- United States

- /

- Industrial REITs

- /

- NasdaqGS:LINE

Automated Cold Storage Expansion Could Be a Game Changer for Lineage (LINE)

Reviewed by Sasha Jovanovic

- Lineage recently broke ground on a next-generation automated cold storage facility in Dallas and completed a major expansion of its Hobart, Indiana site, further advancing its automation capabilities and increasing temperature-controlled warehouse capacity.

- These projects highlight Lineage's emphasis on advanced automation and end-to-end logistics to enhance supply chain efficiency and meet growing demand across North America.

- We'll examine how Lineage's investment in automation and expanded network influences its broader investment narrative and competitive positioning.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Lineage's Investment Narrative?

For anyone considering an investment in Lineage, the big picture rests on believing in the company’s ability to modernize cold chain logistics through automation and network scale. The recent groundbreaking on a next-generation Dallas facility and Hobart’s major expansion both push that vision forward, displaying Lineage’s commitment to advanced technology and end-to-end solutions. While these initiatives reinforce Lineage’s long-term story and could eventually shape supply chain leadership, they are unlikely to influence short-term catalysts such as profitability, which remains elusive. Risks like ongoing class action litigation, slower revenue growth, and relatively high leadership turnover continue to weigh on confidence, and with near-term earnings pressure and a sizeable loss posted in the last quarter, it’s clear the expansion plans don’t alter the main risks for now. Investors should stay focused on the balance between the company’s growth ambitions and persistent operational challenges. Yet, management changes present a challenge that can’t be ignored.

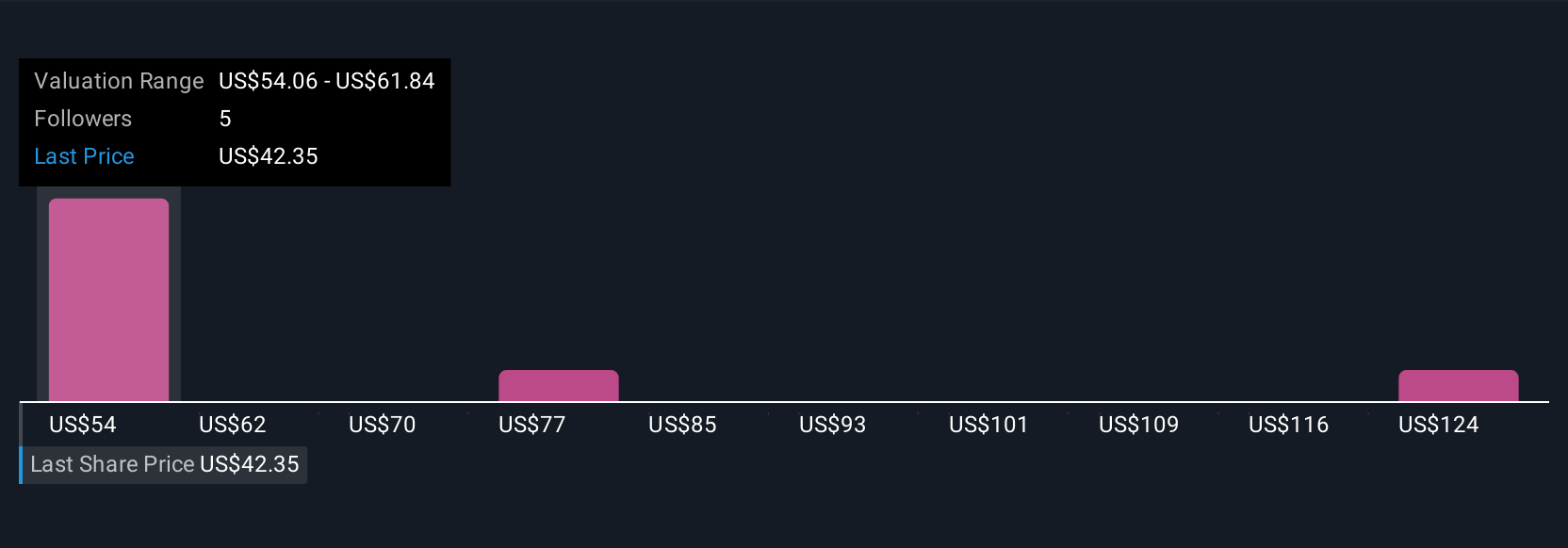

Despite retreating, Lineage's shares might still be trading 46% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Lineage - why the stock might be worth over 3x more than the current price!

Build Your Own Lineage Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lineage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lineage's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LINE

Lineage

Lineage, Inc. (NASDAQ: LINE) is the world’s largest global temperature-controlled warehouse REIT with a network of over 485 strategically located facilities totaling approximately 88 million square feet and approximately 3.1 billion cubic feet of capacity across countries in North America, Europe, and Asia-Pacific.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives