- United States

- /

- Retail REITs

- /

- NYSE:ADC

Agree Realty (ADC): Examining Valuation After Recent 5% Share Price Rebound

Reviewed by Simply Wall St

See our latest analysis for Agree Realty.

Agree Realty’s 1-month share price return of over 5% marks a meaningful rebound, hinting at renewed optimism after a steady but more modest pace earlier in the year. With a 1-year total shareholder return of nearly 5% and longer-term gains in the double digits, momentum appears to be picking up again as investors reassess both growth opportunities and perceived risks.

If you’re curious to see what else is catching investor attention lately, now is the perfect time to discover fast growing stocks with high insider ownership

As shares head higher and fundamentals improve, a key question emerges for investors: is Agree Realty still trading at attractive value levels, or has the recent run already incorporated expectations for the company’s future growth?

Most Popular Narrative: 8.5% Undervalued

With Agree Realty's fair value pegged by the most popular narrative at $81.88, and the last close at $74.96, the gap suggests investor expectations haven’t fully closed with analysts' projections. This sets the stage for a pivotal debate: does recent momentum really capture the company’s upside, or is there more driving the enthusiasm?

Strong ongoing migration to suburban areas and robust demand for necessity-based retail space, as evidenced by record-high retailer demand for new brick-and-mortar locations, positions Agree Realty to maintain near-full occupancy and drive consistent rental revenue growth. The durability of essential retail categories (grocery, pharmacy, home improvement, auto parts) is translating into high-quality, e-commerce-resistant tenant composition, supporting rent stability and protecting net margins against shifts in consumer behavior or economic cycles.

Want the real story behind why this target sits so far above today’s price? It all comes down to how dramatic growth rates and future profit margins shape the bull case. There is a bold set of forecasts packed into this narrative: see which surprising projections underpin this standout valuation.

Result: Fair Value of $81.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, aggressive acquisition growth and heavy reliance on a few large tenants could challenge earnings stability if market conditions change unexpectedly.

Find out about the key risks to this Agree Realty narrative.

Another View: What Market Multiples Tell Us

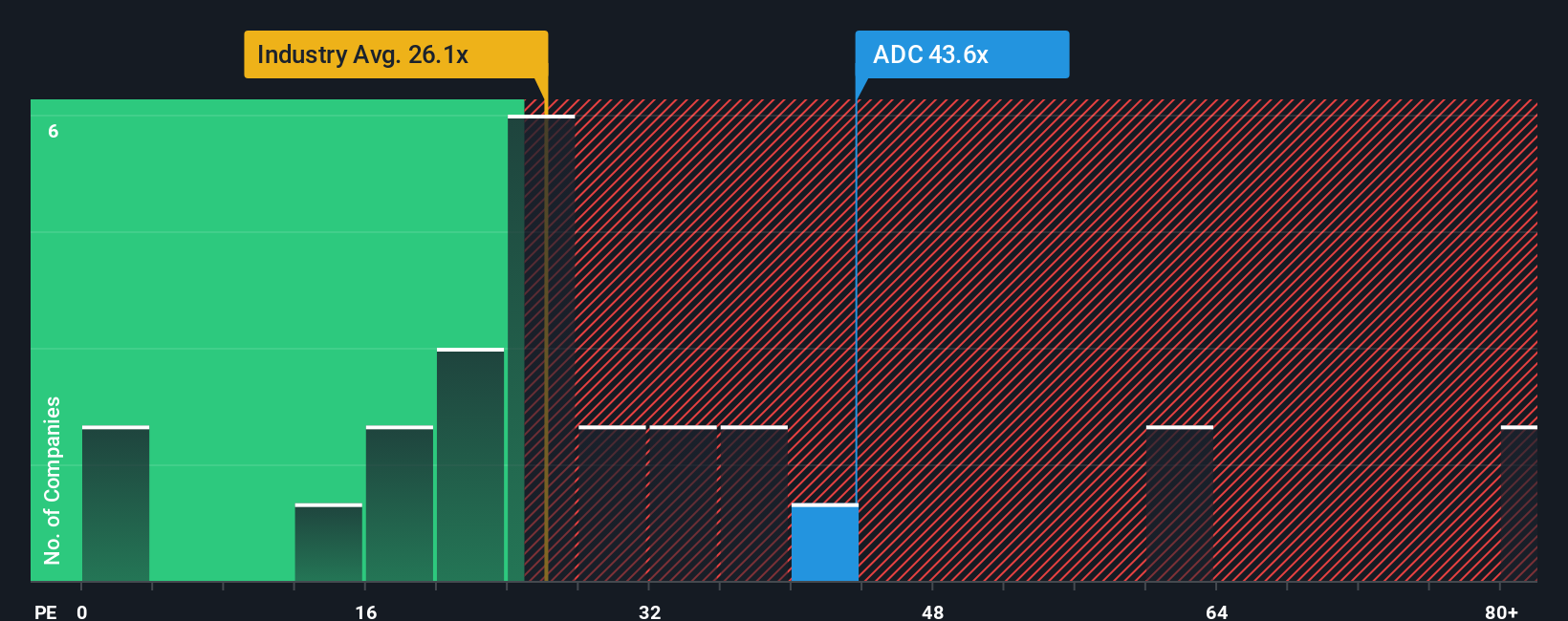

Looking at how Agree Realty trades using its price-to-earnings ratio, there is a big gap between perception and broader industry standards. It currently sits at 46.3x earnings, well above both its peer group at 26.5x and what regression suggests as a fair ratio at 37.1x. This rich valuation could mean investors are pricing in high growth, but it also raises the risk that expectations have gone too far. Will the fundamentals deliver enough for the market to keep rewarding that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agree Realty Narrative

If you want a different perspective or enjoy digging into the numbers yourself, try shaping your own Agree Realty narrative in under three minutes with Do it your way.

A great starting point for your Agree Realty research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one stock. Open up your investment playbook by targeting opportunities that match your strategy and curiosity. With these handpicked screens, you could find tomorrow’s winners ahead of the crowd.

- Boost your income by targeting consistent payouts with these 19 dividend stocks with yields > 3%, highlighting stocks offering yields above 3% for more reliable returns.

- Ride the wave of technological disruption by tapping into these 28 quantum computing stocks and get ahead with companies driving quantum computing breakthroughs.

- Stay ahead of market trends by focusing on value with these 870 undervalued stocks based on cash flows, uncovering stocks that look undervalued based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADC

Agree Realty

A publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives