- United States

- /

- Retail REITs

- /

- NYSE:BRX

How Will Brixmor’s (BRX) Upbeat Q2 Results and Updated Guidance Shape Investor Expectations?

Reviewed by Simply Wall St

- Brixmor Property Group recently reported its second-quarter 2025 results, highlighting increased sales of US$339.4 million and net income of US$85.14 million, alongside an updated full-year earnings guidance and a reaffirmed quarterly dividend.

- An interesting detail is that while the company achieved higher quarterly sales and net income versus a year ago, its six-month net income was slightly lower, indicating some variability in performance across reporting periods.

- We'll review how Brixmor's updated full-year guidance and solid quarterly earnings impact its investment narrative and future expectations.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Brixmor Property Group Investment Narrative Recap

Owning shares in Brixmor Property Group means believing in the ongoing demand for well-located retail centers, stable tenant demand, and the company’s ability to backfill vacant spaces at higher rents. The updated earnings guidance and solid quarterly results largely reinforce the near-term catalyst of sustained leasing momentum, but risks around tenant bankruptcies and economic pressures remain unchanged in the short term.

The most relevant announcement is the reaffirmed quarterly dividend of US$0.2875 per share. This steady payout serves as a signal of management’s confidence in ongoing cash flows, supporting the thesis of resilience against current retail sector challenges.

However, against the backdrop of consistent dividends and improving quarterly net income, investors should still keep a close watch on tenant risks, particularly as...

Read the full narrative on Brixmor Property Group (it's free!)

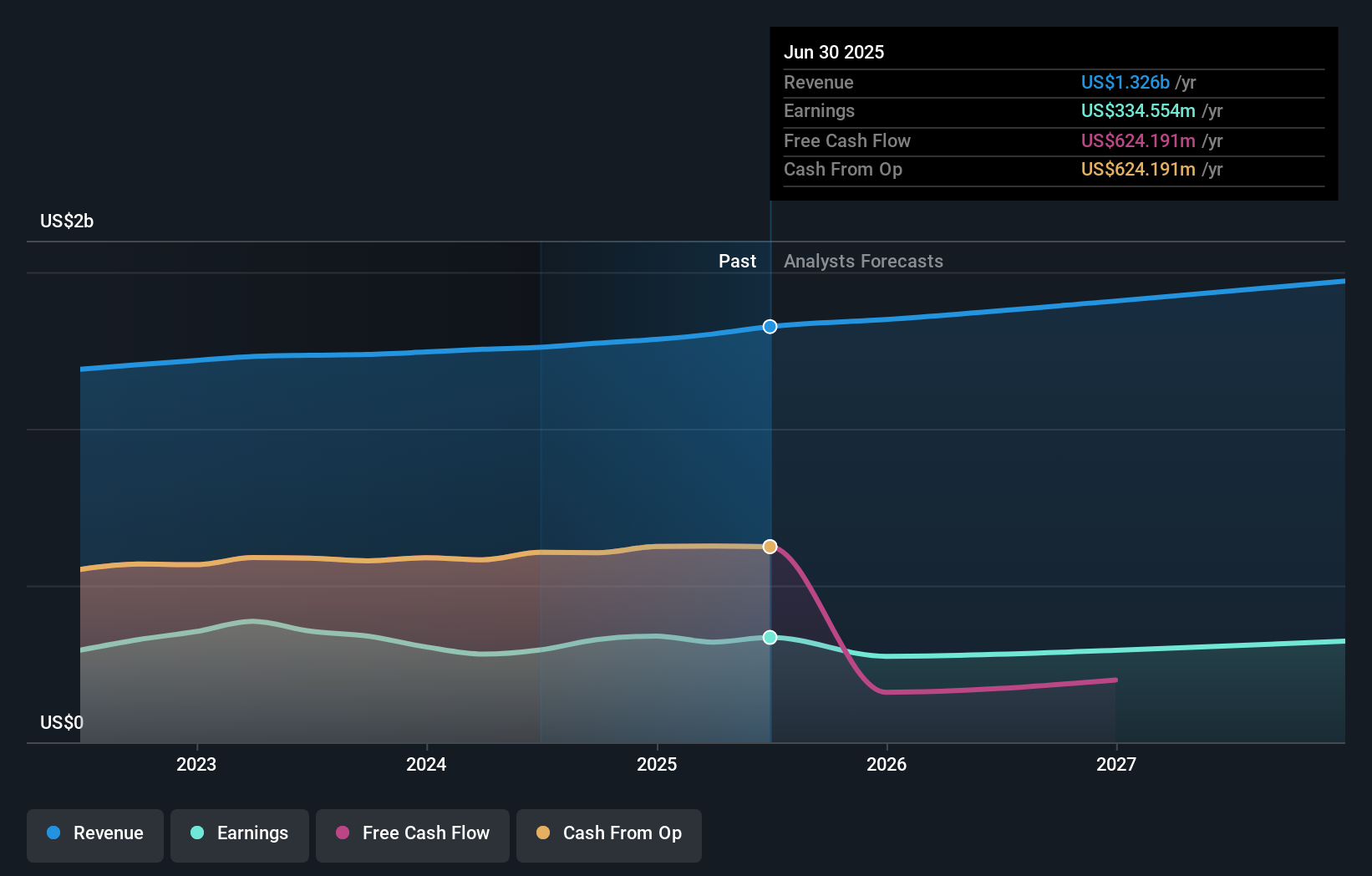

Brixmor Property Group's outlook forecasts $1.5 billion in revenue and $322.3 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 4.9% and a modest earnings increase of $2.7 million from the current $319.6 million.

Uncover how Brixmor Property Group's forecasts yield a $29.97 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided a single fair value estimate for Brixmor at US$29.97 per share, showing limited diversity in this round of perspectives. With execution risk on redevelopment projects still top of mind, you may find it useful to explore a spectrum of alternative forecasts and opinions from other market participants.

Explore another fair value estimate on Brixmor Property Group - why the stock might be worth just $29.97!

Build Your Own Brixmor Property Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brixmor Property Group research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Brixmor Property Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brixmor Property Group's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brixmor Property Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRX

Brixmor Property Group

Brixmor (NYSE: BRX) is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives