- United States

- /

- REITS

- /

- NasdaqGS:GOOD

Gladstone Commercial (GOOD): Profit Margins Slip, Challenging Bulls on Long-Term Return Durability

Reviewed by Simply Wall St

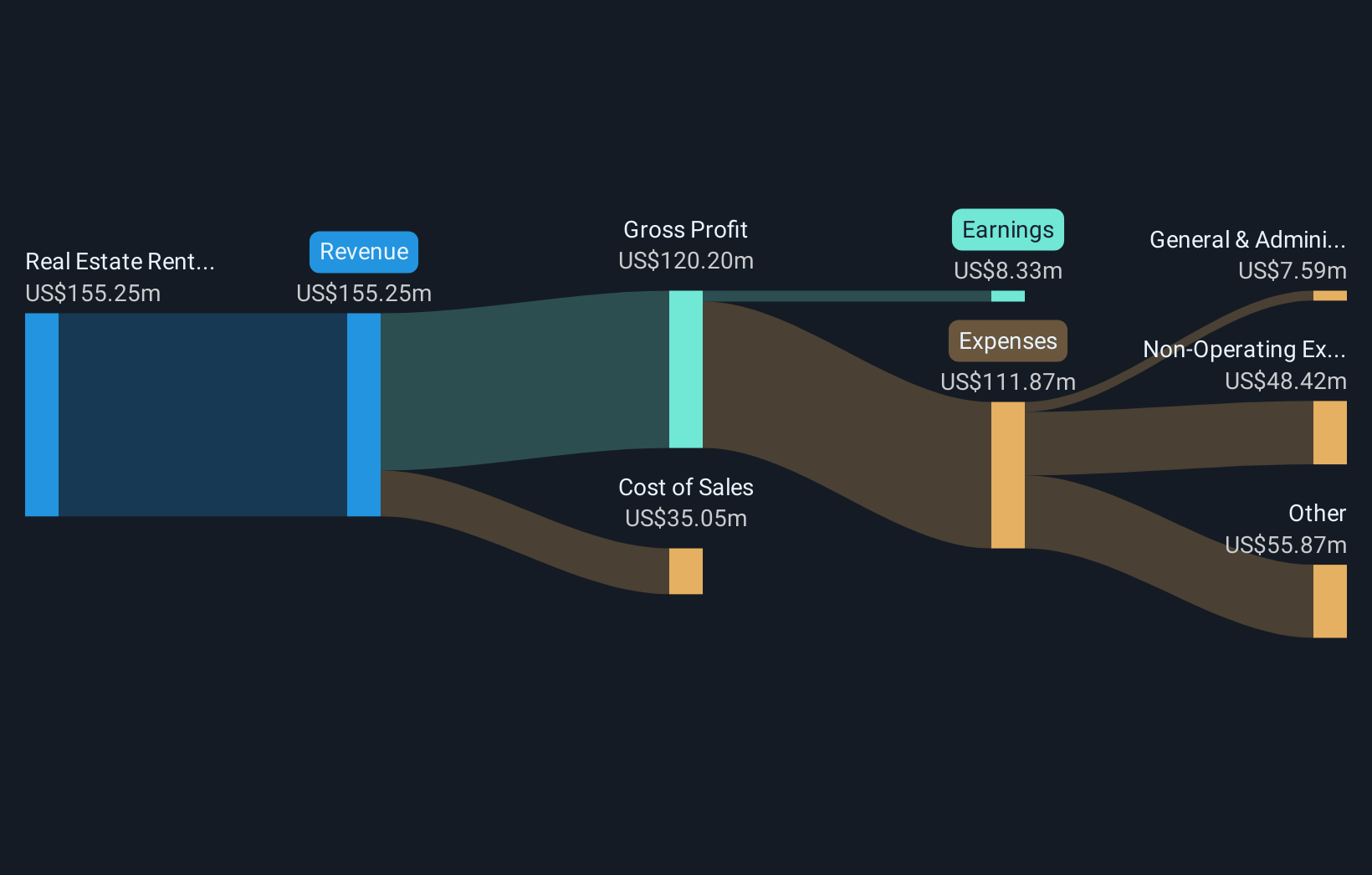

Gladstone Commercial (GOOD) is forecasting earnings growth of 20.6% per year, outpacing the US market’s expected 16% annual growth rate. Over the last five years, the company’s earnings have grown at an impressive average rate of 41.7% each year, and earnings quality remains high. Revenue growth is projected at 5.5% per year, trailing the broader US market average of 10.5%. Net profit margin stands at 5.4%, just below last year’s 5.7%. With shares currently trading at $10.7, below both discounted cash flow fair value estimates and analyst price targets, investors may see room for upside. However, a weaker financial position and questions around dividend sustainability remain key considerations.

See our full analysis for Gladstone Commercial.Now, let’s see how these headline numbers stack up against the main narratives around Gladstone Commercial and whether the latest results reinforce or challenge popular views.

See what the community is saying about Gladstone Commercial

Margin Pressure as Profitability Shrinks

- Analysts expect profit margins to decline from 10.3% today to 8.8% within three years, signaling headwinds for profitability even as revenues inch upward.

- According to the analysts' consensus view, shifting focus to industrial assets and a high 98.7% portfolio occupancy is expected to underwrite stable earnings and offset margin erosion,

- however, higher interest costs and tenant demands may force rental incentives or property upgrades that could sap margins over time.

- Conservative management of fixed and hedged-rate debt is positioned as critical for preserving long-term profit stability as rates rise.

- For a look at how analysts break down these margin and occupancy tensions in more detail, read the full consensus narrative. 📊 Read the full Gladstone Commercial Consensus Narrative.

High Occupancy Supports Predictability

- Portfolio occupancy is holding at a robust 98.7%, with an average remaining lease term of 7.1 years, indicating strong tenant retention and visibility into cash flows.

- Analysts' consensus underscores that this lease stability, combined with a low development pipeline in the industrial market, could help sustain earnings through macro volatility,

- however, heavy exposure to secondary and tertiary markets heightens sensitivity to localized downturns if tenant renewal trends were to weaken.

- Management's ongoing capital recycling, shifting from office to higher-growth industrial assets, aligns the asset mix with segments showing stronger demand momentum.

Share Price Trades Below DCF Fair Value

- With the current share price at $10.70, Gladstone Commercial sits at a sizable 47% discount to its latest DCF fair value estimate of $20.03, and is also below the consensus analyst price target of $14.30.

- Analysts' consensus maintains that this valuation gap could present upside for investors who believe earnings will grow as projected,

- however, with leverage running high and margins forecast to shrink, resetting market expectations could keep pressure on the stock unless execution improves.

- The need for future capital, potentially through share issuance, raises dilution and refinancing risks, which could curb near-term share price recovery even if fundamentals stabilize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Gladstone Commercial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? Share your outlook and build your own interpretation in just a few minutes. Do it your way

A great starting point for your Gladstone Commercial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

While Gladstone Commercial offers predictability through high occupancy, its shrinking profit margins, elevated leverage, and concerns over debt sustainability signal vulnerabilities in its financial foundation.

If you want stocks with healthier finances and less debt risk, start with solid balance sheet and fundamentals stocks screener (1981 results) to discover companies built on stronger balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOD

Gladstone Commercial

Gladstone Commercial (Nasdaq: GOOD) is an established real estate investment trust (REIT) that invests in single tenant and anchored multi-tenant net leased assets.

Fair value with moderate growth potential.

Market Insights

Community Narratives