- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Is Equinix a Hidden Opportunity After This Year's 16.8% Stock Drop?

Reviewed by Bailey Pemberton

- Wondering if Equinix stock is a real bargain or just riding the wave? You are not alone. Plenty of investors are searching for clarity on its true value right now.

- Equinix shares have taken a noticeable dip lately, sliding 4.8% over the past week and leaving the stock down 16.8% so far this year. However, returns over the past three and five years remain in positive territory.

- Much of this recent shift comes as investors react to news of rising interest rates and competitive pressures in the data center sector. Headlines have highlighted new market entrants and major partnerships, which are increasing the competition for existing players like Equinix.

- Currently, Equinix scores a 3 out of 6 on our valuation checks, hinting at mixed signals about whether it is undervalued. We will break down what that means in detail using classic valuation approaches, but there is also a smarter way to get the full picture that we will reveal at the end of the article.

Approach 1: Equinix Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting Equinix's adjusted funds from operations into the future, estimating how much cash the company will generate each year, and then discounting those future cash flows back to today's value in dollars. This process gives investors an estimate of what the business is fundamentally worth right now based on its capacity to generate cash going forward.

Currently, Equinix has last-twelve-month free cash flow of $3.36 billion. Analysts have provided forecasts for the next several years, with free cash flow projected to reach $4.05 billion in 2026 and continue growing to about $5.44 billion by 2029. Beyond five years, projections are extrapolated based on past trends, with estimated free cash flow reaching as high as $7.51 billion by 2035, according to summarized analyst and internal estimates.

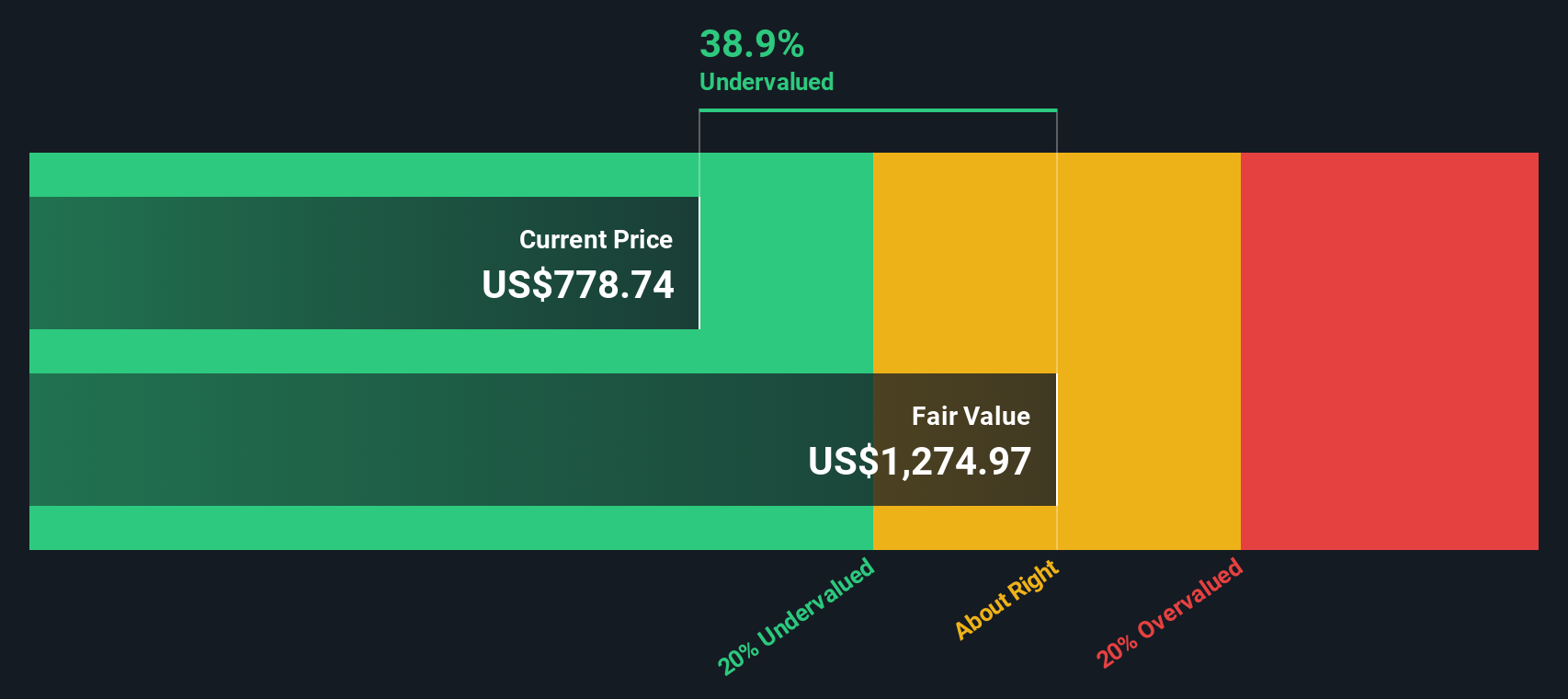

Using this two-stage DCF approach, the estimated intrinsic value of Equinix comes out to $1,246.53 per share. Compared to the current market price, this suggests the stock is undervalued by 37.0% today, which may make it appear particularly attractive on a fundamental basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equinix is undervalued by 37.0%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Equinix Price vs Earnings (PE Ratio)

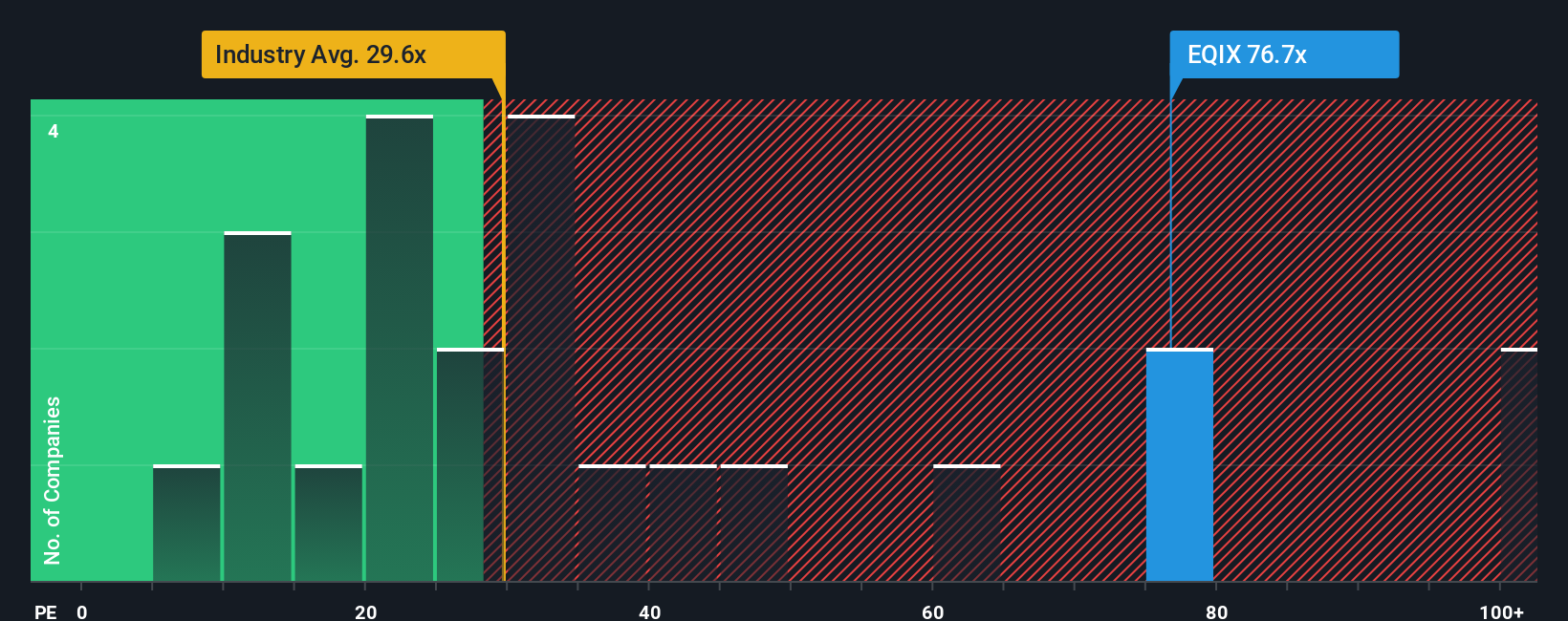

The price-to-earnings (PE) ratio is a widely used valuation metric for companies that are solidly profitable, such as Equinix. It helps investors gauge how much they are paying for each dollar of the company’s earnings. A PE ratio will generally be higher for companies with greater growth potential and lower risk. Firms in mature or slower-growing sectors, or those facing higher risks, typically warrant lower multiples.

Equinix currently trades at a PE ratio of 72.0x, which is notably higher than both the broader Specialized REITs industry average of 17.0x and the average among its listed peers at 66.8x. These benchmarks provide context about how the market values profitability in the sector and among comparable companies, but they do not fully account for company-specific dynamics.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Equinix is calculated to be 35.9x, a metric that considers not just industry and peer multiples, but also crucial factors like the company's earnings growth prospects, profit margins, scale, and unique risks. Relying on the Fair Ratio provides a more tailored assessment of what an appropriate multiple should be for Equinix right now.

Comparing the Fair Ratio of 35.9x to Equinix’s actual PE ratio of 72.0x, the stock currently appears to be trading at a significant premium relative to its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equinix Narrative

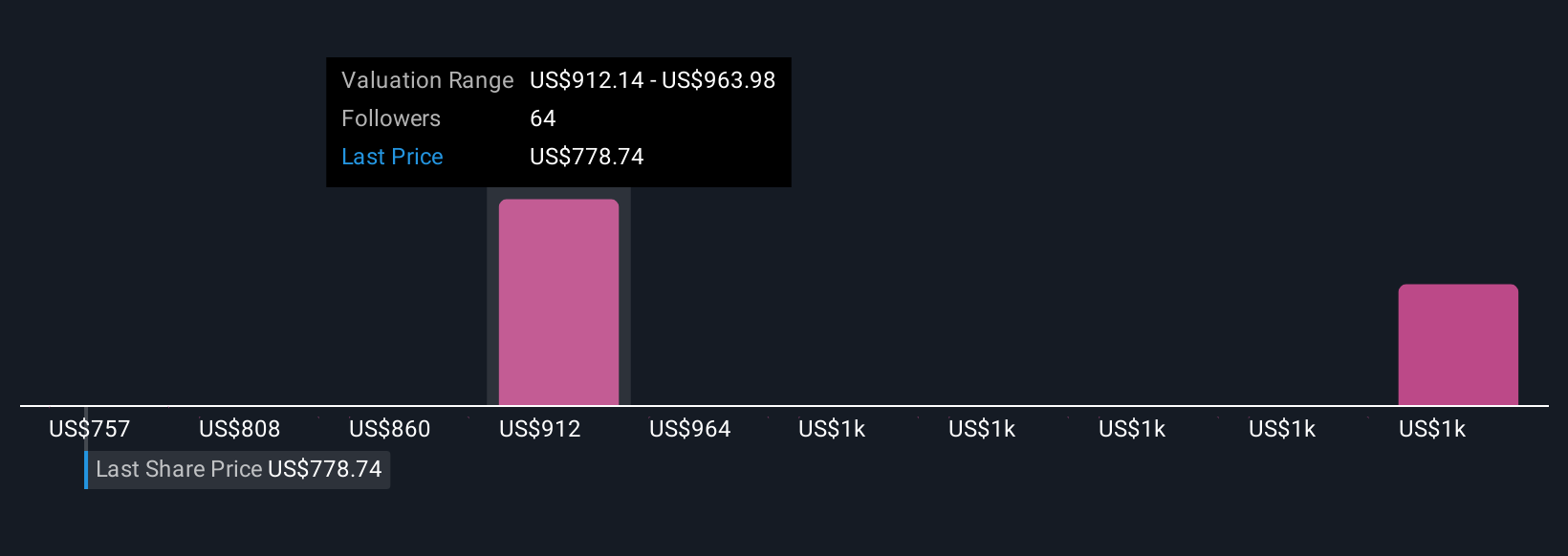

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a dynamic and approachable tool that helps investors go beyond the numbers to tell their own story about a company like Equinix. In simple terms, a Narrative connects your view of a company’s business drivers and future prospects with your financial forecast and resulting fair value, providing a clear link between your investment thesis and actual numbers.

Available on Simply Wall St’s Community page, Narratives make it easy for anyone to create, update, or review personalized forecasts based on real business insights, not just formulas. Investors use Narratives to decide whether to buy or sell by comparing their fair value estimate to the current price. What makes them powerful is that they update automatically as new information, such as earnings results or market news, comes in, keeping your perspective relevant in real-time.

For example, some Equinix investors believe aggressive data center expansion and AI-driven demand will drive earnings as high as $2.6 billion and justify a price above $1,200 per share. Others, wary of competitive and execution risks, see fair value closer to $804 per share. Narratives help surface these differing perspectives so you can choose a story and a fair value that fits your unique outlook.

Do you think there's more to the story for Equinix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives