Stock Analysis

In 1993 Bernard Saul was appointed CEO of Saul Centers, Inc. (NYSE:BFS). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Saul Centers

How Does Bernard Saul's Compensation Compare With Similar Sized Companies?

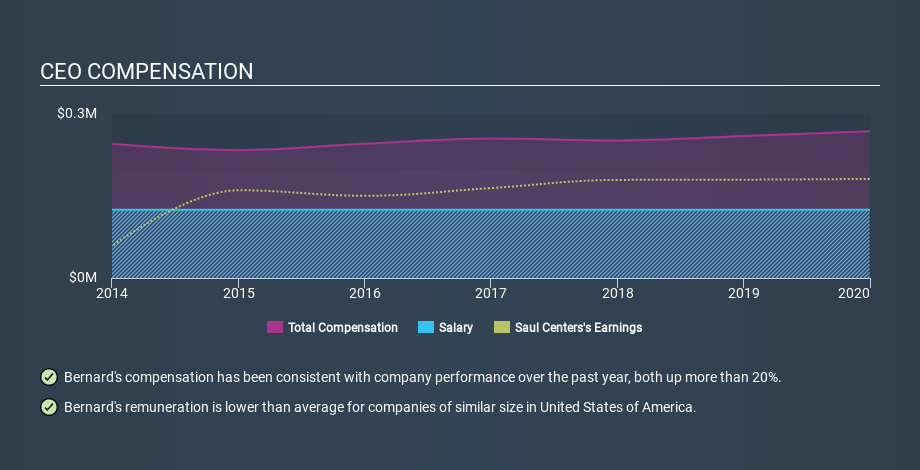

Our data indicates that Saul Centers, Inc. is worth US$1.2b, and total annual CEO compensation was reported as US$269k for the year to December 2019. That's a modest increase of 3.4% on the prior year year. While we always look at total compensation first, we note that the salary component is less, at US$125k. We looked at a group of companies with market capitalizations from US$400m to US$1.6b, and the median CEO total compensation was US$3.1m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Saul Centers. On a sector level, around 15% of total compensation represents salary and 85% is other remuneration. It's interesting to note that Saul Centers pays out a greater portion of remuneration through salary, in comparison to the wider industry.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. While this is a good thing, you'll need to understand the business better before you can form an opinion. You can see, below, how CEO compensation at Saul Centers has changed over time.

Is Saul Centers, Inc. Growing?

On average over the last three years, Saul Centers, Inc. has seen earnings per share (EPS) move in a favourable direction by 3.0% each year (using a line of best fit). Its revenue is up 1.9% over last year.

I would argue that the improvement in revenue isn't particularly impressive, but it is good to see modest EPS growth. Considering these factors I'd say performance has been pretty decent, though not amazing. It could be important to check this free visual depiction of what analysts expect for the future.

Has Saul Centers, Inc. Been A Good Investment?

Given the total loss of 34% over three years, many shareholders in Saul Centers, Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Saul Centers, Inc. is currently paying its CEO below what is normal for companies of its size.

It's well worth noting that while Bernard Saul is paid less than most company leaders (at similar sized companies), performance has been somewhat uninspiring, and total returns have been lacking. Many shareholders would probably like to see improvements, but our analysis does not suggest that CEO compensation is too generous. Shifting gears from CEO pay for a second, we've spotted 4 warning signs for Saul Centers you should be aware of, and 1 of them can't be ignored.

Important note: Saul Centers may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:BFS

Saul Centers

Saul Centers is a self-managed, self-administered equity REIT headquartered in Bethesda, Maryland.

6 star dividend payer with solid track record.