- United States

- /

- Health Care REITs

- /

- NasdaqGS:SBRA

Upbeat Guidance and Dividend Commitment Might Change the Case for Investing in Sabra Health Care REIT (SBRA)

Reviewed by Sasha Jovanovic

- On November 5, 2025, Sabra Health Care REIT announced its third-quarter earnings, updated full-year earnings guidance, reaffirmed a US$0.30 quarterly dividend payout, and disclosed a US$2.57 million real estate impairment.

- While quarterly net income and sales declined year-on-year, revenue grew and full-year net income guidance was increased, signaling resilience alongside the dividend commitment.

- We’ll now examine how Sabra’s updated earnings guidance and continued dividend payments shape the company’s investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sabra Health Care REIT Investment Narrative Recap

To be a Sabra Health Care REIT shareholder, you need to believe in long-term demand for senior housing and healthcare real estate, supported by demographic shifts and tight supply. The recent Q3 update, with increased earnings guidance and another US$0.30 dividend, does not materially shift the most important short-term catalyst (stable occupancy and rental growth), nor amplify the key risk of operator underperformance during ongoing portfolio transitions.

The reaffirmed quarterly dividend stands out as a timely reminder of Sabra’s income focus. This announcement, amid a period of modest impairment charges, signals the company’s commitment to maintaining stable payouts, a crucial support for sentiment while the market focuses on near-term cash flows and operating resilience.

However, behind the updated guidance, investors should also pay close attention to...

Read the full narrative on Sabra Health Care REIT (it's free!)

Sabra Health Care REIT's narrative projects $952.0 million revenue and $224.6 million earnings by 2028. This requires 9.1% yearly revenue growth and a $42.3 million earnings increase from $182.3 million today.

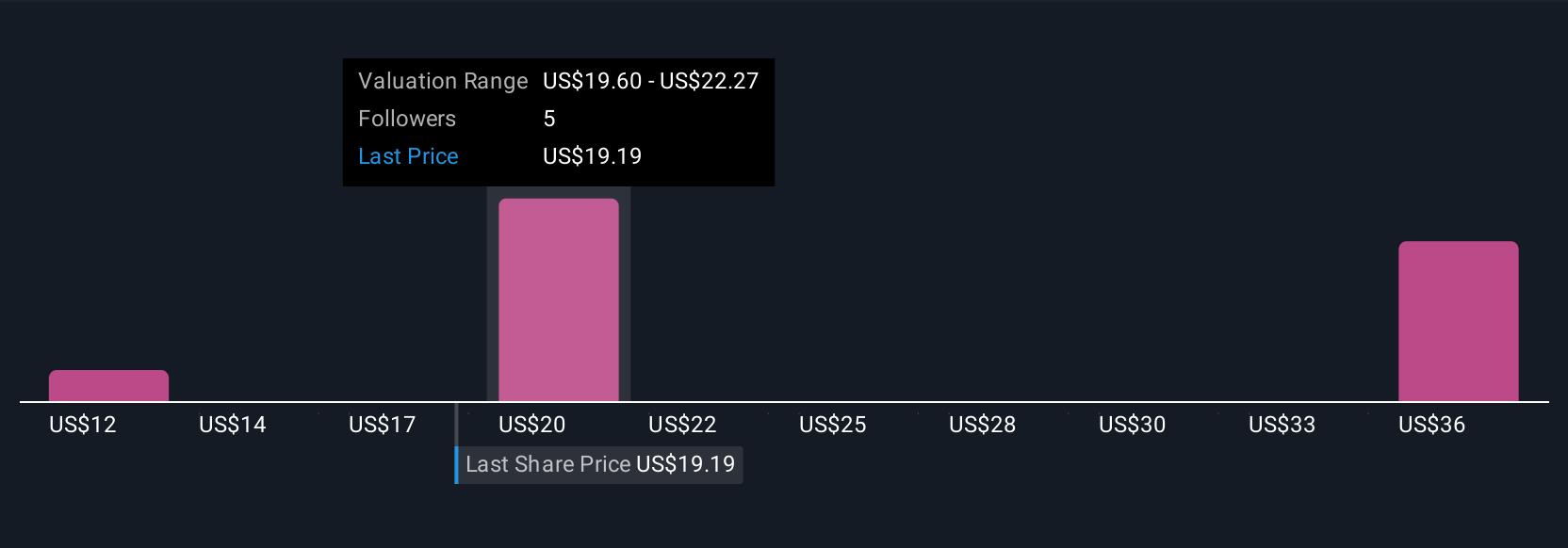

Uncover how Sabra Health Care REIT's forecasts yield a $20.82 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair value as low as US$11.59 and as high as US$43.52, from three independent assessments. Earnings guidance upgrades are attracting attention, but opinions on growth risks and opportunities still vary widely, explore multiple views before making any decisions.

Explore 3 other fair value estimates on Sabra Health Care REIT - why the stock might be worth over 2x more than the current price!

Build Your Own Sabra Health Care REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sabra Health Care REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sabra Health Care REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sabra Health Care REIT's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBRA

Sabra Health Care REIT

As of June 30, 2025, Sabra’s investment portfolio included 359 real estate properties held for investment (consisting of (i) 219 skilled nursing/transitional care facilities, (ii) 36 senior housing communities (“senior housing - leased”), (iii) 73 senior housing communities operated by third-party property managers pursuant to property management agreements (“senior housing - managed”), (iv) 16 behavioral health facilities and (v) 15 specialty hospitals and other facilities), 13 investments in loans receivable (consisting of three mortgage loans and 10 other loans), four preferred equity investments and two investments in unconsolidated joint ventures.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives