- United States

- /

- Hotel and Resort REITs

- /

- NYSE:BHR

Braemar Hotels & Resorts (BHR): No Profit Margin Progress, Low Valuation Frames Investor Debate

Reviewed by Simply Wall St

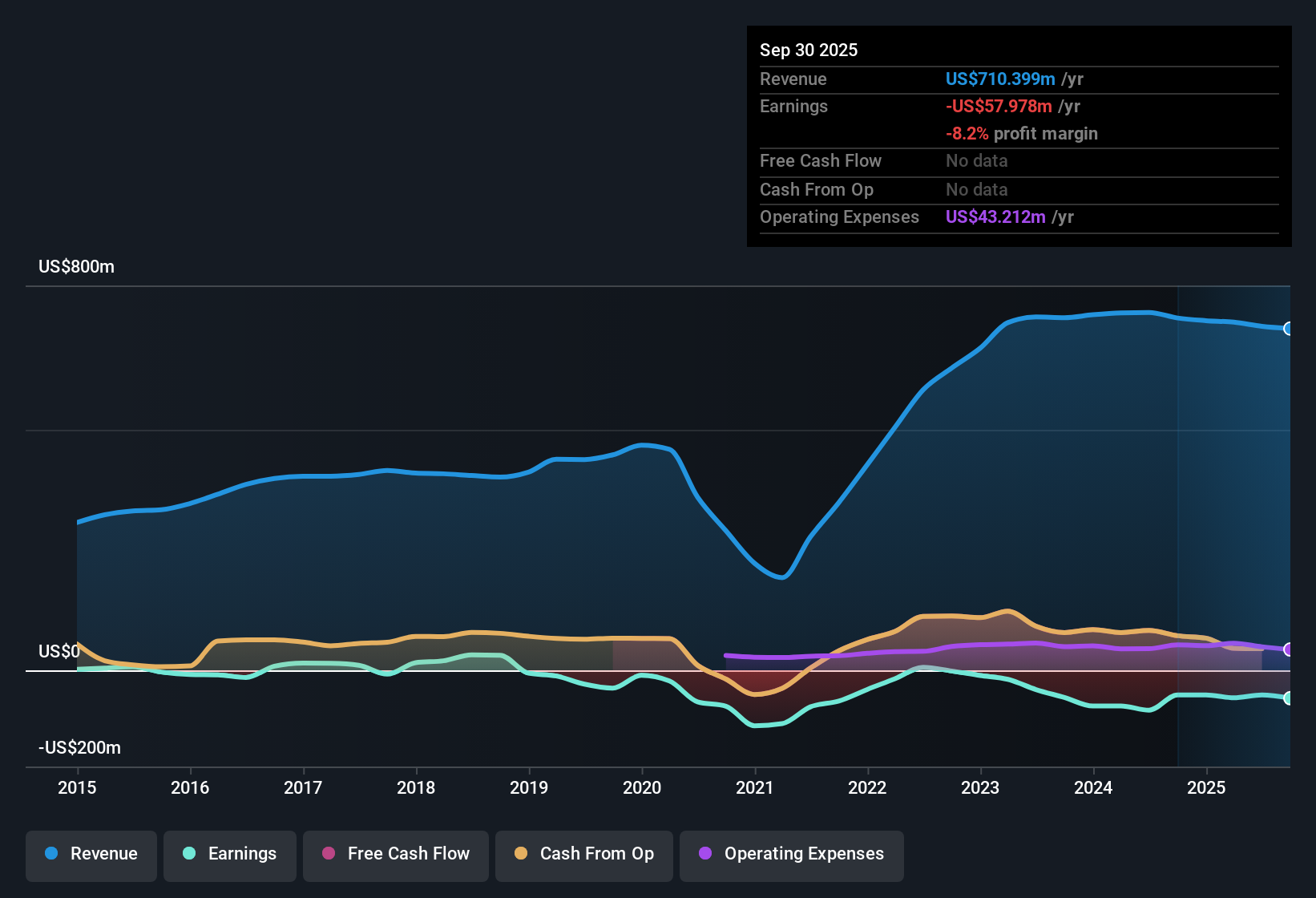

Braemar Hotels & Resorts (BHR) remains unprofitable, with no improvement in its net profit margin over the last year. Over a five-year stretch, however, the company has steadily narrowed its losses at a rate of 7.3% per year. Revenue is forecast to grow at just 0.9% annually, compared to the broader US market’s projected 10.5% growth. In this operational context, BHR’s price-to-sales ratio of 0.2x stands out as especially low relative to both the industry and peers. The share price of $2.58 trades above an estimated fair value of $1.24.

See our full analysis for Braemar Hotels & Resorts.Now, let’s see how these headline results stack up next to Simply Wall St’s widely followed community narratives. This is where the numbers meet the market story.

See what the community is saying about Braemar Hotels & Resorts

Margin Expansion Tied to Streamlined Operations

- Disciplined capital allocation and ongoing cost controls are cited as drivers for improved margins and stronger cash flow. Operational efficiencies are expected to support better net income trends even as net profit margins remain negative.

- According to the analysts' consensus view, property renovations, technology upgrades, and adding high-margin ancillary services are believed to provide a lift to future EBITDA and margins.

- This view is anchored by expectations that ongoing enhancements in Braemar's luxury and experiential amenities will help command premium pricing and higher occupancy, boosting revenue and bottom-line performance.

- Further improvements are anticipated as management continues to reduce leverage and optimize digital distribution and asset management practices. These steps are seen as providing a foundation for long-term margin growth.

Analysts think these operational shifts could finally put margins on the right path. Read the consensus narrative for full details. 📊 Read the full Braemar Hotels & Resorts Consensus Narrative.

Interest Rate Exposure Raises Earnings Risks

- With 78% of debt at floating rates and a net debt to gross assets ratio of 44.2%, Braemar faces sizeable interest cost volatility and refinancing burdens.

- Analysts' consensus view flags that this interest rate sensitivity is a key risk to net margins and cash flow, especially if credit markets tighten or if inflation continues to push labor and operating costs higher.

- This concern is heightened by Braemar’s reliance on luxury property revenues and premium destinations, which could be vulnerable if travel demand softens due to economic or industry shocks.

- Climate-related risks, including severe weather or natural disasters, are also expected to keep pressure on capex and insurance costs. This could complicate near-term earnings stability.

Share Price Trades at Significant Discount to Analyst Target

- Braemar’s share price of $2.58 is 35.5% below the analyst price target of $4.00. It also sits well below both industry average price-to-sales ratios (0.2x for BHR vs. 3.8x for industry), but above the DCF fair value estimate of $1.24.

- From the analysts' consensus view, the low market valuation reflects skepticism about near-term profitability and dividend sustainability. It also highlights a potential rerating opportunity if margin improvements and revenue catalysts are realized.

- Investors are encouraged to compare these current valuation gaps with projected 2028 earnings ($26.1 million) and profit margin changes, as consensus assumes BHR’s profit margin could move from -7.2% to 3.7% over the next few years.

- The share price’s disconnect from both analyst target and fair value underscores the market’s wait-and-see stance regarding Braemar’s operational and financial turnaround story.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Braemar Hotels & Resorts on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the data from a new angle? Share your perspective and craft your own narrative in just minutes. Do it your way

A great starting point for your Braemar Hotels & Resorts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Braemar’s high debt load and sensitivity to interest rates put its earnings and balance sheet at risk. This leaves little room for financial missteps.

If you want to focus on companies with stronger financials and safer capital structures, check out solid balance sheet and fundamentals stocks screener (1979 results) tailored for investors who value robust balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Braemar Hotels & Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHR

Braemar Hotels & Resorts

A Maryland corporation formed in April 2013 that invests primarily in high revenue per available room (“RevPAR”), luxury hotels and resorts.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives