- United States

- /

- Real Estate

- /

- NYSE:MMI

Marcus & Millichap (MMI): Examining Valuation Following Return to Profitability in Q3

Reviewed by Simply Wall St

Marcus & Millichap (MMI) just reported third-quarter results that caught the attention of investors, with revenue growth and a return to profitability compared to last year’s loss. This shift suggests their business is gaining strength.

See our latest analysis for Marcus & Millichap.

Momentum has picked up in recent weeks, with Marcus & Millichap’s 1-month share price return of 9.6% outshining a difficult year. Total shareholder return over the past 12 months remains down 27%. The company’s renewed profitability and ongoing talk of strategic acquisitions have encouraged buyers lately. However, long-term investors will remember the wider multi-year decline that still weighs on sentiment.

If this recent shift has you rethinking where the next opportunity could be, it might be the perfect moment to check out fast growing stocks with high insider ownership.

Yet with shares rebounding in the short term but still trading below recent highs, the question remains: is Marcus & Millichap undervalued at these levels, or is the potential for future growth already reflected in the current price?

Most Popular Narrative: 0.3% Overvalued

The narrative places Marcus & Millichap’s fair value just a touch below its recent close, suggesting that shares are trading right in line with expectations set by future earnings growth. What drives this assessment? Take a closer look at the catalyst that underpins this fair value logic.

The company is benefiting from renewed institutional investor activity and an improving lending environment, which is fueling larger transaction volumes and a stronger capital markets pipeline. Both factors are likely to boost future revenue and earnings growth. Ongoing investments in technology, including AI and centralized production support, are expected to enhance operational efficiency, lower costs, and increase productivity over time. This should support expansion in net margins.

Curious what bold profit assumptions and operational upgrades justify valuing the company almost exactly at its current price? The real story involves a dramatic turnaround narrative and some aggressive forecasts for margin expansion that could surprise even the most seasoned market-watchers. Hungry for the granular details behind these future expectations? Find out what’s driving this finely balanced valuation.

Result: Fair Value of $30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on real estate commissions and increasing competition in digital platforms could present challenges to Marcus & Millichap’s growth outlook.

Find out about the key risks to this Marcus & Millichap narrative.

Another View: What Multiples Say

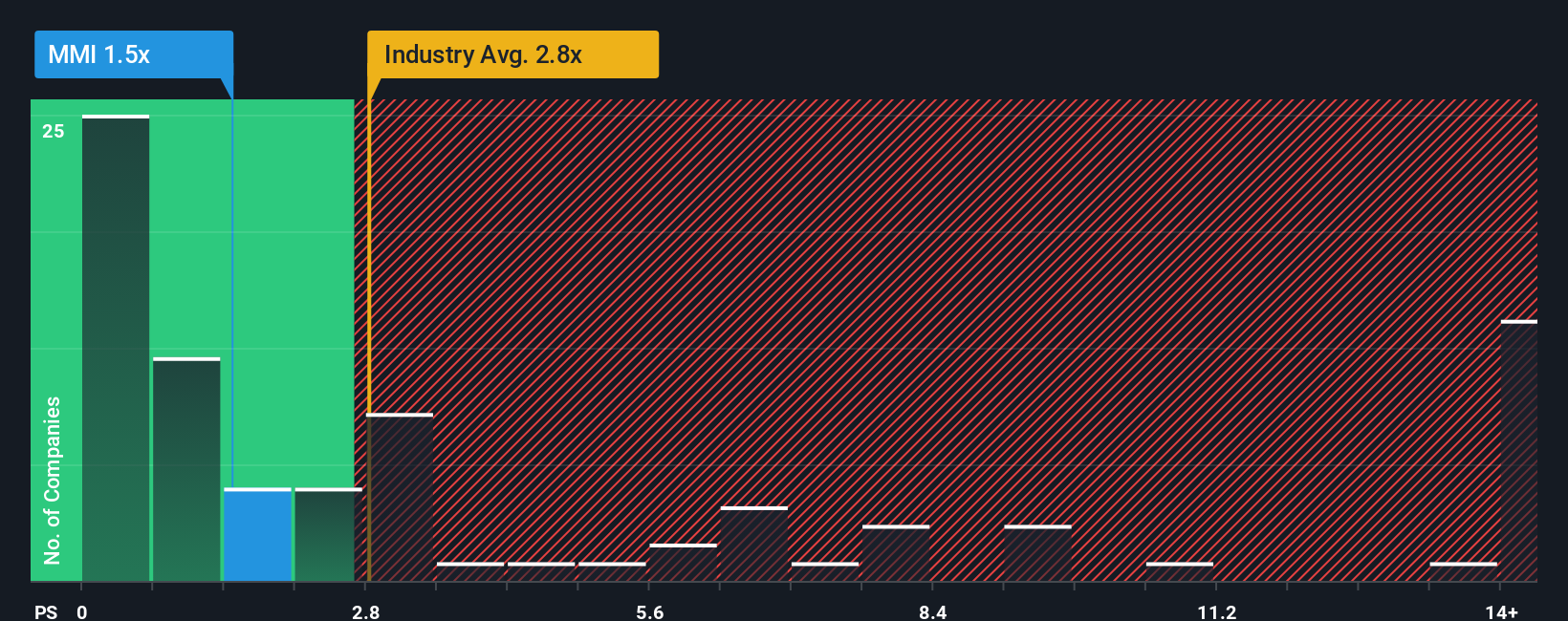

Switching lenses, the current price tells a slightly different story when you compare Marcus & Millichap’s price-to-sales ratio of 1.6x. This is lower than the US real estate industry average of 2.8x, but pricier than close peers at 0.6x and above the fair ratio of 0.9x. This suggests the shares may be on the expensive side if the market shifts closer to the fair ratio. Could this multiple risk overshadow the growth narrative, or is there a sound reason for the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marcus & Millichap Narrative

If you see the story differently or want to test your own assumptions, you can build your personal narrative in just a few minutes, your way. Do it your way.

A great starting point for your Marcus & Millichap research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Ready to broaden your portfolio and spot your next break? Turn insight into action with these standout opportunities, each chosen to spark your investing strategy.

- Tap into the future of artificial intelligence by following these 25 AI penny stocks paving the way in automation, data-driven innovation, and intelligent platforms.

- Unlock steady income streams by selecting these 16 dividend stocks with yields > 3% with yields above 3% and strong fundamentals to boost your returns.

- Seize tomorrow’s potential by backing these 28 quantum computing stocks at the forefront of advanced computing and groundbreaking scientific advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives