- United States

- /

- Specialized REITs

- /

- NasdaqCM:SELF

The Compensation For Global Self Storage, Inc.'s (NASDAQ:SELF) CEO Looks Deserved And Here's Why

We have been pretty impressed with the performance at Global Self Storage, Inc. (NASDAQ:SELF) recently and CEO Mark Winmill deserves a mention for their role in it. Coming up to the next AGM on 08 June 2021, shareholders would be keeping this in mind. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

Check out our latest analysis for Global Self Storage

How Does Total Compensation For Mark Winmill Compare With Other Companies In The Industry?

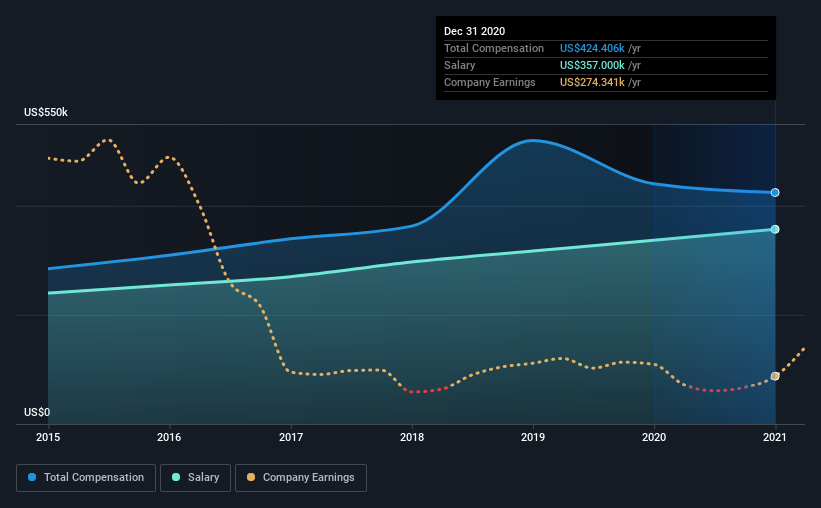

According to our data, Global Self Storage, Inc. has a market capitalization of US$51m, and paid its CEO total annual compensation worth US$424k over the year to December 2020. That's slightly lower by 3.6% over the previous year. In particular, the salary of US$357.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$424k. So it looks like Global Self Storage compensates Mark Winmill in line with the median for the industry. What's more, Mark Winmill holds US$965k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$357k | US$337k | 84% |

| Other | US$67k | US$103k | 16% |

| Total Compensation | US$424k | US$440k | 100% |

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. Global Self Storage pays out 84% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Global Self Storage, Inc.'s Growth

Global Self Storage, Inc. has seen its funds from operations (FFO) increase by 15% per year over the past three years. Its revenue is up 6.8% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Global Self Storage, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Global Self Storage, Inc. for providing a total return of 59% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 5 warning signs for Global Self Storage (2 shouldn't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Global Self Storage, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SELF

Global Self Storage

Global Self Storage is a self-administered and self-managed REIT that owns, operates, manages, acquires, and redevelops self-storage properties.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives