- United States

- /

- Office REITs

- /

- NYSE:BDN

Brandywine Realty Trust (BDN): Dividend Sustainability Concerns Reinforced by Persistent Losses and Elevated Payout Ratio

Reviewed by Simply Wall St

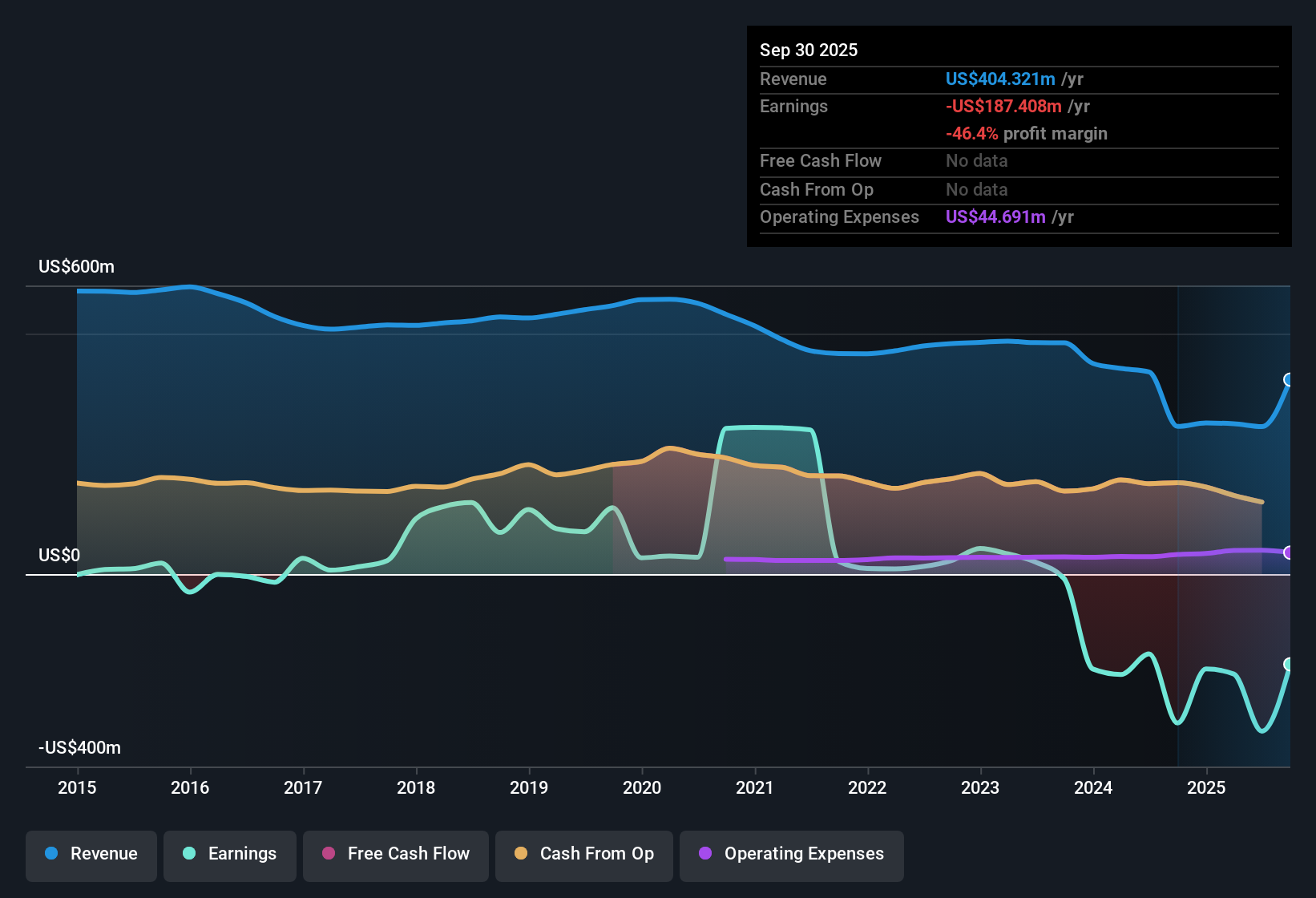

Brandywine Realty Trust (BDN) remains unprofitable, with net losses accelerating at a steep 76.5% per year over the past five years. Revenue is projected to grow at 10% annually, which matches the broader US market rate, but the company is not expected to turn a profit within the next three years. Despite shares appearing fairly valued on a price-to-sales basis compared to peers and the US Office REITs industry average of 2.2x, they trade above an estimated fair value of $1.74 based on discounted cash flow models, closing most recently at $3.69. For investors, financial risks and concerns about the sustainability of Brandywine’s dividend remain front and center as ongoing losses continue to dominate the company’s outlook.

See our full analysis for Brandywine Realty Trust.Now, let’s see how these key numbers measure up to the prevailing narratives about Brandywine Realty Trust. Some expectations could be reinforced, while others might get challenged.

See what the community is saying about Brandywine Realty Trust

Dividend Coverage at Risk Amid 176% CAD Payout Ratio

- Brandywine’s cash available for distribution (CAD) payout ratio stands at 176%, signaling that the company is distributing far more to shareholders than it generates from core real estate operations.

- Consensus narrative warns that this steep payout ratio puts the dividend under pressure, with a high likelihood of reductions or suspensions until development projects stabilize.

- Recurring headwinds in the life science segment, including delays in lease-up, are extending the timeline for new income streams to offset elevated cash distributions.

- Critics highlight that the expensive new hotel project and other development costs further stretch cash flows, heightening risk to the current dividend policy.

Leverage Remains Elevated at 7.7x to 8.4x Net Debt/EBITDA

- Net debt to EBITDA ratio guidance between 7.7 and 8.4 times underscores that Brandywine carries significant leverage, well above levels typically considered healthy in the REIT sector.

- Bears argue that this persistent high leverage could compound financial risk, especially if recapitalization or planned asset sales are delayed.

- The consensus narrative details that outsize reliance on asset disposals for liquidity means any disruptions could directly pressure margins and complicate obligations tied to debt covenants.

- Long-term exposure to high-vacancy urban office markets like Austin and Philadelphia amplifies the risk that leverage remains elevated longer than management targets.

Fair Value Gap: Share Price Far Above DCF

- Brandywine trades at $3.69, notably higher than its DCF fair value of $1.74, highlighting a sizable disconnect between current market price and underlying cash flow-based valuation.

- Analysts’ consensus view sees the price gap continuing unless profit margin assumptions improve dramatically, as current net losses and persistent operational risks leave little near-term catalyst to close the valuation spread.

- Despite trading on par with the sector’s average 2.2x price-to-sales ratio, the company’s above-fair-value share price signals that market participants are pricing in a future turnaround not yet supported by fundamental results.

- The 11.93% discount rate used in DCF analysis makes elevated growth or sustained margin improvement essential for the current valuation to hold.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Brandywine Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from a different angle? Take a couple of minutes to put your own viewpoint into a narrative and share your outlook. Do it your way

A great starting point for your Brandywine Realty Trust research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Explore Alternatives

Brandywine Realty Trust faces persistent losses, high leverage, and an unsustainable dividend payout ratio. These factors raise concerns about its financial resilience.

If you want to prioritize companies with sounder debt profiles and robust financial stability, check out solid balance sheet and fundamentals stocks screener (1984 results) to spot businesses built for less risk and healthier balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brandywine Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDN

Brandywine Realty Trust

Brandywine Realty Trust (NYSE: BDN) is one of the largest, publicly traded, full-service, integrated real estate companies in the United States with a core focus in Philadelphia, PA and Austin, TX.

Average dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives