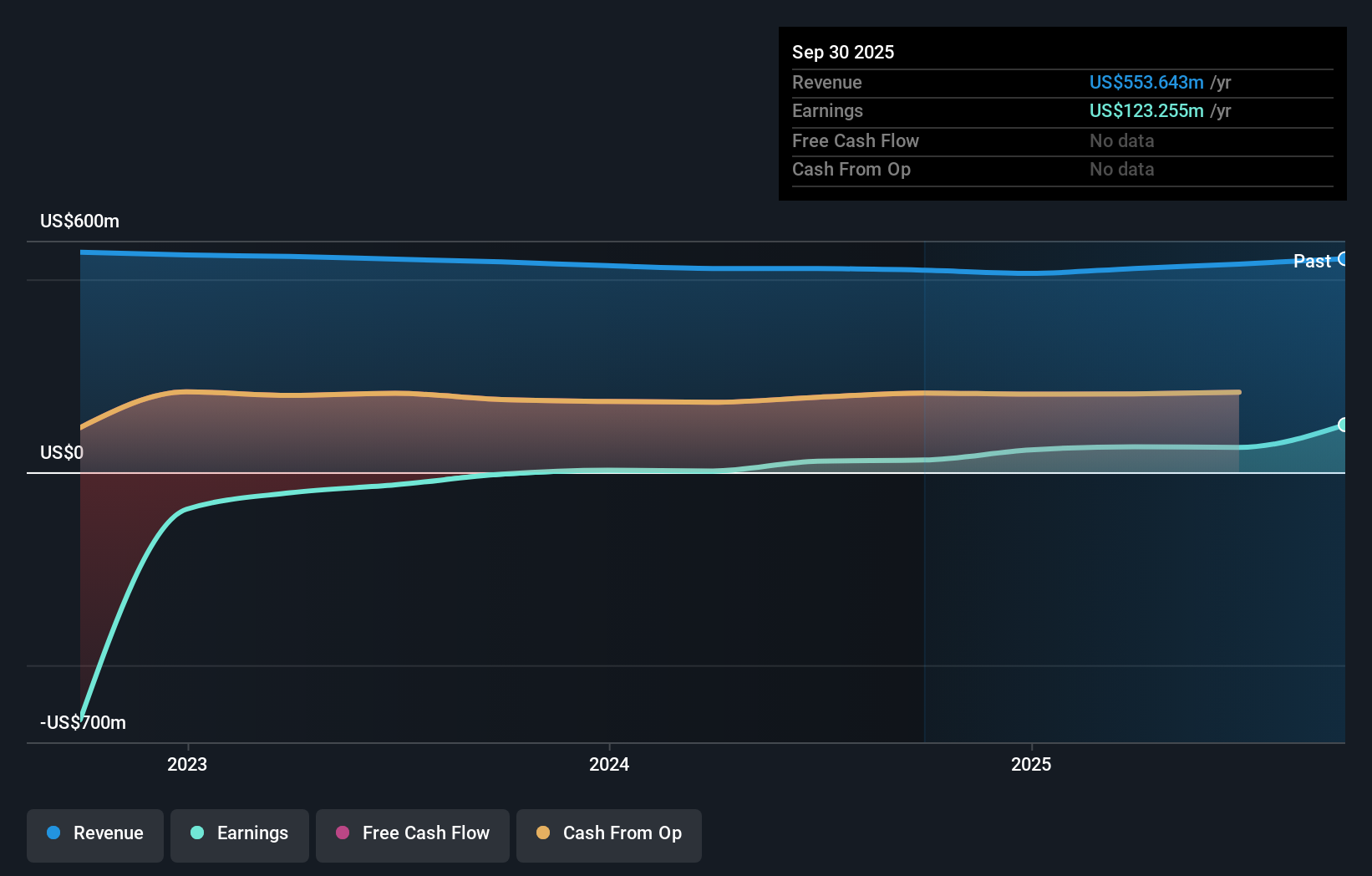

- CBL & Associates Properties recently announced a US$25 million stock repurchase program and reported increased rental revenues and gains from real estate sales, alongside portfolio optimization efforts.

- Director Michael A. Torres’s personal purchase of 4,000 company shares underscores board-level confidence at a time of operational and financial momentum.

- Let’s explore how the newly announced stock buyback program shapes CBL & Associates Properties’ broader investment narrative and management priorities.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is CBL & Associates Properties' Investment Narrative?

To own a piece of CBL & Associates Properties, you need to believe in their turnaround story backed by improving rental revenues, rising net income, and stronger tenant demand for mall-based retail. The recently announced US$25 million stock repurchase program and board-level insider buying both signal clear management alignment and confidence, which could reinforce investor sentiment as a short-term catalyst. However, these moves, while bolstering perceived value and offering downside support, may not fundamentally shift the biggest risks, namely, the sustainability of recent profit growth given large one-off gains, and reliance on debt financing with interest coverage remaining a concern. While buyback news adds some positive momentum, it does not by itself resolve underlying earnings quality or leverage risks. Keep an eye on how management manages these headwinds moving forward. Yet, ongoing concerns about earnings quality and debt coverage remain information investors should be aware of.

CBL & Associates Properties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on CBL & Associates Properties - why the stock might be worth just $36.00!

Build Your Own CBL & Associates Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBL & Associates Properties research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CBL & Associates Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBL & Associates Properties' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBL

CBL & Associates Properties

Headquartered in Chattanooga, TN, CBL Properties owns and manages a national portfolio of market-dominant properties located in dynamic and growing communities.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives