- United States

- /

- Health Care REITs

- /

- NYSE:AHR

A Closer Look at American Healthcare REIT’s (AHR) Valuation Following Robust Q3 Results and Upgraded 2025 Guidance

Reviewed by Simply Wall St

American Healthcare REIT (AHR) delivered a strong third-quarter update that caught the attention of investors, as the company reported a 22% increase in normalized funds from operations and raised its full-year 2025 guidance.

See our latest analysis for American Healthcare REIT.

Momentum has clearly been picking up for American Healthcare REIT after its strong Q3 results and improved 2025 guidance. The 13.1% share price return over the past month and an impressive 83.2% total shareholder return over the past year suggest that investors are recognizing the company’s operational strength and growth trajectory, especially after overcoming sector headwinds and reporting higher earnings per share.

Inspired by AHR’s sharp turnaround? See which other healthcare stocks are showing similar resilience and growth prospects with our comprehensive discovery tool: See the full list for free.

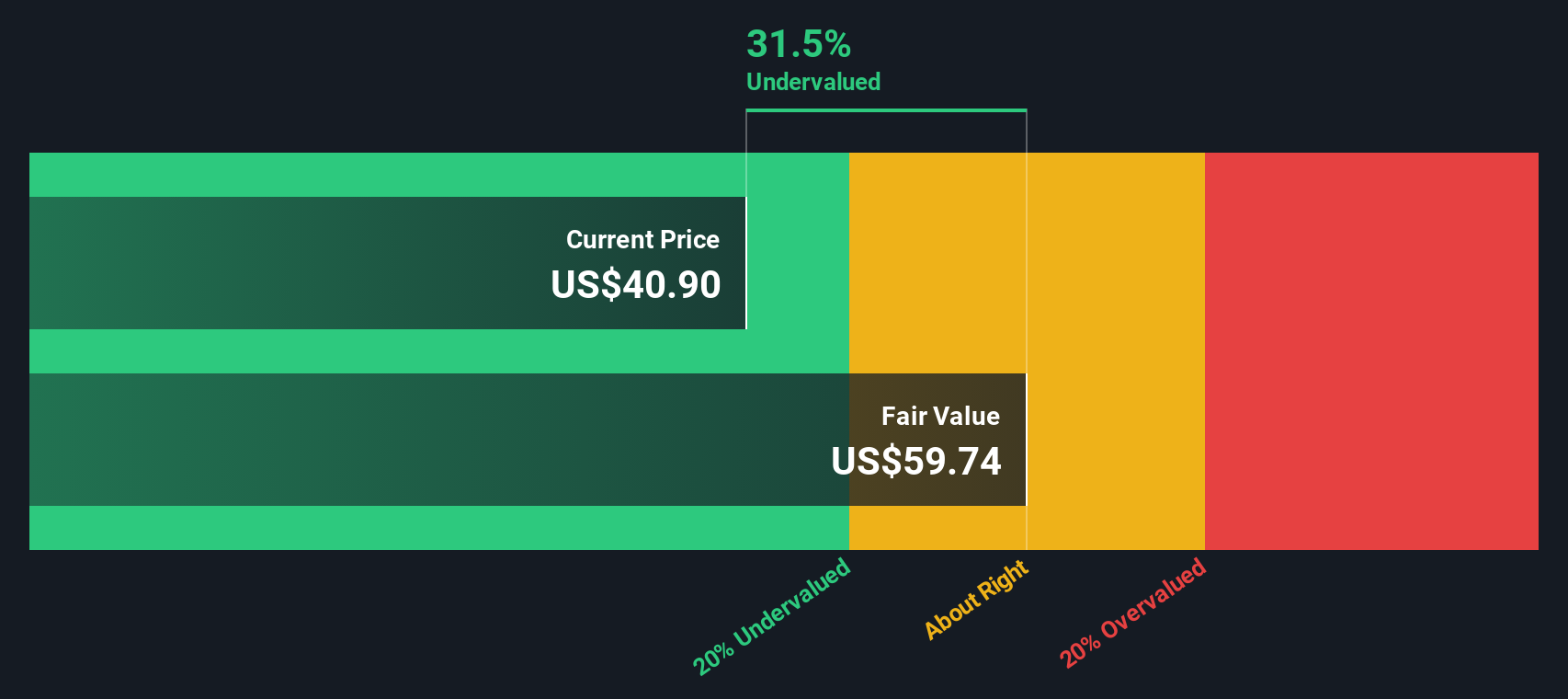

But with shares surging in response to these standout results and outlook upgrades, is American Healthcare REIT still undervalued? Or has the latest optimism already been factored into its price, leaving limited room for further gains?

Most Popular Narrative: 0.8% Undervalued

American Healthcare REIT's most closely followed valuation narrative pins its fair value just above the latest closing price of $48.32, suggesting only a sliver of potential upside from current levels. The narrative’s conclusion reflects a careful balance of rising profit margins, a modestly lower discount rate, and future profit expectations.

The company's disciplined portfolio optimization, selling older, lower-quality assets and redeploying proceeds into modern, higher-acuity, and recently developed properties at below replacement cost, should improve asset quality and accelerate future AFFO and earnings growth as new assets stabilize. Scalable operating initiatives, such as advanced revenue management systems and best-in-class benchmarking across operators, are expected to further increase pricing power and operational efficiency. These initiatives could translate into continued net margin improvement and higher cash flows.

Want to know what financial levers could keep boosting margins and earnings for years? The narrative’s math hinges on stronger efficiencies and bigger, bolder growth bets next. Discover the bold projections that may surprise you and get behind the headline price target.

Result: Fair Value of $48.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued growth depends on sustaining high occupancy and navigating tougher year-over-year comparisons. Both of these factors could dampen future momentum if trends reverse.

Find out about the key risks to this American Healthcare REIT narrative.

Another View: Our DCF Model Points to Modest Overvaluation

Looking through the lens of our SWS DCF model, American Healthcare REIT appears to be slightly overvalued and is currently trading above its estimated fair value. This method incorporates future cash flows and sets a more cautious benchmark, challenging the idea of remaining upside. Could market optimism be outpacing fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Healthcare REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Healthcare REIT Narrative

If you want to dig deeper or take a different perspective, you can analyze the numbers yourself and shape your own story in just a few minutes. Do it your way

A great starting point for your American Healthcare REIT research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities slip away. The right screener can help you spot stocks with explosive upside, defensive income, or tech sector momentum before everyone else.

- Tap into the market’s most overlooked gems by uncovering these 874 undervalued stocks based on cash flows that may be trading below their true worth right now.

- Boost your passive income with these 17 dividend stocks with yields > 3% offering more than 3% yields. This puts regular cash returns front and center on your watchlist.

- Ride the future of artificial intelligence and spot high-potential players via these 26 AI penny stocks as they dominate the next tech wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AHR

American Healthcare REIT

A Maryland-based self-managed REIT, owns and operates a diversified portfolio of clinical healthcare real estate across the U.S., U.K., and the Isle of Man.

Moderate growth potential second-rate dividend payer.

Market Insights

Community Narratives