- United States

- /

- Hotel and Resort REITs

- /

- NYSE:APLE

Is Softer Q3 Results and Lower Guidance Altering the Investment Case for Apple Hospitality REIT (APLE)?

Reviewed by Sasha Jovanovic

- Apple Hospitality REIT recently reported lower third-quarter revenue and net income compared to the previous year, and updated its 2025 earnings guidance downward due to concerns about ongoing economic uncertainty and potential impacts from a government shutdown.

- Despite cost control measures supporting margins, analysts have grown cautious on the company’s near-term outlook, prompting a recent downgrade and highlighting challenges from softer market demand and revised guidance.

- We’ll examine how the revised earnings guidance and softer revenue shape Apple Hospitality REIT’s investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Apple Hospitality REIT Investment Narrative Recap

To be a shareholder in Apple Hospitality REIT, you need confidence in the company’s ability to maintain its resilience amid hotel industry cycles, manage costs effectively, and navigate shifts in travel demand and economic sentiment. The latest lowered earnings guidance and softer revenue figures heighten concerns about near-term profitability and cash flow, underscoring that economic uncertainty and the risk of further disruptions, such as a government shutdown, remain the most pressing immediate risks. Short-term catalysts now depend on the pace of travel demand recovery and the effectiveness of operational cost controls; recent news has made the risk side more material.

Among recent announcements, the quarterly earnings release is especially relevant. The fall in revenue and net income significantly influenced the company’s decision to revise guidance downward, which in turn signals management’s caution as conditions remain unpredictable. While these results put pressure on the outlook, the continued optimization of expenses has at least partially offset margin impacts, an important point for anyone watching what propels or restrains future performance.

Yet, in contrast to cost management efforts, the threat from prolonged economic uncertainty is a key challenge that investors should be aware of...

Read the full narrative on Apple Hospitality REIT (it's free!)

Apple Hospitality REIT is projected to reach $1.5 billion in revenue and $179.3 million in earnings by 2028. This outlook assumes annual revenue growth of 1.7% and a $1.7 million decrease in earnings from the current $181.0 million.

Uncover how Apple Hospitality REIT's forecasts yield a $12.92 fair value, a 10% upside to its current price.

Exploring Other Perspectives

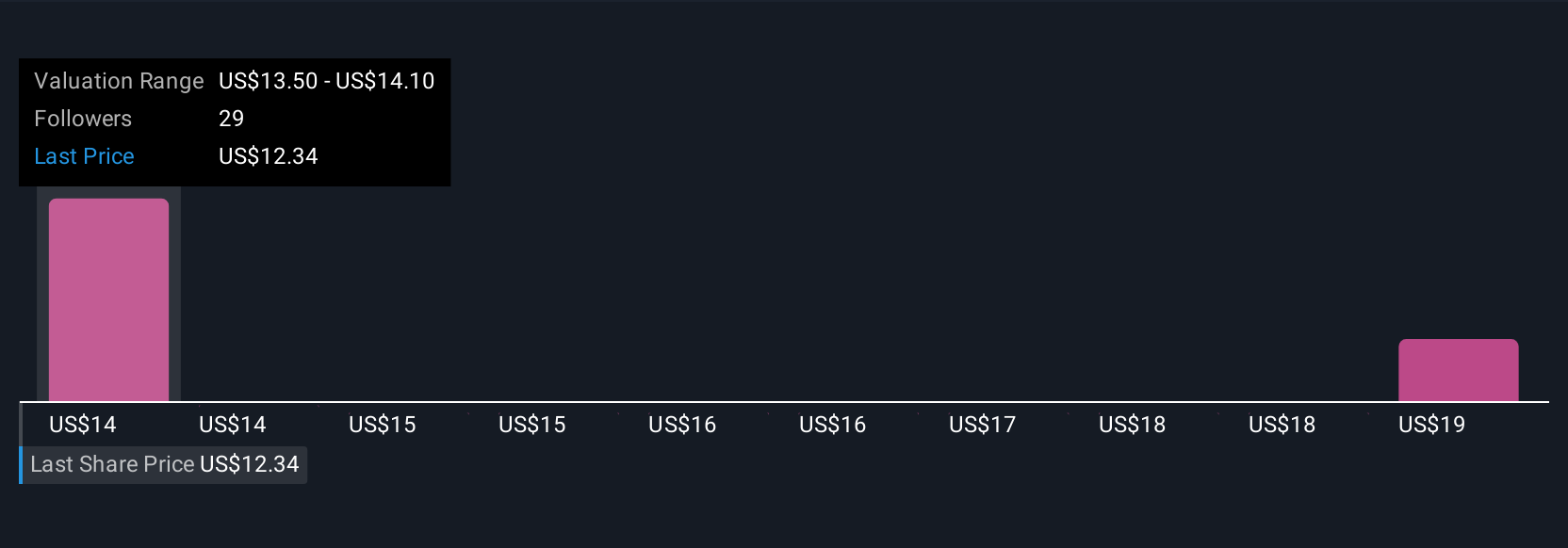

Simply Wall St Community members contributed 4 fair value estimates for Apple Hospitality REIT, ranging from US$12.92 to US$20.12 per share. With such wide variability in views, remember that the recent guidance cut highlights how sensitive future results could be to macroeconomic shifts and travel trends; you can compare these opinions to see how your expectations align.

Explore 4 other fair value estimates on Apple Hospitality REIT - why the stock might be worth just $12.92!

Build Your Own Apple Hospitality REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apple Hospitality REIT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Apple Hospitality REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apple Hospitality REIT's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APLE

Apple Hospitality REIT

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (“REIT”) that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives