- United States

- /

- Specialized REITs

- /

- NasdaqGS:EQIX

Equinix (EQIX): Assessing Valuation as Brazil Expansion and New Partnerships Signal Strategic Growth

Reviewed by Simply Wall St

Equinix (EQIX) has just made two moves that speak volumes about where the digital infrastructure market is headed. The company is increasing its data center footprint in Brazil, and it is also launching new managed services through a partnership with NetApp, Broadcom, and Kochasoft.

See our latest analysis for Equinix.

Equinix’s strategic moves come at a moment when the stock’s momentum is still rebounding. While the 1-year total shareholder return is down 5.1%, the three-year total return remains a strong 59.4%, pointing to substantial long-term value even as shares have not kept pace in 2024. Recent partnerships and expansion plans highlight a growth narrative that could help restore confidence as demand for digital infrastructure accelerates.

If these infrastructure growth stories have you thinking about what’s next, consider expanding your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets, investors are left wondering: Is Equinix undervalued right now, or is the market already factoring in the company’s next wave of growth?

Most Popular Narrative: 13.1% Undervalued

Equinix’s popular narrative points to a gap between the company’s fair value and its latest closing price, suggesting analysts see more upside from the current level. With $957 currently set as the fair value and shares last closing at $831.93, the difference is hard to ignore in a market hungry for reliable digital infrastructure plays.

Equinix's aggressive capital allocation toward global data center and interconnection capacity, anchored in large, high-demand metros and emerging markets, positions the company to capture accelerating enterprise AI, cloud adoption, and digital transformation demand. This is expected to drive robust long-term revenue growth.

Want a glimpse inside the high-stakes projections fueling this valuation? The secret is in the bold revenue and profit forecasts baked into the narrative. Uncover exactly what’s driving these numbers before everyone else does.

Result: Fair Value of $957 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or a slowdown in AI-driven demand could challenge Equinix’s projected growth and put pressure on long-term profitability.

Find out about the key risks to this Equinix narrative.

Another View: Multiples Point to Lofty Valuation

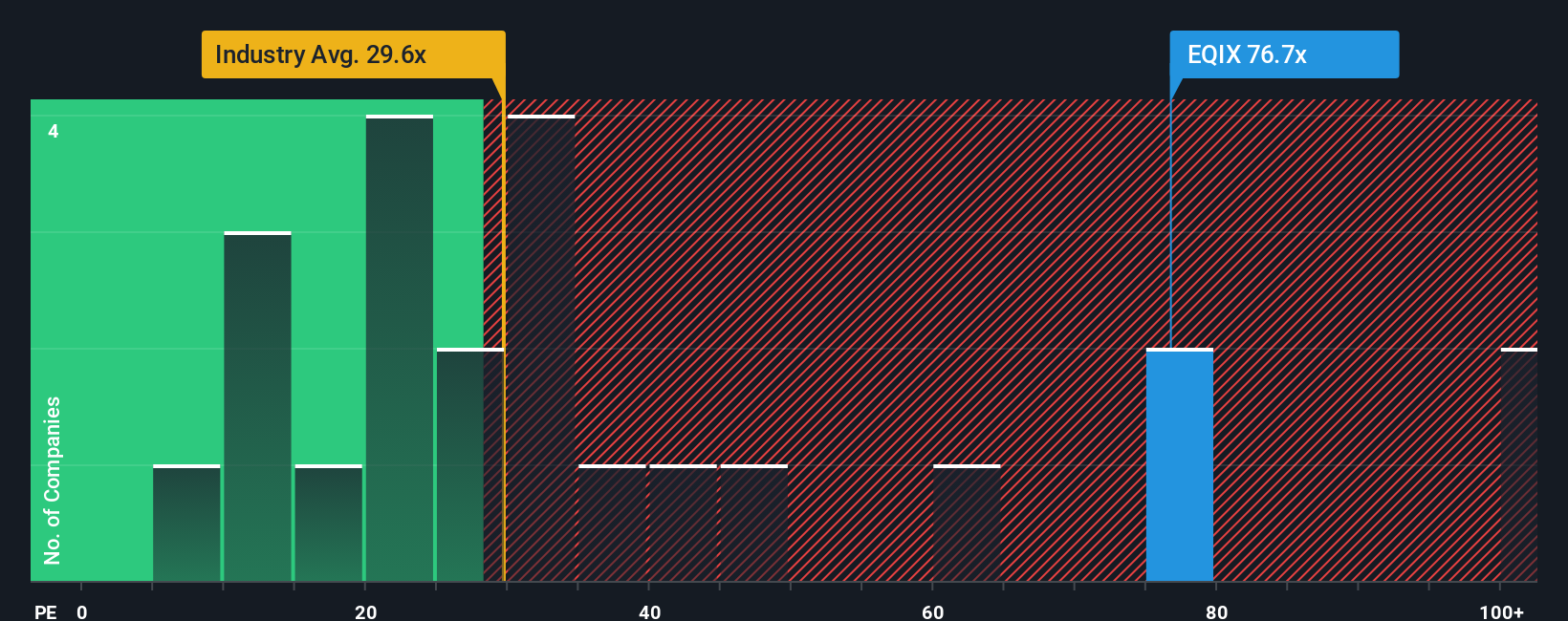

While our first look suggests Equinix trades below fair value, a multiples analysis paints a different picture. The company’s price-to-earnings ratio sits at 81.9x, which is far above both the industry average of 29x and its peer average of 31.4x. This is more than double what the fair ratio of 40.1x implies, meaning investors are paying a significant premium. Is the market’s optimism fully justified, or could this premium come under pressure if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinix Narrative

If these perspectives don’t quite fit your outlook, dive into the numbers and build your own view in just a few minutes. Do it your way

A great starting point for your Equinix research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for the obvious. Take advantage of handpicked opportunities you might be missing. These could be the catalyst for your portfolio’s next breakout.

- Expand your horizons and identify companies poised for growth among these 875 undervalued stocks based on cash flows that remain overlooked by the crowd.

- Tap into companies benefiting from the AI revolution by checking out these 27 AI penny stocks. These companies are accelerating innovation and reshaping entire industries.

- Unlock hidden yield potential by pinpointing reliable earners with these 17 dividend stocks with yields > 3%. These pay out attractive returns above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EQIX

Equinix

Equinix, Inc. (Nasdaq: EQIX) shortens the path to boundless connectivity anywhere in the world.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives