- United States

- /

- Real Estate

- /

- NYSE:MMI

Marcus & Millichap (MMI): Exploring Current Valuation After Recent Share Price Movement

Reviewed by Simply Wall St

Marcus & Millichap (MMI) shares have seen some movement recently, prompting investors to take a closer look at the company’s latest performance trends and financial health. The stock’s trajectory over the past month hints at shifting sentiment.

See our latest analysis for Marcus & Millichap.

While Marcus & Millichap’s share price rebounded 1.6% over the past month, momentum has faded compared to earlier in the year. The latest dip adds to a broader trend, with a 12-month total shareholder return of -21.5% highlighting how sentiment has remained cautious despite occasional upswings.

If you’re weighing new opportunities after MMI’s recent moves, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

The real question now is whether Marcus & Millichap is trading at an attractive discount, or if the latest price movements simply reflect investors already accounting for any future rebound in growth prospects.

Most Popular Narrative: 2% Undervalued

With Marcus & Millichap’s current share price landing just above the most widely watched fair value estimate, the stock finds itself in a tight zone where investor expectation and reality are closely aligned. The market is weighing recent growth, margin improvements, and the outlook for commercial real estate services as it digests the company’s evolving narrative.

The company is benefiting from renewed institutional investor activity and an improving lending environment, which is fueling larger transaction volumes and a stronger capital markets pipeline. Both factors are likely to boost future revenue and earnings growth.

Curious what's driving this price tag? The most popular narrative pulls together future revenue ramp-up, growing profit margins, and a next-level profit multiple. Only those who dig into the assumptions will learn which bold step-change in fundamentals is thought to unlock the upside and justify the latest price projections.

Result: Fair Value of $30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on transaction commissions and ongoing fee compression could quickly derail growth if market conditions worsen or if competition intensifies.

Find out about the key risks to this Marcus & Millichap narrative.

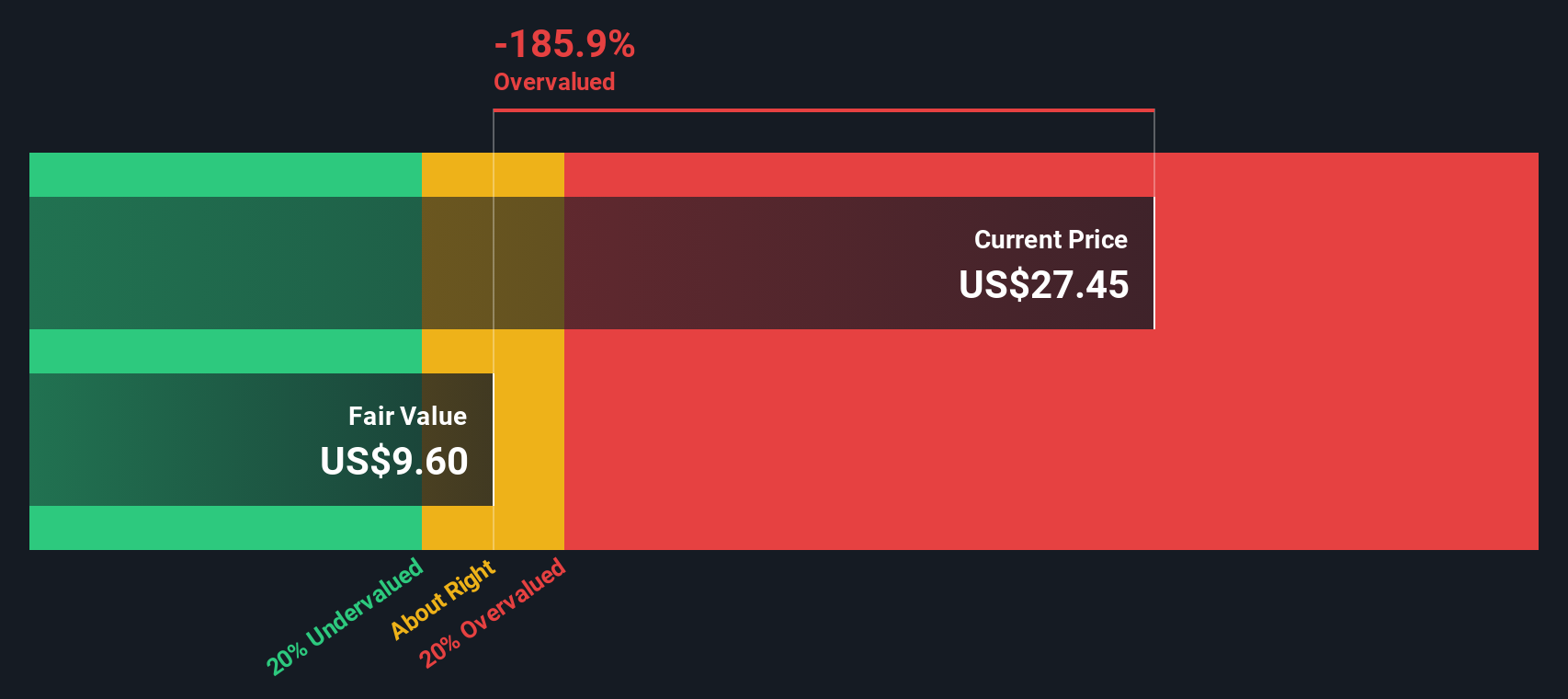

Another View: SWS DCF Model Points to Overvaluation

While multiples suggest Marcus & Millichap looks relatively attractive, the SWS DCF model tells a different story. According to this cash flow-based approach, the current share price of $29.35 sits far above our estimated fair value of $6.79. This sizable gap signals that, by this method, the stock could be significantly overvalued. Could the market be overestimating the company's future cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marcus & Millichap for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marcus & Millichap Narrative

If you see the story differently or want to dive deeper into the numbers, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Marcus & Millichap research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself? Stay a step ahead by tapping into high-potential stocks that most investors miss. If you want winning ideas, this is your moment.

- Capitalize on tech’s unstoppable rise by checking out these 27 AI penny stocks, which are reshaping industries with breakthrough artificial intelligence innovations.

- Earn steady income with confidence when you see these 18 dividend stocks with yields > 3%, offering yields above 3% for your portfolio’s peace of mind.

- Catch tomorrow’s biggest surprises early by exploring these 840 undervalued stocks based on cash flows, which trade below their true value to give you an investing edge today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion