- United States

- /

- Specialized REITs

- /

- NYSE:AMT

American Tower (AMT) Margin Surge Reinforces Efficiency Narrative Despite Slower Growth Outlook

Reviewed by Simply Wall St

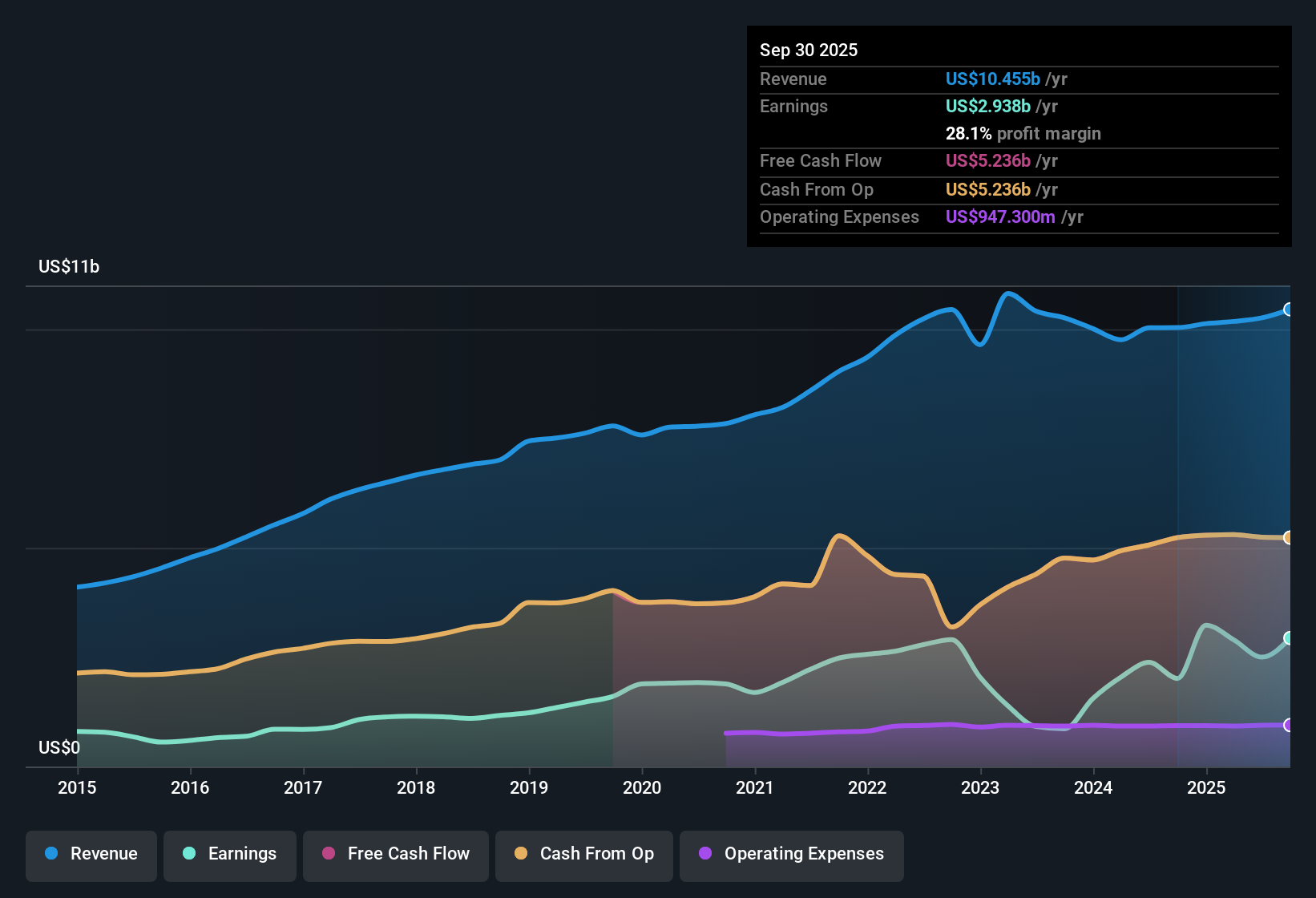

American Tower (AMT) posted a net profit margin of 28.1%, a sharp rise from last year’s 20.1%, with EPS growing 45.9% over the past year and a five-year average EPS growth of 4.2%. Investors saw this come with a price-to-earnings ratio of 28.5x, which is lower than the peer average but above the US Specialized REITs industry. Shares recently traded at $179.08, below some fair value estimates of $278.23. The setup for investors is clear, with an attractive dividend, strong margin expansion, and the stock still trading below several analyst price targets. However, forecasts call for profit and revenue growth to lag behind the pace of the broader US market.

See our full analysis for American Tower.Up next, we’ll put these headline results side by side with the prevailing narratives around American Tower to see which stories hold up and where expectations may need revisiting.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Climb Past 28% Even as Growth Slows

- Net profit margin reached 28.1%, a steep increase from 20.1% last year, while forward-looking revenue growth is projected to average just 4.7% per year, which is below the wider US market trend.

- What matters most for investors is that ongoing expansion in margins supports the view that American Tower's core business remains highly efficient even as overall revenue growth moderates.

- Strong profit margins support the idea that the company’s large-scale tower footprint and steady demand for wireless infrastructure insulate operations, making it a defensive pick in a choppy market environment.

- However, with revenue forecast to trail the pace of the overall market, this margin strength may not satisfy those looking for signs of faster top-line momentum.

Peer Discount in P/E Ratio Stands Out

- American Tower trades at a price-to-earnings (P/E) ratio of 28.5x, making it noticeably cheaper than the peer group average of 43.9x but still slightly more expensive than the US Specialized REITs industry at 26.6x.

- The relatively modest P/E ratio, combined with a current share price of $179.08, reinforces the prevailing view that American Tower offers value compared to direct competitors, though not as a fire-sale bargain.

- Investors who value stable cash flows and a steady dividend stream may find this discount appealing, especially when compared to the sector’s average premium pricing.

- However, the fact that the company remains above the industry’s P/E midpoint keeps valuation-sensitive buyers alert for further downside or a shift in broader REIT sentiment.

DCF Fair Value Leaves Room for Upside

- With shares changing hands at $179.08, the gap to the DCF fair value estimate of $278.23 per share suggests considerable room for potential upside if medium-term forecasts for earnings growth hold true.

- The market appears to be weighing American Tower’s solid reward profile, highlighted by historically strong earnings growth and ongoing margin gains, against the single flagged risk regarding its financial position.

- On one side, the stock’s position well below fair value and analyst price targets points to the possibility for multiple expansion if fundamentals remain resilient.

- On the other side, cautious investors point to American Tower’s financial structure as something that could limit gains if sector volatility or interest rates move against REITs in the coming cycle.

Have a read of the narrative in full and understand what's behind the forecasts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on American Tower's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While American Tower's profit margins are widening, its future revenue and earnings growth are projected to lag behind broader market trends.

If sustained growth is your priority, you can use stable growth stocks screener (2122 results) to zero in on companies delivering the reliable expansion that American Tower currently lacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 149,000 communications sites and a highly interconnected footprint of U.S.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives