- United States

- /

- Food

- /

- NYSE:BRCC

BRC And 2 Other High Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 2.7% in the last week and rising 13% over the past year, with earnings expected to grow by 15% annually. In this environment, identifying growth companies with high insider ownership can be a promising strategy as it often indicates strong confidence from those closest to the business's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 170.8% |

| Super Micro Computer (SMCI) | 13.9% | 39.1% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| Prairie Operating (PROP) | 34.6% | 75.7% |

| OS Therapies (OSTX) | 23.2% | 13.4% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 12% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 13.1% | 44.4% |

We're going to check out a few of the best picks from our screener tool.

BRC (BRCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BRC Inc., with a market cap of $275.51 million, operates in the United States by purchasing, roasting, and selling coffee and coffee accessories through its subsidiaries.

Operations: The company generates revenue of $383.07 million from its Consumer Products Business segment, which involves the sale of coffee and related accessories in the U.S.

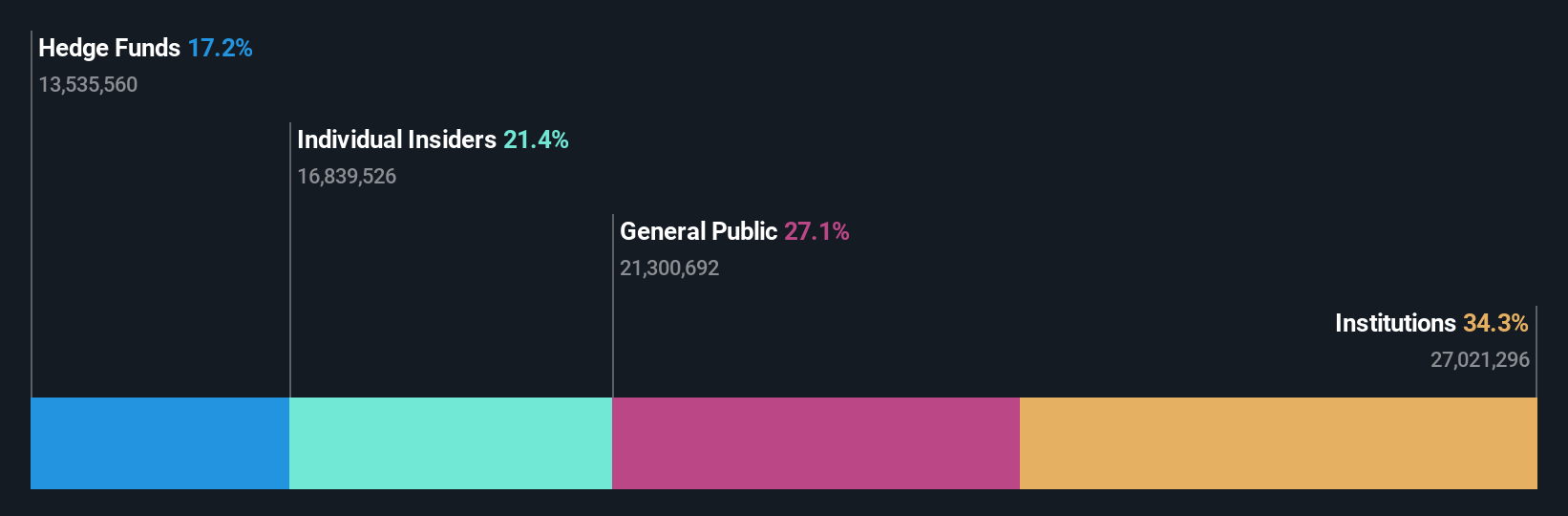

Insider Ownership: 21.6%

Earnings Growth Forecast: 59.3% p.a.

BRC Inc. demonstrates potential as a growth company with high insider ownership, trading significantly below its estimated fair value and expected to outpace the US market with 13% annual revenue growth. Despite recent challenges, including a net loss of US$2.89 million in Q1 2025 and executive changes, BRC remains focused on profitability within three years. The appointment of an experienced CFO aims to drive strategic growth amid legal settlements and equity offerings impacting share distribution.

- Click to explore a detailed breakdown of our findings in BRC's earnings growth report.

- In light of our recent valuation report, it seems possible that BRC is trading behind its estimated value.

Fiverr International (FVRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $1.04 billion.

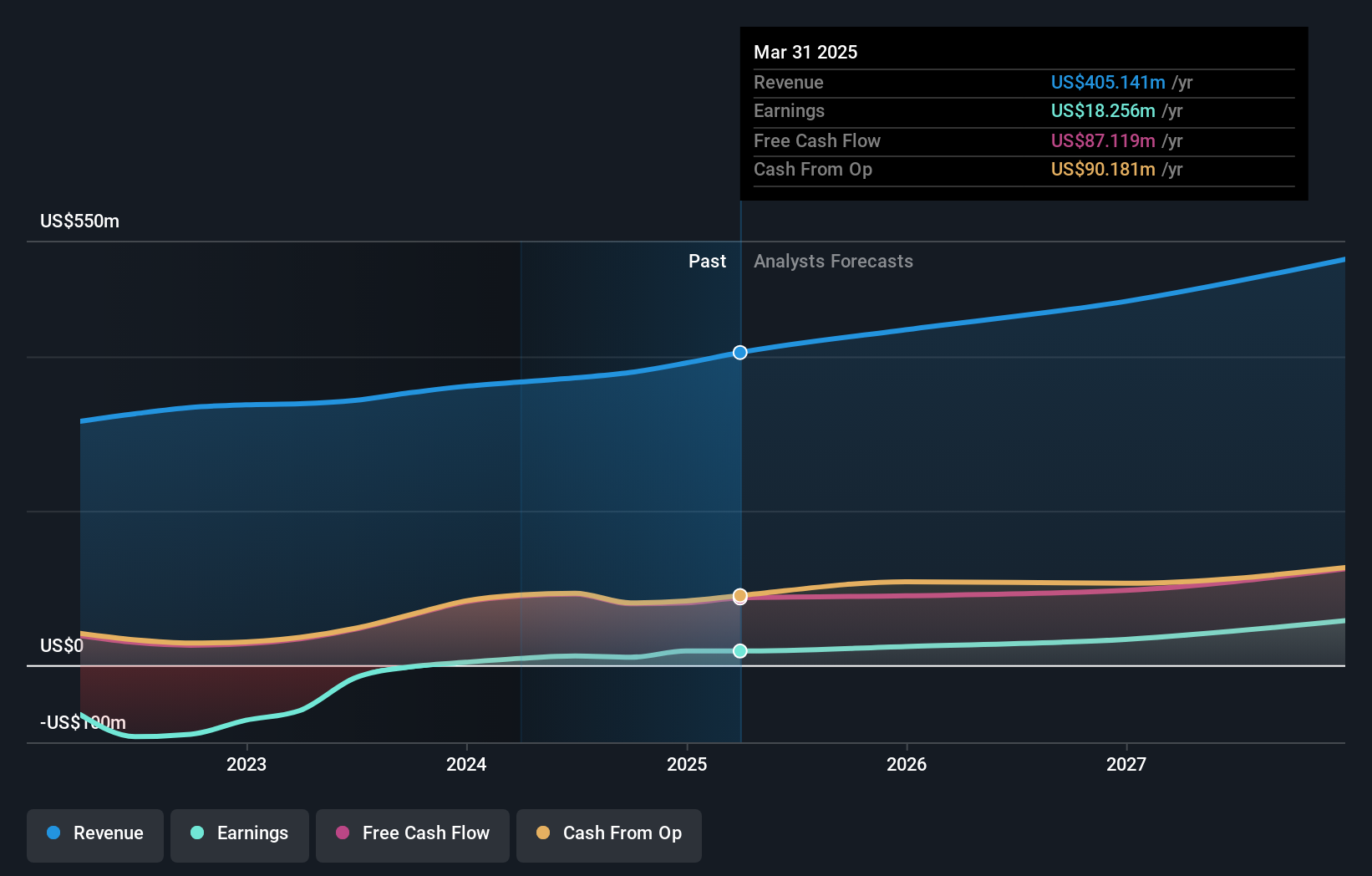

Operations: The company generates revenue of $405.14 million from its Internet Software & Services segment.

Insider Ownership: 13.5%

Earnings Growth Forecast: 38.4% p.a.

Fiverr International is trading at 48.8% below its estimated fair value, with earnings forecasted to grow significantly at 38.4% annually, outpacing the US market's growth rate. Recent corporate guidance raised revenue expectations for 2025 to between US$425 million and US$438 million, reflecting a year-on-year growth of up to 12%. Despite limited recent insider trading activity, analysts agree on a potential stock price increase of 25.3%.

- Click here and access our complete growth analysis report to understand the dynamics of Fiverr International.

- The analysis detailed in our Fiverr International valuation report hints at an deflated share price compared to its estimated value.

Marcus & Millichap (MMI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Marcus & Millichap, Inc. is an investment brokerage company offering real estate investment brokerage and financing services to commercial real estate buyers and sellers in the United States and Canada, with a market cap of approximately $1.17 billion.

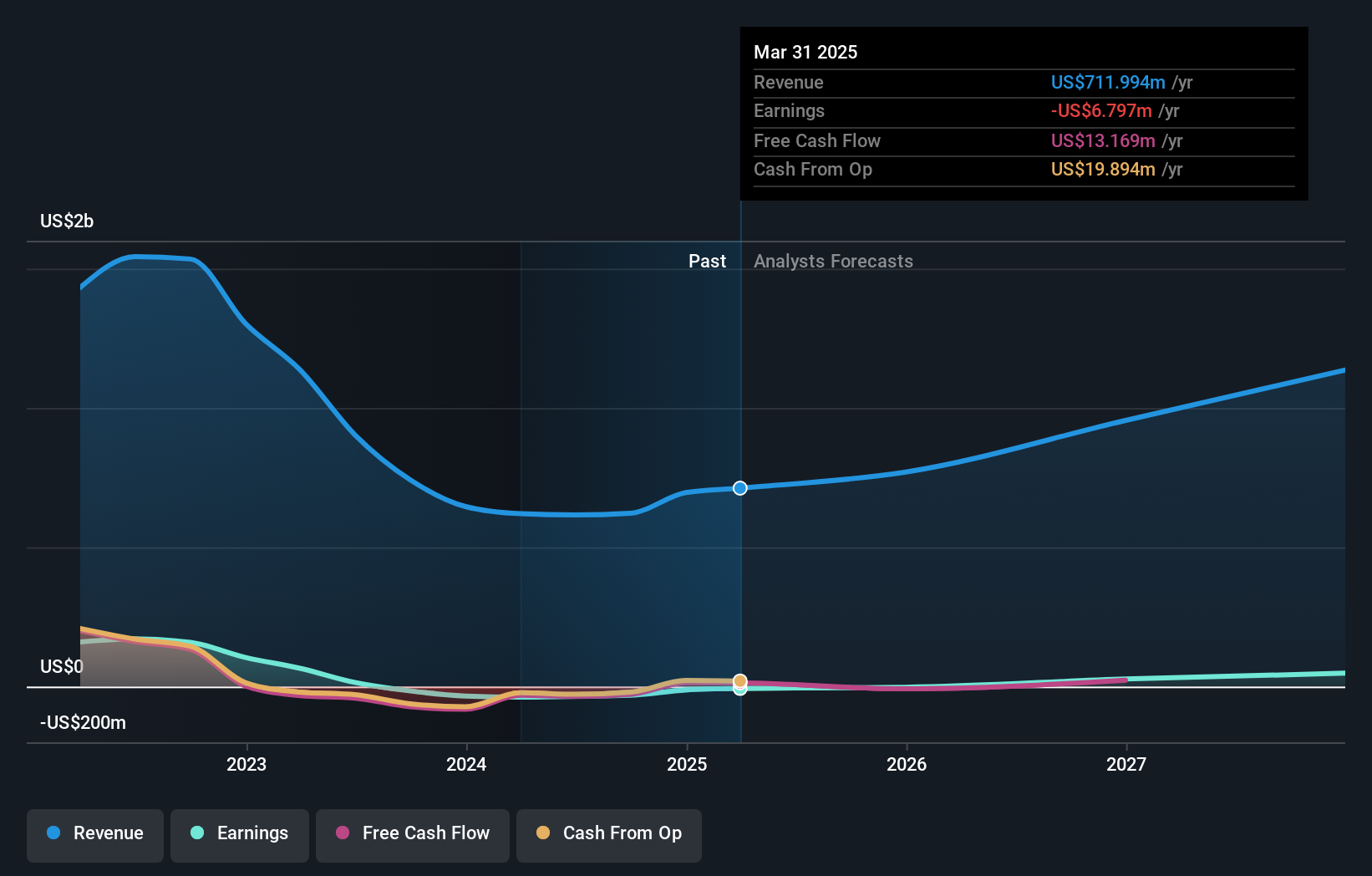

Operations: The company's revenue is primarily derived from the delivery of commercial real estate services, amounting to $711.99 million.

Insider Ownership: 37.5%

Earnings Growth Forecast: 100.7% p.a.

Marcus & Millichap, with substantial insider ownership, is trading at 34.8% below its estimated fair value and is projected to achieve profitability within three years, surpassing average market growth. Revenue growth of 17.8% annually outpaces the US market's 8.8%. Recent strategic initiatives include share buybacks totaling $74.48 million and ongoing acquisition pursuits to enhance core operations. Despite recent losses, the company demonstrates a commitment to long-term expansion and financial recovery strategies.

- Get an in-depth perspective on Marcus & Millichap's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Marcus & Millichap's share price might be too pessimistic.

Summing It All Up

- Click here to access our complete index of 193 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BRC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRCC

BRC

Through its subsidiaries, purchases, roasts, and sells coffee and coffee accessories in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives