- United States

- /

- Office REITs

- /

- NYSE:BXP

Should BXP's (BXP) Third Quarter Loss and Cautious Guidance Prompt Investor Reassessment?

Reviewed by Sasha Jovanovic

- BXP, Inc. reported a net loss of US$121.71 million for the third quarter ended September 30, 2025, reversing from a net profit in the prior year, and issued full-year 2025 earnings guidance of US$0.99 to US$1.02 per share while highlighting continued discipline in evaluating acquisitions against development yields.

- The company’s management emphasized that although there has been some increase in acquisition opportunities lately, capital has primarily been allocated to new development projects due to higher expected returns, even as current market cap rates remain below their development yield thresholds.

- We’ll examine how BXP’s third quarter earnings miss and cautious forward guidance may influence the company’s long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

BXP Investment Narrative Recap

To own BXP stock, an investor needs to believe in a long-term recovery for high-quality office and life science assets in gateway cities, anchored by tenant demand and successful development execution. The recent third quarter loss and tighter guidance place heightened attention on lease-up risks as new projects come online, but in the short term, these results do not appear to meaningfully change the immediate catalyst of strong leasing in core markets or override the biggest threat: prolonged weakness in occupancy and rent growth.

The company’s full-year 2025 earnings guidance, now at US$0.99 to US$1.02 per share, stands out as particularly relevant, reflecting more cautious expectations after a challenging quarter. This more conservative outlook shifts focus to BXP's ability to stabilize performance amidst headwinds, as investors weigh prospects for occupancy gains and NOI expansion.

However, investors should also be alert to the risk that rising vacancy in new developments could...

Read the full narrative on BXP (it's free!)

BXP's outlook anticipates $3.7 billion in revenue and $368.8 million in earnings by 2028. This is based on a projected annual revenue growth rate of 2.5% and an increase in earnings of about $363.9 million from the current $4.9 million.

Uncover how BXP's forecasts yield a $79.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

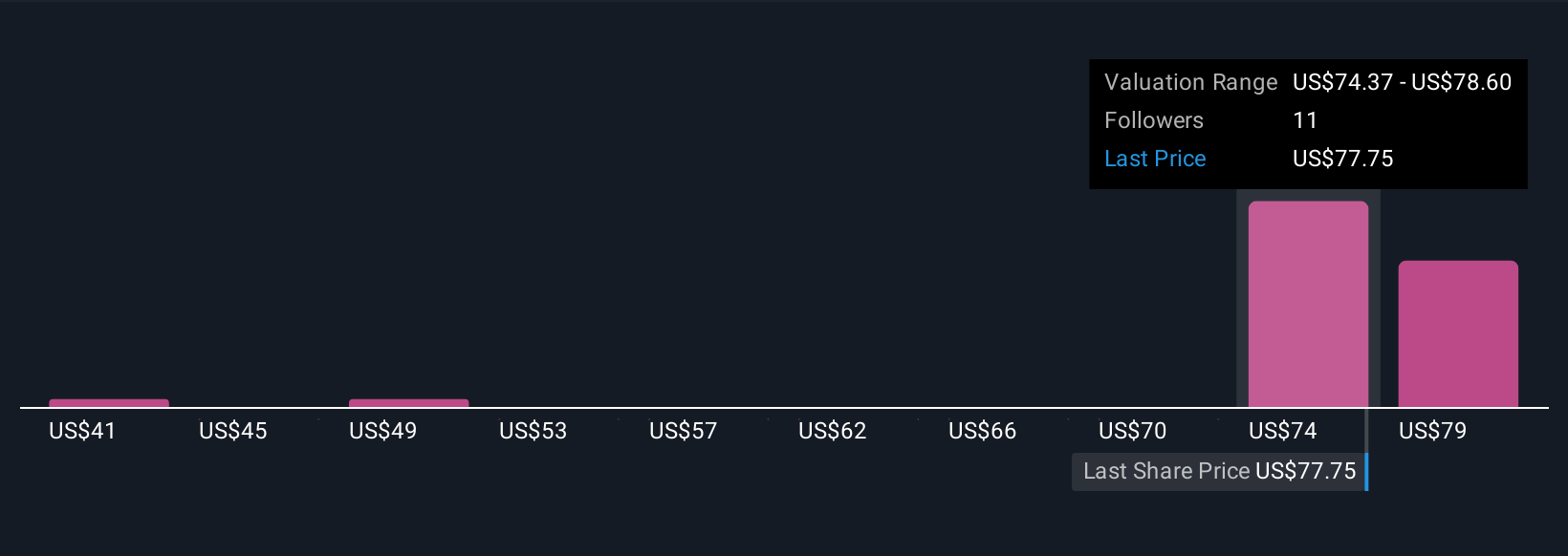

Four fair value estimates from the Simply Wall St Community range from US$40.50 to US$90.65 per share. While opinions differ widely, lease-up risks will remain central to evaluating BXP’s performance in the months ahead, explore these alternative viewpoints to broaden your perspective.

Explore 4 other fair value estimates on BXP - why the stock might be worth 44% less than the current price!

Build Your Own BXP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BXP research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BXP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BXP's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BXP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives