- United States

- /

- Retail REITs

- /

- NYSE:AKR

Assessing Acadia Realty Trust (AKR) Valuation: Is a Quiet Recovery Signaling Opportunity?

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 9.9% Undervalued

According to the most widely followed valuation narrative, Acadia Realty Trust is considered nearly 10 percent undervalued at its current share price, based on analyst consensus and key financial projections.

The company’s outsized exposure to dense, affluent urban corridors, where urbanization trends and demographic shifts continue to drive premium consumer demand and limited new retail development, supports strong occupancy rates, rent increases, and margin expansion.

Want to know what drives this upbeat view? This narrative banks on bold growth, powerful urban strategies, and aggressive earnings expectations not often seen outside of tech stocks. Which financial forecasts spark such a high estimate? Dive in to discover the ambitious targets and unusual valuation logic that power this outlook.

Result: Fair Value of $22.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent e-commerce adoption or regulatory shifts in Acadia’s key urban markets could quickly challenge the bullish outlook and change investor sentiment.

Find out about the key risks to this Acadia Realty Trust narrative.Another View: What Do Other Valuations Say?

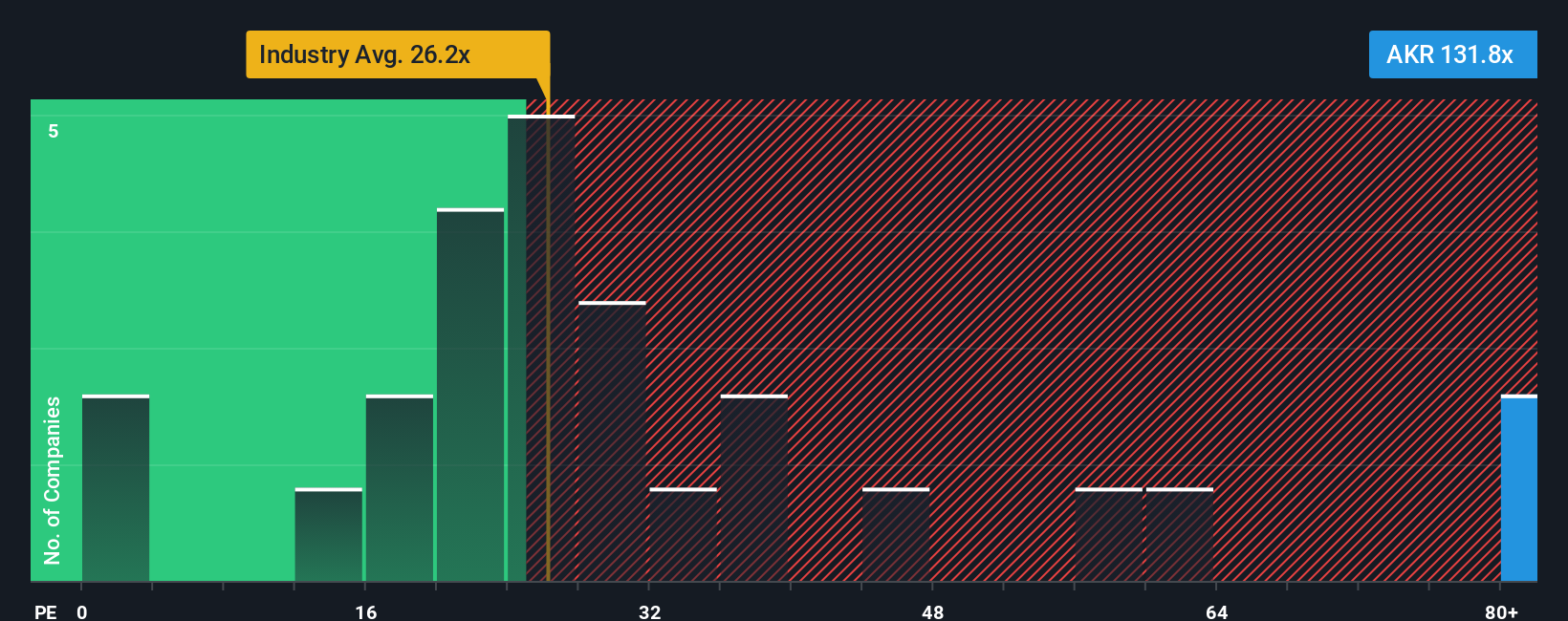

Looking through a different lens, some investors point out that Acadia Realty Trust looks quite expensive versus other retail REITs on a key valuation metric. This challenges the optimistic outlook. So what’s really factored in at today’s price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Acadia Realty Trust Narrative

If you see the story differently or want to test your own assumptions, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Acadia Realty Trust research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Unlock an even bigger advantage by putting the power of unique stock screens to work for you now. Don’t let the next winner slip away.

- Tap into opportunities with stable cash flows and strong fundamentals as you evaluate undervalued stocks based on cash flows. This is perfect for finding companies the market may be overlooking right now.

- Spot companies pioneering intelligent breakthroughs when you check out AI penny stocks, where AI innovation isn’t just a buzzword but a strategy for real growth.

- Boost your regular income while minimizing risk by exploring dividend stocks with yields > 3%, so you never miss a solid business offering impressive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AKR

Acadia Realty Trust

An equity real estate investment trust focused on delivering long-term, profitable growth.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives