- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

How Might Lineage’s (LINE) CFO Transition Reflect on Management Strategy Amid Sector Headwinds?

Reviewed by Sasha Jovanovic

- Lineage, Inc. recently announced that Robb LeMasters will become Chief Financial Officer on November 10, 2025, succeeding Rob Crisci who will remain in an advisory role during the transition.

- LeMasters brings over twenty years of finance experience from leadership positions across investment management, private equity, and public company finance, including his most recent role as CFO at BWX Technologies.

- This executive transition comes as Lineage manages sector headwinds and ahead of its anticipated third-quarter earnings release, making leadership focus a key point to consider in its investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Lineage's Investment Narrative?

To be a shareholder in Lineage, you need to believe in its long-term ability to stabilize earnings, navigate industry headwinds, and make smart use of its scale and assets, even as it remains unprofitable and its peer group delivers mixed results. The appointment of Robb LeMasters as CFO, who arrives with a breadth of financial leadership experience from capital-intensive sectors, could bring a sharper focus on efficiency and capital discipline, which some consider crucial given recent underperformance and ongoing margin pressure. That said, with the Q3 earnings release approaching and major sector challenges still in play, the near-term catalysts remain much the same, with the market looking for signs that new leadership can support the company’s bid for operational improvement. Short-term downside risk tied to weak earnings, slow revenue growth, and board inexperience hasn’t materially changed with this transition, so the big picture for Lineage still depends on whether execution can outpace persistent risks.

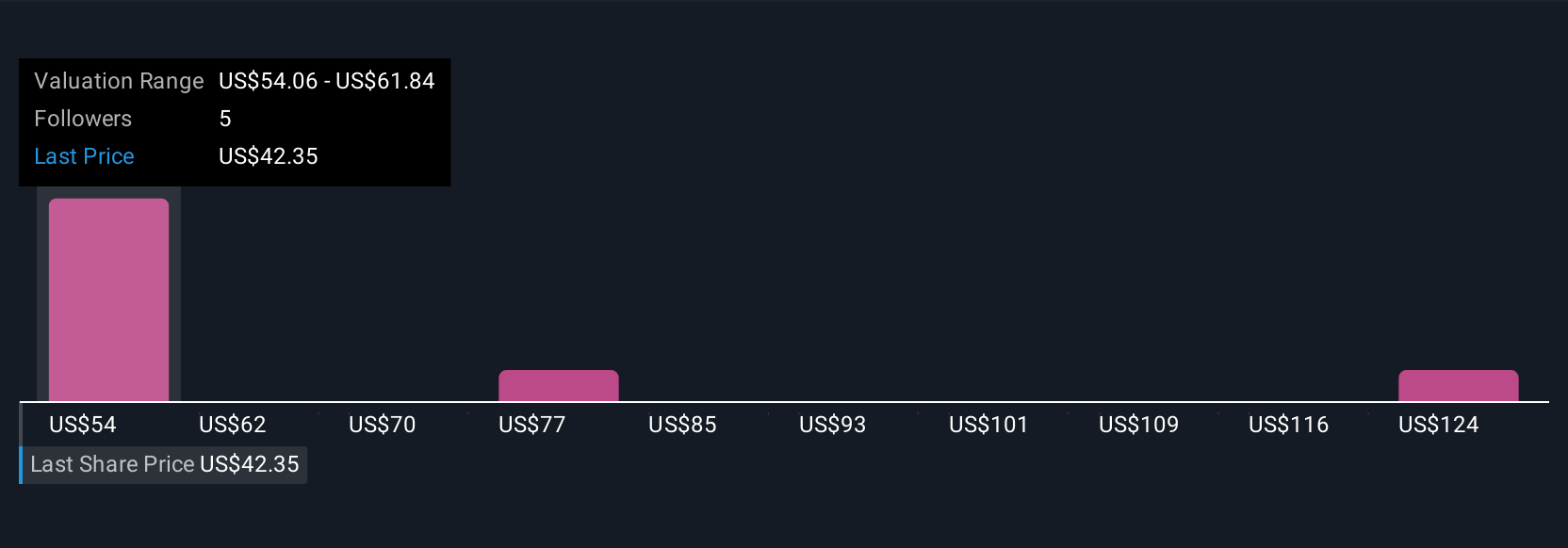

But board inexperience is a risk investors should be aware of, especially during leadership transitions. Despite retreating, Lineage's shares might still be trading 42% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Lineage - why the stock might be worth over 3x more than the current price!

Build Your Own Lineage Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lineage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lineage's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 88 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives