- United States

- /

- Specialized REITs

- /

- NasdaqGS:PCH

Examining PotlatchDeltic Shares After Sawmill Expansion Plans and 53.9% Fair Value Gap

Reviewed by Bailey Pemberton

Thinking about what to do with PotlatchDeltic stock? You're not alone. The company has been catching investor interest lately, thanks in part to a combination of modest long-term growth and a few notable news headlines. With shares last trading at $42.06, PotlatchDeltic has seen a 4.7% gain over the past month, bringing its year-to-date return to 7.6% and notching up a solid 8.4% increase in the past year. The five-year return stands stronger at 29.1%, hinting at a track record of resilience and steady demand for its timber and real estate assets.

Much of this price movement can be traced back to recent developments in the broader housing and construction markets, where rising demand for sustainable building materials has played in PotlatchDeltic's favor. The company also attracted attention after announcing plans to invest in expanding its sawmill operations, which signaled greater confidence in long-term demand but also brought questions about future capital outlays and market risk.

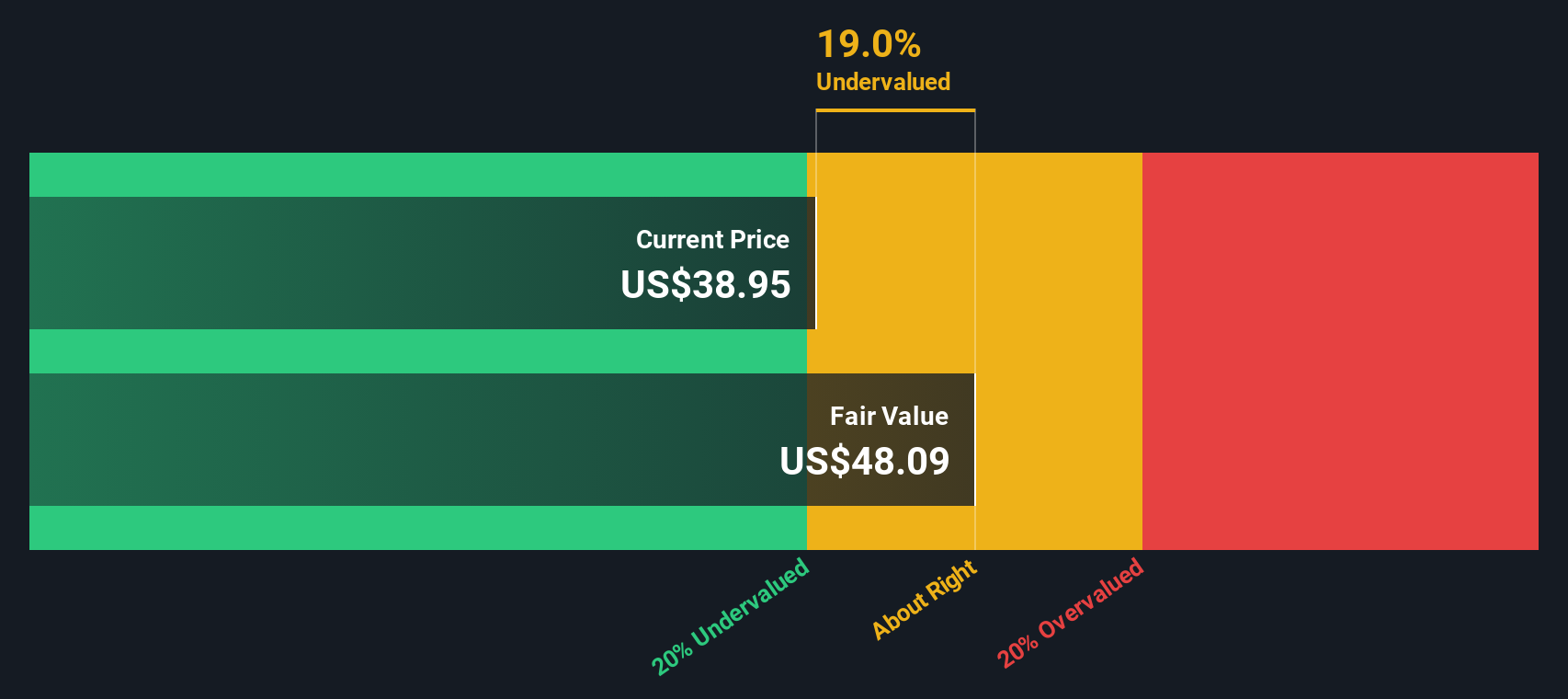

It’s no surprise, then, that investors are trying to make sense of whether the current share price offers real value. According to our latest screening, PotlatchDeltic is considered undervalued in 2 out of 6 key valuation checks, giving it a value score of 2. But what does that actually mean in practice, and how reliable are those valuation tools in this market?

Let’s break down the standard valuation approaches for PotlatchDeltic, and then explore an even sharper way to cut through the noise and understand what this company is truly worth.

PotlatchDeltic scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: PotlatchDeltic Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by forecasting its future cash generation and then discounting those cash flows back to today’s dollars to reflect their present worth. For PotlatchDeltic, this approach uses funds from operations to calculate Free Cash Flow (FCF).

The company reported $161.9 Million in FCF for the last twelve months. According to analyst estimates, PotlatchDeltic’s annual FCF is projected to steadily grow in the coming years. For example, FCF is estimated to reach $228 Million by 2026 and $255.4 Million by 2027. Longer-term projections are extrapolated using industry growth assumptions, which continue this upward trend over the next decade.

All figures use the United States Dollar ($). The DCF model calculates an intrinsic fair value of $91.30 per share. Compared to the current market price of $42.06, this suggests PotlatchDeltic is trading at a 53.9% discount to its underlying value.

The evidence is clear. The DCF analysis implies that PotlatchDeltic shares are sharply undervalued right now based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PotlatchDeltic is undervalued by 53.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PotlatchDeltic Price vs Earnings

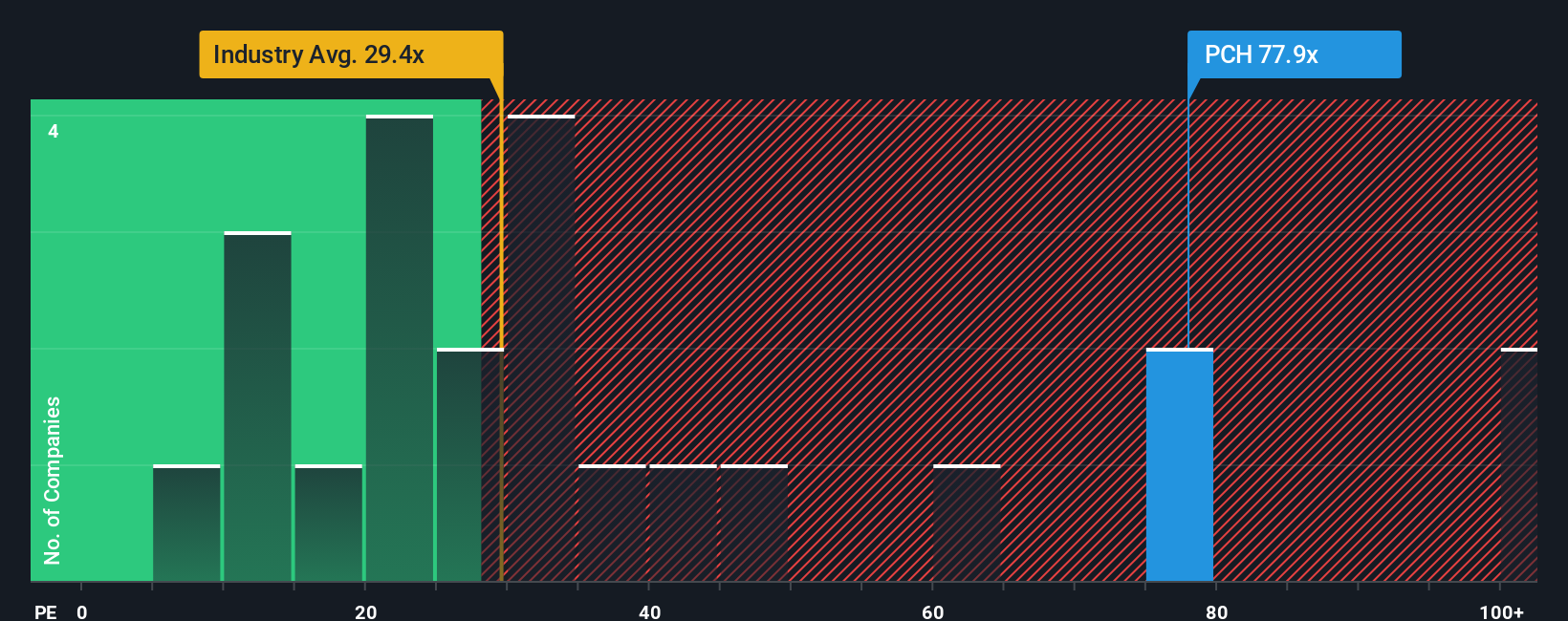

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like PotlatchDeltic, as it quickly shows how much investors are willing to pay for each dollar of company earnings. A higher or lower PE can reflect market optimism about future growth or concerns about risk. Typically, strong growth prospects and lower risk justify a higher "normal" or "fair" PE ratio, while slower growth or higher risk push that number down.

PotlatchDeltic currently trades at a PE ratio of 78x. For context, the average PE among industry peers is 38x, and the broader Specialized REITs industry PE ratio sits even lower at 18x. On the surface, this suggests that PotlatchDeltic is priced at a significant premium relative to peers and the sector.

However, to get a more tailored view, Simply Wall St uses the Fair Ratio, a proprietary benchmark that blends the company’s earnings growth, risk level, profit margin, market cap, and industry into a single multiple. PotlatchDeltic’s Fair Ratio is 52x, reflecting its specific financial qualities and outlook. This makes the Fair Ratio a more holistic and accurate gauge than simple peer or industry comparisons because it accounts for company-specific growth drivers and risks.

Comparing PotlatchDeltic’s current PE ratio (78x) to its Fair Ratio (52x) reveals that the stock is trading well above what would be expected given its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PotlatchDeltic Narrative

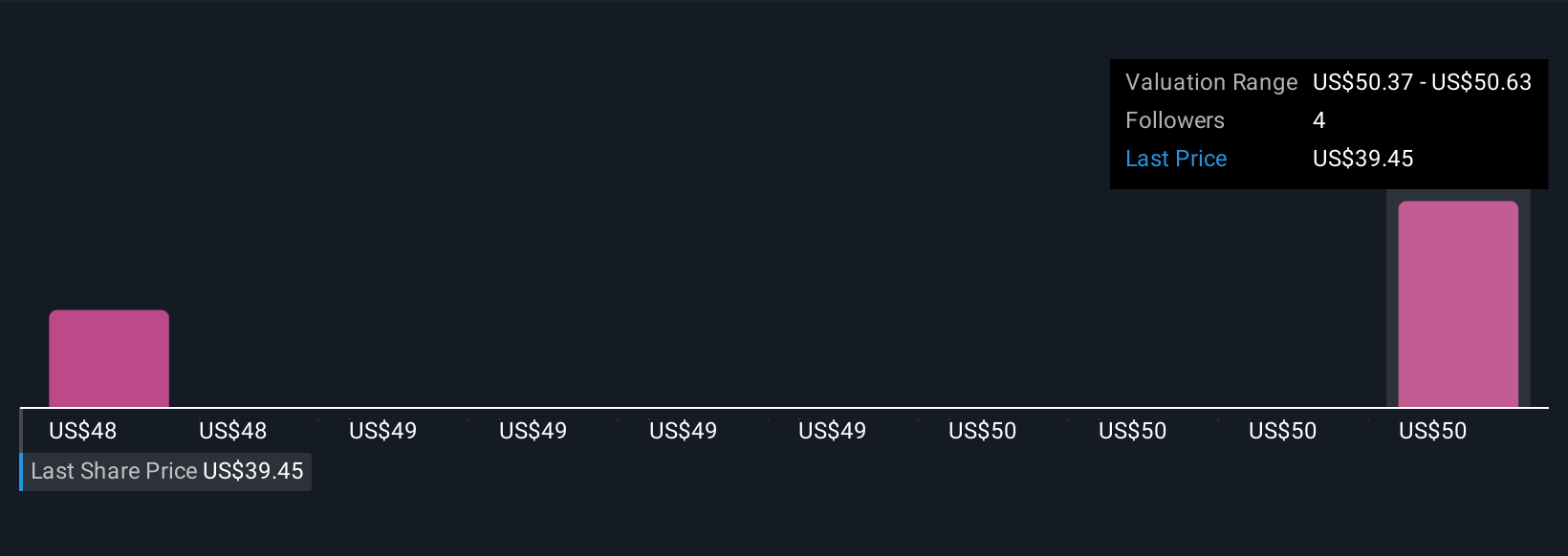

Earlier we mentioned that there's an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are your own story or perspective about a company’s future. They link what you believe about a business, including its strengths, risks, and opportunities, with concrete forecasts for revenue, earnings, and margins to arrive at your unique estimate of fair value.

Rather than just relying on numbers alone, Narratives help you explain why you expect a certain outcome, making your investment decisions more intentional and personal. Narratives connect the dots: your outlook leads to your forecast, which drives your fair value calculation. This all happens easily on Simply Wall St’s Community page, used by millions of investors.

You can use Narratives to see, at a glance, whether your fair value supports buying or selling based on today’s price, and your story automatically updates whenever new information or news arrives. For example, one user might believe PotlatchDeltic’s long-term housing tailwinds justify a fair value of $51 per share, while another, worried about regulatory risk, sets fair value closer to $39. You can see instantly how differing stories lead to different investment decisions.

Do you think there's more to the story for PotlatchDeltic? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCH

PotlatchDeltic

PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) with ownership of 2.1 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives