- United States

- /

- Health Care REITs

- /

- NYSE:ARE

Alexandria Real Estate Equities (ARE): Five-Year Losses Challenge Bull Case Despite Deep Discount

Reviewed by Simply Wall St

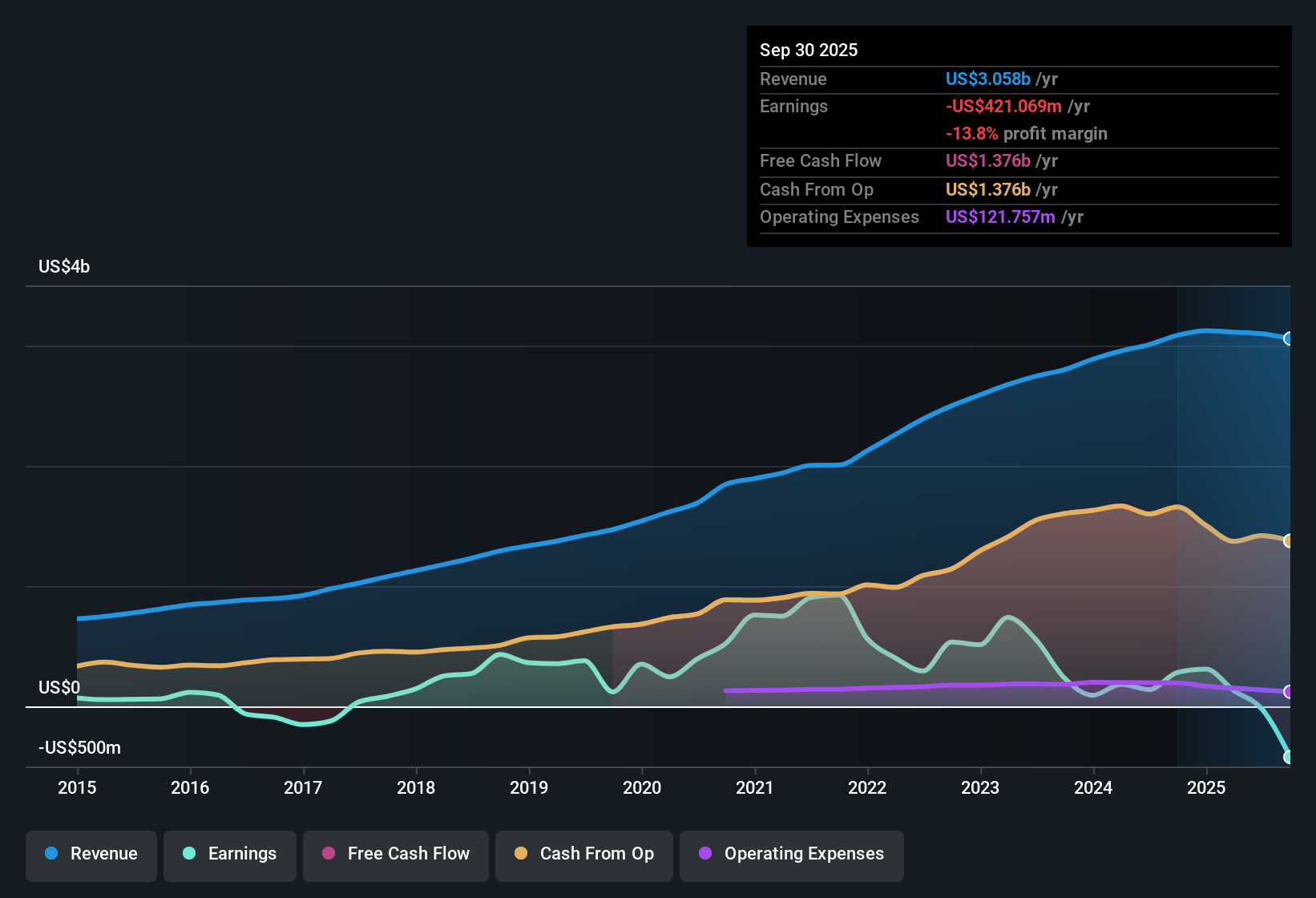

Alexandria Real Estate Equities (ARE) remains unprofitable, having seen its losses grow at an average rate of 39.5% a year over the past five years. Despite this, investors are watching closely as the company’s earnings are forecast to surge 110.3% per year and move into profitability within the next three years. Meanwhile, revenue growth is projected at a modest 0.7% annually, which is well below the US market’s pace of 10.2% per year. Net profit margins are still in negative territory, with the latest data showing no signs of improvement. This sets the stage for a critical turning point in the company’s financial story.

See our full analysis for Alexandria Real Estate Equities.The real test comes in comparing these figures with the big-picture narratives investors follow. Some expectations may be confirmed, while others could face a reality check.

See what the community is saying about Alexandria Real Estate Equities

Premium Leases Support Cash Flow Stability

- Premium assets in major innovation clusters are locked into long-term leases with top tenants. This helps stabilize cash flows and allows above-market rent growth even when broader sector trends soften.

- Analysts' consensus view highlights that Alexandria’s portfolio benefits from high-value, resilient tenant relationships and rising demand for specialized lab space. This reinforces the company's competitive position and strengthens its long-term earnings outlook.

- High barriers to entry and concentrated locations in Boston, San Diego, and San Francisco create a competitive moat that preserves rental spreads even as biotech markets experience cycles.

- The ability to secure long-duration tenancy with blue-chip clients means recurrent revenue and cash flow remain stable despite macro pressures in the life sciences sector.

- To see how these portfolio strengths shape a long-term thesis, dig into the full consensus narrative and context on Alexandria’s strategy. 📊 Read the full Alexandria Real Estate Equities Consensus Narrative.

Net Margin Projected to Swing Positive

- Profit margins, currently at -0.7 percent, are forecast to rise to 9.1 percent within three years, according to analyst estimates. This signals a move from persistent losses toward sustainable profitability.

- Consensus narrative points out several operational trends that could drive margin recovery:

- Development and redevelopment activity in top-tier markets is positioned to deliver incremental NOI growth as new build-to-suit projects come online and get leased to stable tenants.

- Rising occupancy rates driven by successful tenant renewals and expansion, together with decreased outstanding shares projected at -1.03 percent per year, could improve per-share performance as profitability inches higher.

Priced Below Both Peers and DCF Fair Value

- Alexandria’s current share price of $58.76 sits well below its DCF fair value of $100.50. Its 3.3x Price-to-Sales Ratio is also a considerable discount to peers at 8.7x and the industry average of 4.8x.

- Consensus narrative suggests this discounted valuation creates room for future upside if the expected recovery in margins materializes and analysts’ revenue and earnings forecasts prove accurate:

- With a sector price/earnings multiple of 33.2x, even partial progress toward the 9.1 percent net margin target could attract investor interest, closing the valuation gap and supporting price momentum toward the $92.38 analyst target.

- However, continued pressure on occupancy, NOI, and capital markets could limit rerating potential if sluggish leasing trends persist and asset disposition drags on earnings power.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Alexandria Real Estate Equities on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Viewing the figures from a different angle? Shape your perspective into a unique story in just a few minutes. Do it your way

A great starting point for your Alexandria Real Estate Equities research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Alexandria is contending with ongoing losses, slow revenue growth, and persistent margin pressure while waiting for its projected turnaround to materialize.

If you'd rather focus on companies with consistent earnings and revenue strength across market cycles, use stable growth stocks screener (2127 results) to discover stocks delivering steady results regardless of the environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARE

Alexandria Real Estate Equities

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives