- United States

- /

- Health Care REITs

- /

- NasdaqGS:DHC

A Fresh Look at Diversified Healthcare Trust (DHC) Valuation Following Third-Quarter Results and Strategy Update

Reviewed by Simply Wall St

Citizens has reiterated its stance on Diversified Healthcare Trust (DHC) after the company reported third-quarter results, highlighting increasing occupancy in senior housing properties and transparent efforts to tackle high-cost debt through asset sales and credit facilities by early 2026.

See our latest analysis for Diversified Healthcare Trust.

Momentum has clearly shifted for Diversified Healthcare Trust. After months of strategic moves and improved occupancy across its senior housing assets, the share price shows a strong 17.6% return over the past month and an impressive year-to-date run of 114.5%. Looking at the bigger picture, the three-year total shareholder return of 423% highlights a remarkable long-term turnaround for investors.

If this recovery story has you curious about market leaders making waves, it’s the perfect moment to explore fast growing stocks with high insider ownership.

With such rapid gains and strong turnaround metrics, the key question facing investors now is whether Diversified Healthcare Trust is still undervalued or if the recent surge means the market has already priced in its future growth potential.

Most Popular Narrative: 7.2% Undervalued

The latest consensus narrative sees Diversified Healthcare Trust trading at a meaningful discount to its fair value of $5.25, with the last close at $4.87. This sets an optimistic tone as market watchers track closely for further upside catalysts in the current environment.

Active portfolio repositioning, executing non-core asset sales and focusing on higher growth senior housing and medical office/life science properties enables the company to concentrate capital on assets with sector tailwinds (strong demand for outpatient care settings) and embedded rent growth, supporting long-term revenue and FFO growth.

What hidden financial mechanics explain this surprisingly bullish view? The narrative’s fair value math hinges on a blend of standout cash flow upgrades, faster-than-expected operational recovery, and a powerful profitability swing. Think you know the driver that makes the numbers work? The unknown may surprise you.

Result: Fair Value of $5.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest costs and heavy reliance on asset sales could pose real challenges. These factors may potentially limit future gains if market conditions shift suddenly.

Find out about the key risks to this Diversified Healthcare Trust narrative.

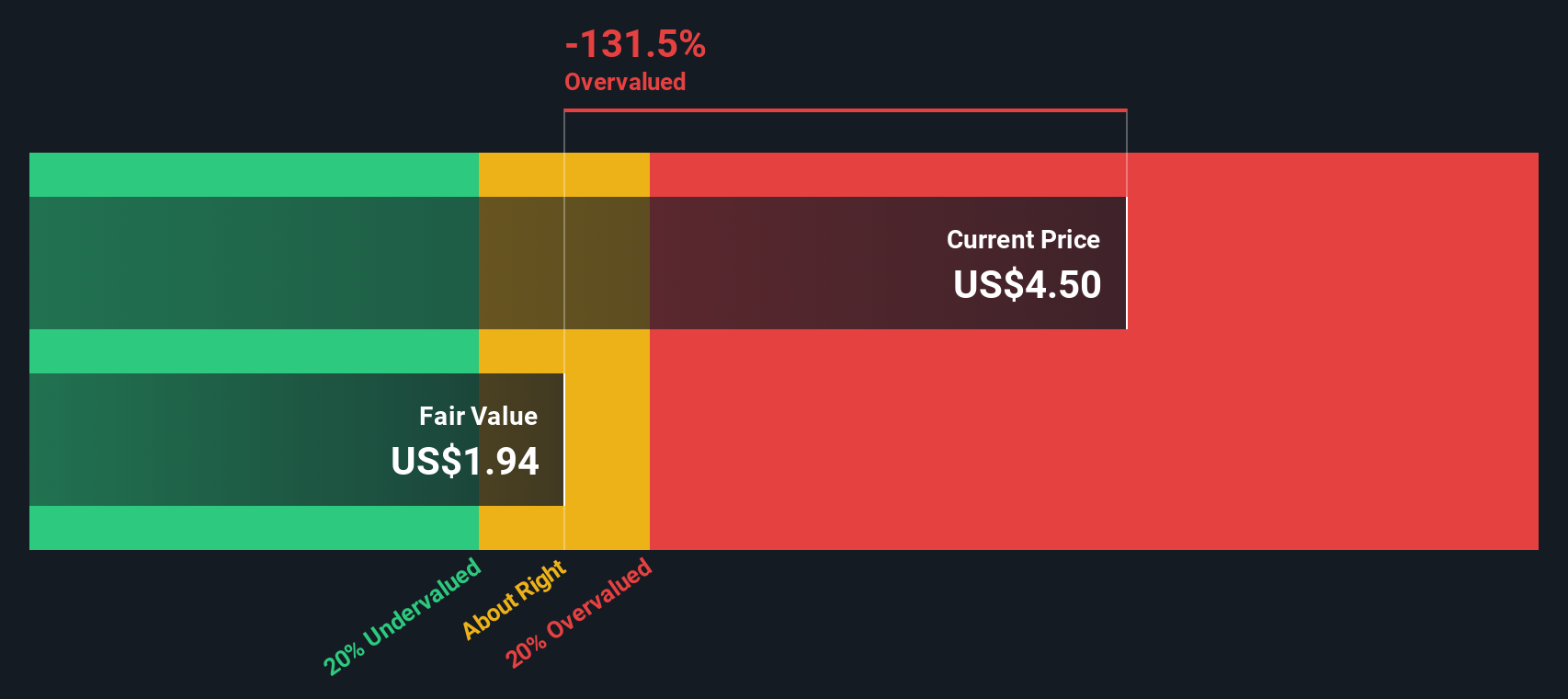

Another View: SWS DCF Model Suggests a Conservative Outlook

While the consensus narrative points to undervaluation, our DCF model tells a different story. It finds Diversified Healthcare Trust trading above its fair value estimate of $4.03 per share, indicating that shares may be slightly overvalued from a pure cash flow perspective. Does this challenge the optimism in recent analyst targets?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Diversified Healthcare Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Diversified Healthcare Trust Narrative

If you have a different perspective or want to dive deeper into the numbers, you can quickly craft a personalized take in just a few minutes by using Do it your way.

A great starting point for your Diversified Healthcare Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

If you want to stay ahead and spot new opportunities before the crowd, now is the time to check out powerful stock themes making headlines.

- Seize the chance for steady income by reviewing these 15 dividend stocks with yields > 3%, which offers reliable yields above 3%.

- Catch the next wave of growth with these 30 healthcare AI stocks, as artificial intelligence continues to drive innovation in healthcare.

- Position yourself early in tomorrow’s tech with these 27 quantum computing stocks, a key player in advances in computing and data security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHC

Diversified Healthcare Trust

DHC is a real estate investment trust focused on owning high-quality healthcare properties located throughout the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success