- United States

- /

- Specialized REITs

- /

- NasdaqGS:PCH

Assessing PotlatchDeltic (PCH) Valuation: Is Steady Growth Hiding an Undervalued Opportunity?

Reviewed by Simply Wall St

See our latest analysis for PotlatchDeltic.

PotlatchDeltic’s share price momentum has been quietly building, delivering a 5.87% 1-month share price return and an 8.83% gain year-to-date. Its 1-year total shareholder return of 5.2% underscores a trend of solid, if unspectacular, progress against a backdrop of improving fundamentals.

If this performance has you reevaluating your portfolio mix, now could be the perfect time to discover fast growing stocks with high insider ownership.

But with shares trading nearly 17% below analyst targets and strong net income growth on the books, is PotlatchDeltic now attractively undervalued, or has the market already accounted for all the good news?

Most Popular Narrative: 16% Undervalued

PotlatchDeltic's fair value, according to the most widely followed narrative, stands well above its last close and highlights a sizable gap between price and expectation. This difference invites a closer look at what might be fueling bullish optimism.

*Heightened environmental focus and expanding opportunities in solar, carbon offsets, lithium, and other natural climate solutions are creating new, high-margin revenue streams that diversify earnings and bolster long-term margin expansion.*

Curious how this narrative justifies a premium valuation? The answer lies in a bold set of growth projections and innovative revenue streams that could reshape PotlatchDeltic's financial future. Discover the hidden factors that make this storyline so compelling.

Result: Fair Value of $50.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering weakness in the housing market or regional operating risks could quickly undermine these optimistic projections and challenge PotlatchDeltic’s long-term growth outlook.

Find out about the key risks to this PotlatchDeltic narrative.

Another View: Multiples Tell a Different Story

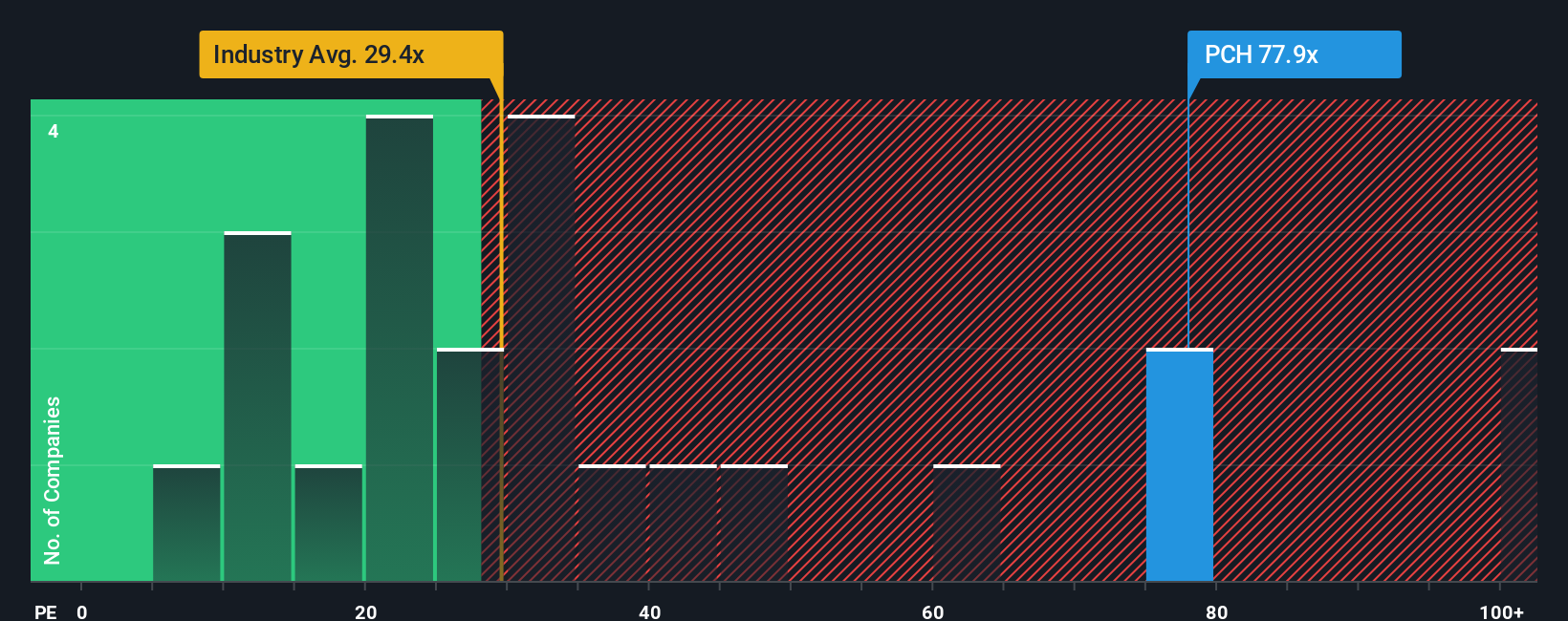

While the prevailing narrative points to PotlatchDeltic as significantly undervalued, a closer look at its current market multiple suggests caution. The company trades at 78.9 times earnings, much higher than the industry average of 27.9 and the peer average of 38.3. Even compared to its fair ratio of 51.7, shares look expensive, which may signal valuation risk if expectations do not materialize. Is the market placing too much faith in future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PotlatchDeltic Narrative

If you want to see things differently or make your own assessment, you can craft a personalized view in just a few minutes. Do it your way.

A great starting point for your PotlatchDeltic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

If you want your portfolio to stay ahead, expand your search for winning stocks using these powerful tools. Don’t let the next breakout opportunity slip away. See what others might miss today.

- Supercharge your potential returns by picking from these 876 undervalued stocks based on cash flows that the market has yet to fully appreciate.

- Maximize your passive income with these 17 dividend stocks with yields > 3% offering yields above 3%, powering your wealth over time.

- Get an edge on tomorrow by uncovering these 27 AI penny stocks driving breakthroughs in artificial intelligence and reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCH

PotlatchDeltic

PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) with ownership of 2.1 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives