- United States

- /

- Specialized REITs

- /

- NasdaqGS:PCH

PotlatchDeltic (PCH): Evaluating Valuation as Shares Edge Lower and Analyst Targets Remain Out of Reach

Reviewed by Simply Wall St

See our latest analysis for PotlatchDeltic.

PotlatchDeltic’s share price has given up some ground lately, most recently dipping by 5% over the past week. Its year-to-date return is just above water at 0.6%. The past year’s total shareholder return of -1.7% hints that momentum has faded. Recent price movements suggest investors are still weighing up shifting expectations around timberland and real estate markets.

If you’re eyeing where opportunities might emerge next, now’s the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

But with PotlatchDeltic now trading more than 20% below analyst targets and showing solid profit growth, do current prices suggest an undervalued stock, or is the market already anticipating and including its future gains in the price?

Most Popular Narrative: 17.8% Undervalued

PotlatchDeltic’s last close of $39.33 sits well below the most popular narrative’s fair value estimate of $47.88. This gap reflects optimism around shifting industry dynamics beyond today’s cautious market mood.

Heightened environmental focus and expanding opportunities in solar, carbon offsets, lithium, and other natural climate solutions are creating new, high-margin revenue streams that diversify earnings and bolster long-term margin expansion.

What is the secret sauce behind this bullish outlook? Hint: It is not just lumber. The narrative’s fair value is driven by bold expectations for future profits and a premium multiple that is rarely seen in this sector. Want to see the underlying math and ambitious assumptions in full? Do not miss the details that could reshape what you think about PotlatchDeltic’s potential.

Result: Fair Value of $47.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in the housing market or unexpected regulatory changes could quickly alter PotlatchDeltic’s growth story and challenge bullish expectations.

Find out about the key risks to this PotlatchDeltic narrative.

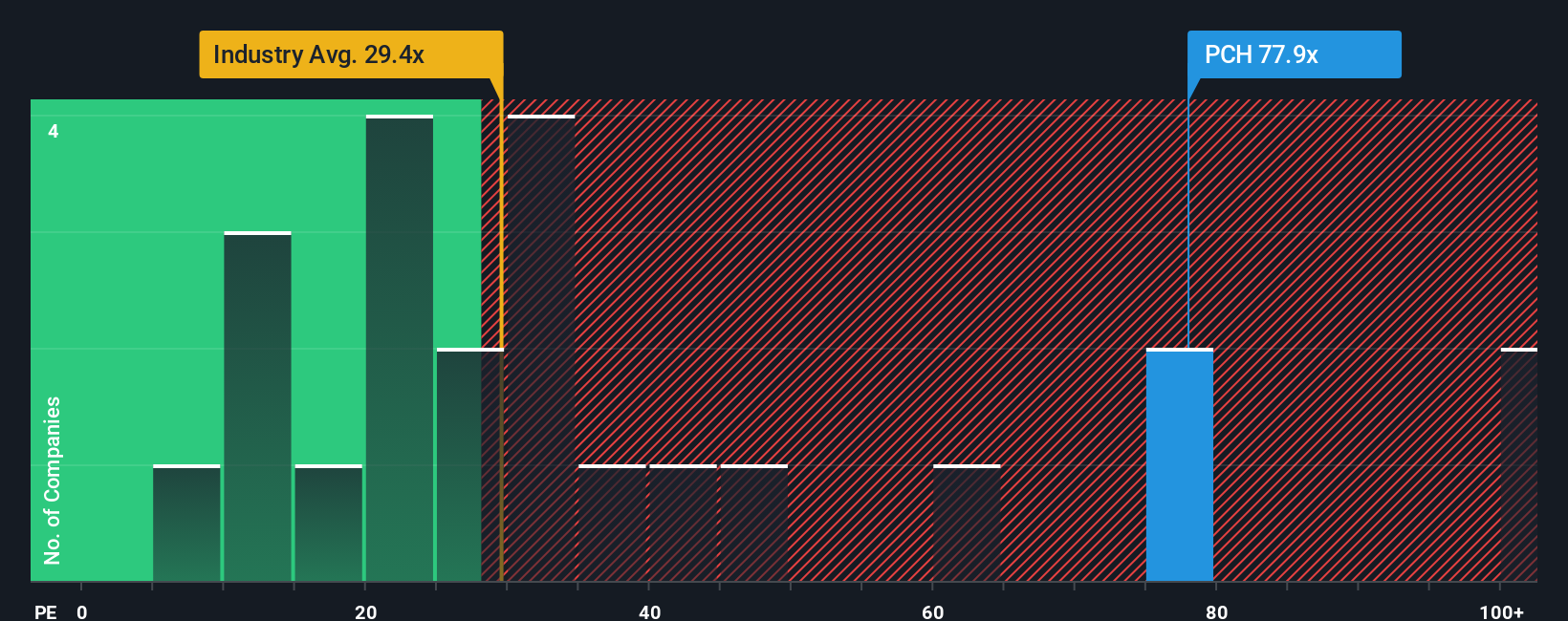

Another View: High PE Ratio Clouds the Picture

Stepping back from fair value estimates, PotlatchDeltic’s price-to-earnings ratio stands at 47.3x, which is much higher than both the US Specialized REITs industry average of 28.6x and its peer average of 34.2x. Even compared to its calculated fair ratio of 41.7x, the stock looks pricey. This suggests that investors may be paying up for growth expectations that could prove optimistic if earnings disappoint. Is the premium deserved, or does it signal added risk beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PotlatchDeltic Narrative

If you see things differently or would rather dig into the details on your own terms, you can build your own narrative in just a few minutes, and Do it your way

A great starting point for your PotlatchDeltic research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just a single stock. The Simply Wall Street Screener puts you a step ahead with handpicked opportunities across game-changing industries.

- Target tomorrow’s winners by reviewing these 874 undervalued stocks based on cash flows which features companies priced below their intrinsic value, ready for potential upside.

- Maximize your dividend income by checking out these 17 dividend stocks with yields > 3% which includes robust yields above 3% to power your portfolio’s cash flow.

- Stay ahead of market megatrends by exploring these 26 AI penny stocks that highlights companies at the forefront of artificial intelligence breakthroughs and rapid thematic growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCH

PotlatchDeltic

PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) with ownership of 2.1 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives