- United States

- /

- Hotel and Resort REITs

- /

- NYSE:APLE

What Apple Hospitality REIT (APLE)'s Reaffirmed Monthly Dividend Means For Shareholders

Reviewed by Sasha Jovanovic

- Apple Hospitality REIT, Inc. announced that its Board of Directors declared a regular monthly cash distribution of US$0.08 per common share, payable on November 17, 2025, to shareholders of record as of October 31, 2025.

- This consistent dividend policy offers investors continued income visibility and underscores the company's commitment to providing regular shareholder returns.

- We'll examine how the reaffirmed monthly dividend distribution shapes Apple Hospitality REIT's investment outlook and potential income stability.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Apple Hospitality REIT Investment Narrative Recap

To be confident as a shareholder in Apple Hospitality REIT, you need to believe in consistent income from a large, diversified hotel portfolio despite cyclical shifts in travel demand and debt pressures. The reaffirmed monthly dividend policy and an 8.3% yield continue to anchor investor confidence, but the announcement alone does not materially impact the central short-term catalyst, macroeconomic recovery in travel demand, or offset the continuing risk of earnings pressure from persistent hybrid work trends. Among recent announcements, Apple Hospitality's expanded share repurchase activity stands out, with over 1.4 million shares bought back last quarter. While these repurchases, coupled with regular distributions, may support per-share metrics and bolster near-term sentiment, the core investment thesis still hinges on occupancy and rate recovery as corporate travel remains subdued. Yet, in contrast to regular income visibility, there remains a concern investors should be aware of regarding the company’s exposure to shifting travel patterns and...

Read the full narrative on Apple Hospitality REIT (it's free!)

Apple Hospitality REIT is expected to reach $1.5 billion in revenue and $179.3 million in earnings by 2028. This scenario assumes a 1.7% annual revenue growth rate but a decrease in earnings of $1.7 million from current earnings of $181.0 million.

Uncover how Apple Hospitality REIT's forecasts yield a $13.60 fair value, a 18% upside to its current price.

Exploring Other Perspectives

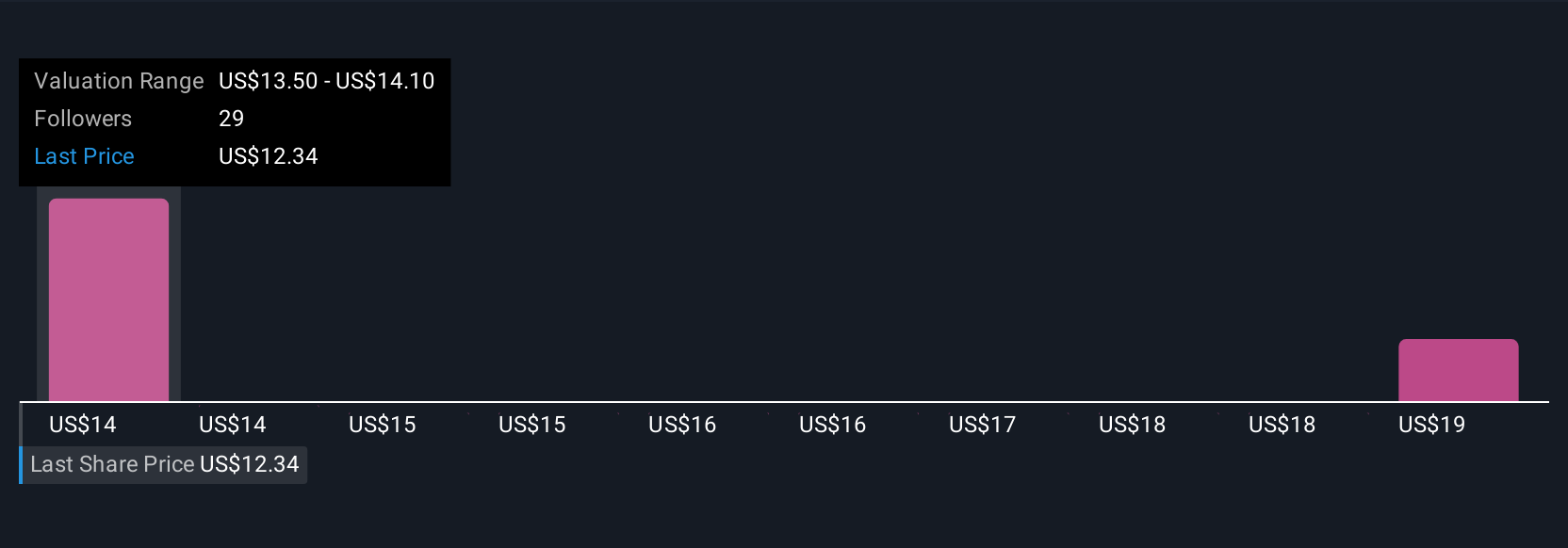

Simply Wall St Community members estimate Apple Hospitality REIT’s fair value between US$13.60 and US$17.32 across three independent views. With ongoing debate about business travel’s muted rebound, you can weigh several diverse perspectives.

Explore 3 other fair value estimates on Apple Hospitality REIT - why the stock might be worth just $13.60!

Build Your Own Apple Hospitality REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apple Hospitality REIT research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Apple Hospitality REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apple Hospitality REIT's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APLE

Apple Hospitality REIT

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (“REIT”) that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States.

Undervalued average dividend payer.

Market Insights

Community Narratives