- United States

- /

- Real Estate

- /

- NYSE:KW

Kennedy-Wilson Holdings (KW): Evaluating Valuation After 27% Share Price Rally This Month

Reviewed by Simply Wall St

Kennedy-Wilson Holdings (KW) has seen its stock pop nearly 27% over the past month, outpacing recent losses from earlier this year. The move has caught the attention of investors who are tracking trends in real estate management.

See our latest analysis for Kennedy-Wilson Holdings.

This recent rally reflects renewed optimism following a tough stretch, as Kennedy-Wilson Holdings' 1-month share price return of 26.8% has helped offset some year-to-date losses. Even so, its 1-year total shareholder return lags at minus 6.6%, highlighting that while short-term momentum has turned positive, the longer-term performance remains under pressure.

If you’re exploring opportunities beyond real estate, this is a great chance to broaden your search and discover fast growing stocks with high insider ownership

With shares trading just below analyst targets but still at a notable discount to intrinsic value, investors might be wondering whether Kennedy-Wilson Holdings is genuinely undervalued or if the market already anticipates better days ahead.

Most Popular Narrative: 12.5% Undervalued

With the most recent fair value set at $11, Kennedy-Wilson Holdings' last close of $9.62 suggests the narrative sees untapped potential compared to current market pricing. Investors tracking the stock are watching how these projections might play out in the coming years.

The company is rapidly expanding its rental housing portfolio in both the US and Europe, moving from 65% to a projected 80% of assets under management. This positions Kennedy-Wilson to benefit from persistent housing shortages and growing rental demand, which may drive future revenue growth and higher occupancy.

Curious about what's driving these ambitious expectations? You may be surprised at the bold financial forecasts, including dramatic portfolio shifts and a valuation model built on future topline momentum and increasing platform scalability. The real details behind this optimism? Only revealed in the full narrative.

Result: Fair Value of $11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant reliance on rental housing and exposure to local market shifts could challenge Kennedy-Wilson Holdings’ optimistic outlook if conditions turn less favorable.

Find out about the key risks to this Kennedy-Wilson Holdings narrative.

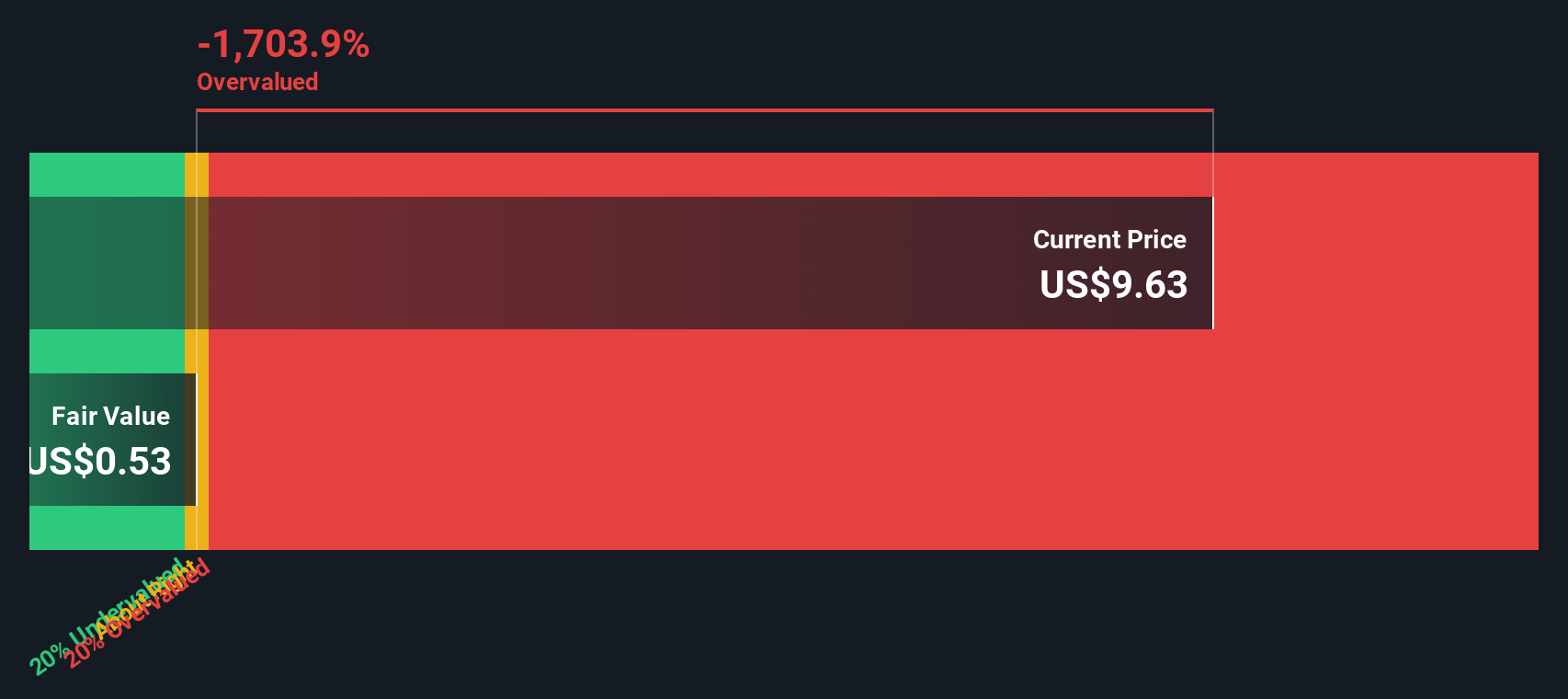

Another View: The SWS DCF Model Perspective

Looking at Kennedy-Wilson Holdings through the lens of our discounted cash flow (DCF) model offers a different perspective on the company's value. The SWS DCF model, which estimates intrinsic value using projected cash flows, suggests that shares may be trading above what long-term fundamentals alone would justify. This contrast with market optimism raises the question: could sentiment be outpacing underlying value, or is this an opportunity for patient investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kennedy-Wilson Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kennedy-Wilson Holdings Narrative

If our view differs from yours, or you want to dive deeper on your own, you can shape your take on Kennedy-Wilson Holdings in just a few minutes: Do it your way

A great starting point for your Kennedy-Wilson Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Looking for your next opportunity? There are compelling investment themes gathering momentum right now, and you’ll want to catch them before the crowd rushes in. Let the Simply Wall Street Screener help you quickly spot the stocks that fit your goals. Don’t miss out while others get ahead.

- Capture steady income potential and review reliable companies delivering strong yield with these 14 dividend stocks with yields > 3%.

- Tap into the explosive growth of AI-driven businesses by evaluating these 27 AI penny stocks shaking up multiple industries.

- Unlock undervalued companies that could be flying under the radar with these 885 undervalued stocks based on cash flows and position yourself ahead of the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennedy-Wilson Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KW

Kennedy-Wilson Holdings

Operates as a real estate investment company in the United States and Europe.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives