- United States

- /

- Retail REITs

- /

- NasdaqGS:REG

Is Regency's Dividend Hike and Earnings Guidance Raising the Bar for REG’s Long-Term Resilience?

Reviewed by Sasha Jovanovic

- Regency Centers Corporation recently reported higher third quarter and nine-month revenues and net income for 2025, accompanied by an approximately 7.1% increase in its common stock dividend and raised annual earnings guidance.

- This performance reflects ongoing growth from acquisitions, such as the Rancho Mission Viejo Portfolio in California, and highlights management’s confidence in Regency’s core business despite operating cost and debt-related pressures.

- Next, we'll explore how Regency's earnings and dividend boost signal resilience and potential margin gains for its investment outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Regency Centers Investment Narrative Recap

To own Regency Centers stock, you need to believe in the long-term demand for necessity-based, suburban retail properties and Regency's ability to grow earnings and dividends through portfolio expansion and stable tenant relationships. Recent third-quarter results show consistent revenue and profit growth, healthy dividends, and slightly raised earnings guidance. While this momentum helps reinforce investor confidence, near-term catalysts remain tied to acquisition execution and tenant stability, with persistent risks from higher operating costs and tenant distress; the news does not materially change this outlook.

The most relevant announcement is the 7.1% increase in the quarterly common stock dividend to US$0.755 per share, underscoring management’s continued belief in Regency’s cash flow strength and ability to support shareholder returns despite external pressures. This dividend increase, paired with stable earnings growth, keeps the focus on Regency’s income resilience as investors watch for signs of margin improvement from ongoing acquisitions.

However, despite these positives, investors should remain attentive to the risk that rising operating or debt costs could compress margins if expense recovery rates slow further...

Read the full narrative on Regency Centers (it's free!)

Regency Centers' narrative projects $1.7 billion revenue and $506.7 million earnings by 2028. This requires 2.3% yearly revenue growth and a $116.8 million earnings increase from $389.9 million today.

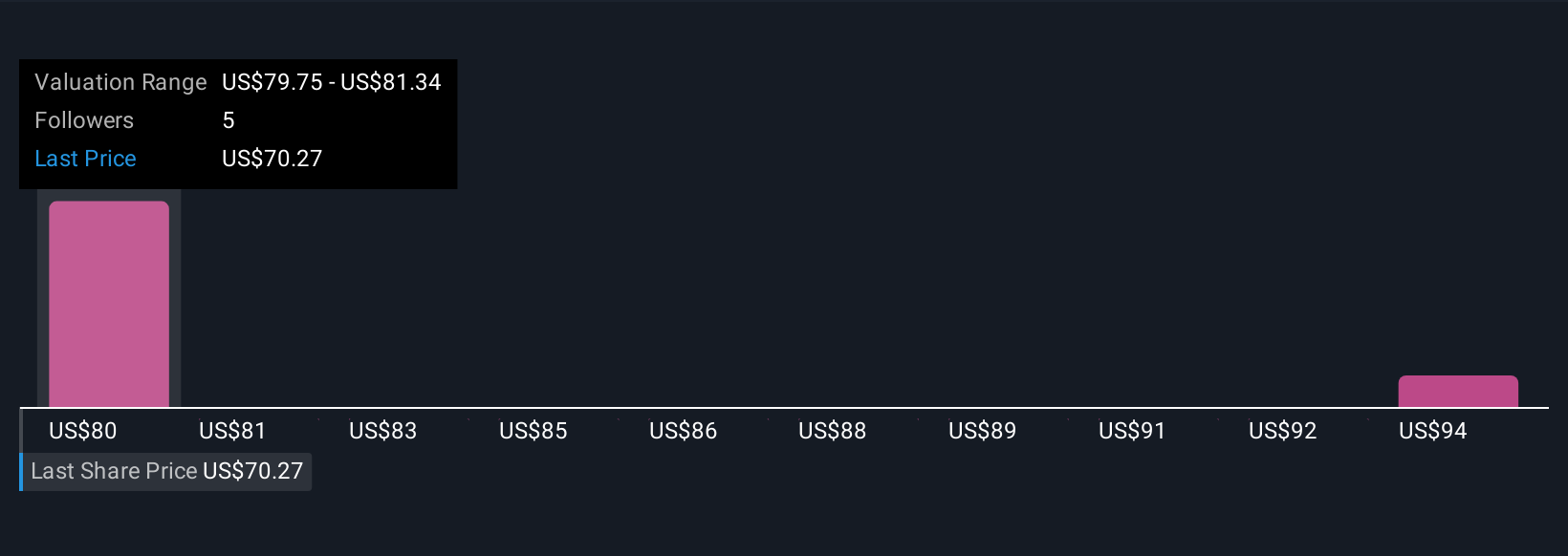

Uncover how Regency Centers' forecasts yield a $80.05 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate Regency Centers’ fair value between US$80.05 and US$101.34 per share. Many see supply constraints benefiting Regency’s centers, but ongoing cost pressures remain a concern for overall returns.

Explore 2 other fair value estimates on Regency Centers - why the stock might be worth as much as 47% more than the current price!

Build Your Own Regency Centers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regency Centers research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Regency Centers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regency Centers' overall financial health at a glance.

No Opportunity In Regency Centers?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REG

Regency Centers

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives