- United States

- /

- Specialized REITs

- /

- NYSE:AMT

Will Leadership Transition at AMT Shape Investor Perceptions Amid Billing and Customer Uncertainties?

Reviewed by Sasha Jovanovic

- On November 5, 2025, American Tower Corporation announced that Robert J. Meyer plans to retire from his position as Senior Vice President and Chief Accounting Officer, remaining until a successor is appointed and assisting with transition before his retirement by the end of 2026.

- This development comes as the company faces heightened investor attention due to delays in U.S. billings and uncertainties after a key customer’s spectrum license divestiture.

- We'll examine how concerns about delayed billings and customer exposure are shaping American Tower's investment narrative in the near term.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is American Tower's Investment Narrative?

To invest in American Tower, you need to believe in the continued demand for wireless and data infrastructure as mobile data consumption rises. The biggest near-term catalysts have centered on American Tower’s progress booking new business in wireless and cloud services, seen through recent project expansions and increasing revenue. However, short-term uncertainty remains around delayed US billings and the possible downside from a key customer’s spectrum divestiture, which previously weighed on share price performance. With Robert J. Meyer’s planned retirement announced, the primary risk for shareholders would be any transition hiccup or further executive turnover that could slow execution or add to uncertainty, though the company’s succession planning appears orderly and likely not material for the broader business. At this point, the focus remains on execution and clarity around customer commitments as the most important factors for the stock’s outlook.

But, for anyone following closely, customer contract risks could still move the needle.

Exploring Other Perspectives

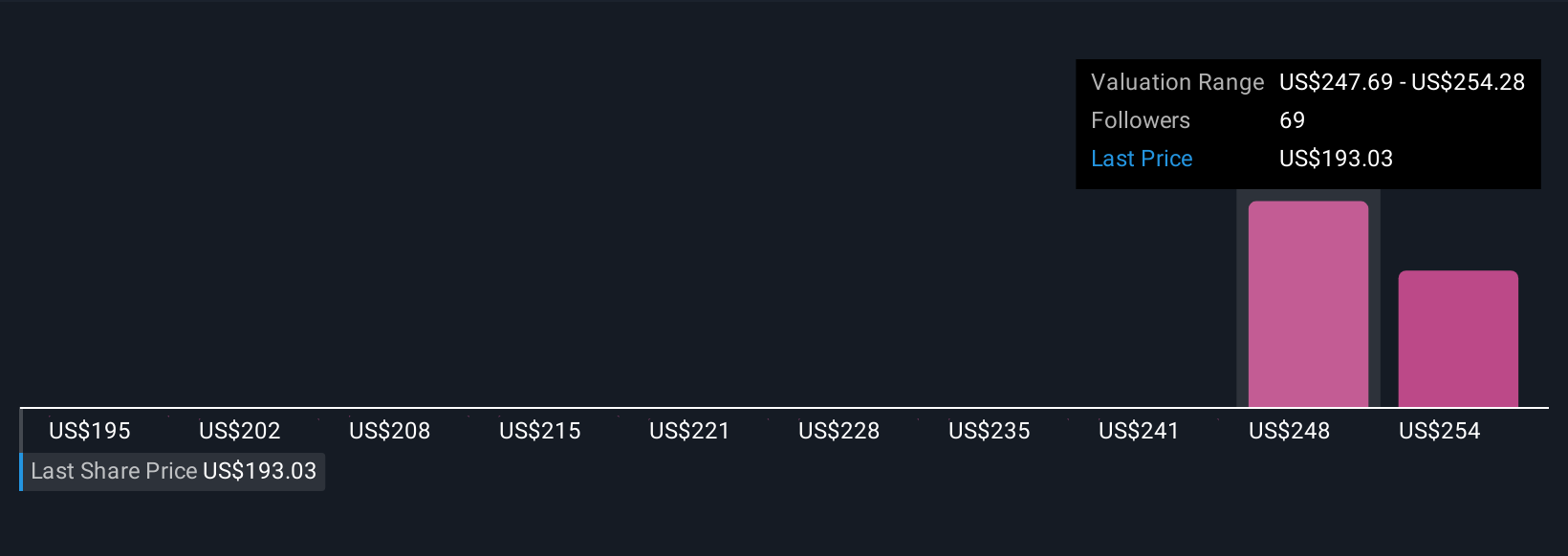

Explore 5 other fair value estimates on American Tower - why the stock might be worth as much as 45% more than the current price!

Build Your Own American Tower Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Tower research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Tower research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Tower's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 149,000 communications sites and a highly interconnected footprint of U.S.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives