- United States

- /

- Residential REITs

- /

- NYSE:AMH

American Homes 4 Rent (AMH) Rises on Strong Q3 Results and Upbeat Outlook—What’s Driving Investor Confidence?

Reviewed by Sasha Jovanovic

- American Homes 4 Rent announced past third quarter 2025 earnings results, reporting US$478.46 million in sales and US$103.18 million in net income, both rising over the prior year, and updated its full-year guidance for Core FFO and Same-Home Core revenues growth.

- Significantly, the company delivered a 7.5% increase in rents and other revenues with high occupancy and strengthened its outlook, reflecting improved financial performance and confidence in the single-family rental market.

- We’ll explore how American Homes 4 Rent’s increased earnings guidance and stronger-than-expected profitability inform the company’s evolving investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

American Homes 4 Rent Investment Narrative Recap

To believe in American Homes 4 Rent, an investor must have confidence in the enduring supply and demand imbalance in the U.S. housing market and the company’s ability to maintain high occupancy and rental growth in its single-family portfolio. The third quarter’s strong financial results and raised earnings guidance support the view that operational execution remains a key short-term catalyst; however, the risk of rising development and maintenance costs persists. At present, the recent news does not materially change this overall risk profile.

The most relevant announcement alongside the earnings results is the company’s upward revision of full-year guidance for Core FFO and Same-Home Core revenues, which specifically reflects better-than-expected performance in property tax expense and financing costs. This directly aligns with the main catalysts for American Homes 4 Rent, underscoring the company’s focus on operational efficiency and expense management in a challenging macro environment.

Conversely, investors should still consider the potential impact that increased labor and material costs could have on future margins and...

Read the full narrative on American Homes 4 Rent (it's free!)

American Homes 4 Rent is projected to reach $2.2 billion in revenue and $320.2 million in earnings by 2028. This outlook assumes annual revenue growth of 6.9% and a decrease in earnings of $91.1 million from the current earnings of $411.3 million.

Uncover how American Homes 4 Rent's forecasts yield a $39.81 fair value, a 26% upside to its current price.

Exploring Other Perspectives

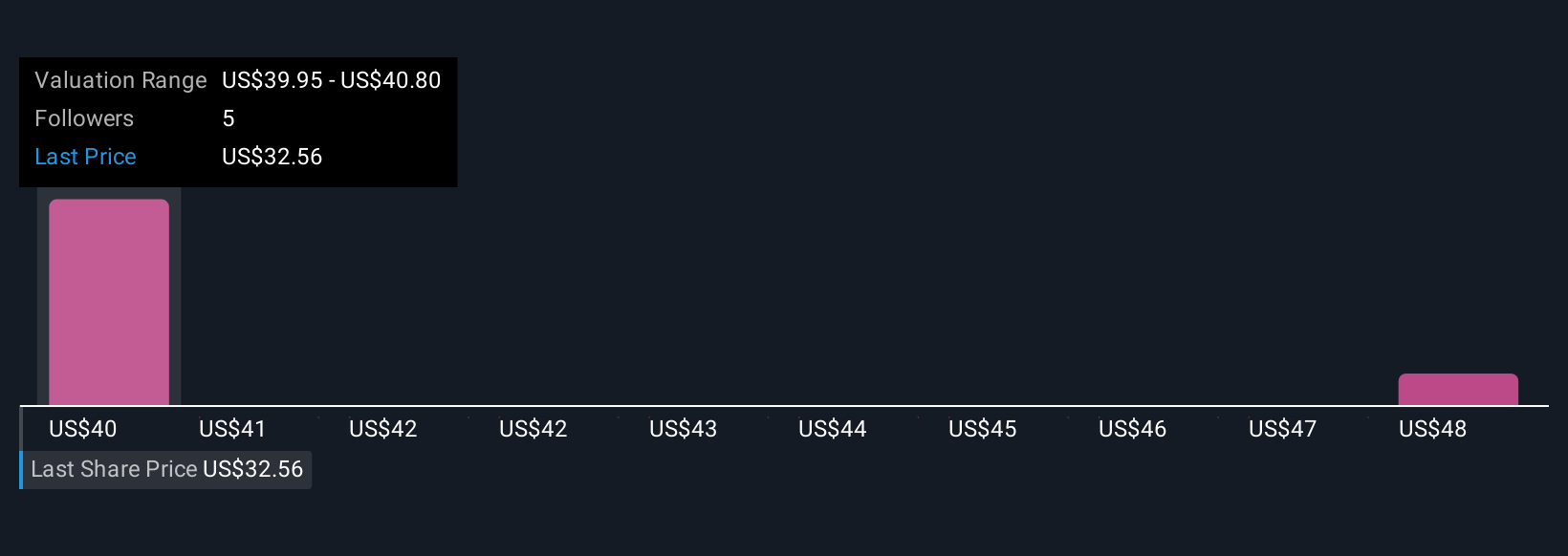

Simply Wall St Community fair value estimates range from US$39.81 to US$48.93 across 2 perspectives. While opinions vary widely, rising costs for development and maintenance remain a key topic shaping AMH’s outlook, so explore how others view the risks before making up your mind.

Explore 2 other fair value estimates on American Homes 4 Rent - why the stock might be worth just $39.81!

Build Your Own American Homes 4 Rent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Homes 4 Rent research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Homes 4 Rent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Homes 4 Rent's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMH

American Homes 4 Rent

AMH (NYSE: AMH) is a leading large-scale integrated owner, operator and developer of single-family rental homes.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives