- United States

- /

- Real Estate

- /

- NYSE:JOE

Will Watersound Town Center’s Leasing Surge Reshape St. Joe’s (JOE) Commercial Growth Narrative?

Reviewed by Sasha Jovanovic

- The St. Joe Company recently announced a series of new national and regional retail, dining, and office tenant leases at its Watersound Town Center in Inlet Beach, FL, bringing the center to 98% leased with anticipated openings extending into mid-2026.

- This leasing momentum underscores strong demand from both businesses and consumers in the rapidly expanding Watersound Origins community, where residential growth continues to bolster commercial opportunities.

- We'll look at how the near-full leasing of Watersound Town Center may affect St. Joe's overall investment appeal and growth outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is St. Joe's Investment Narrative?

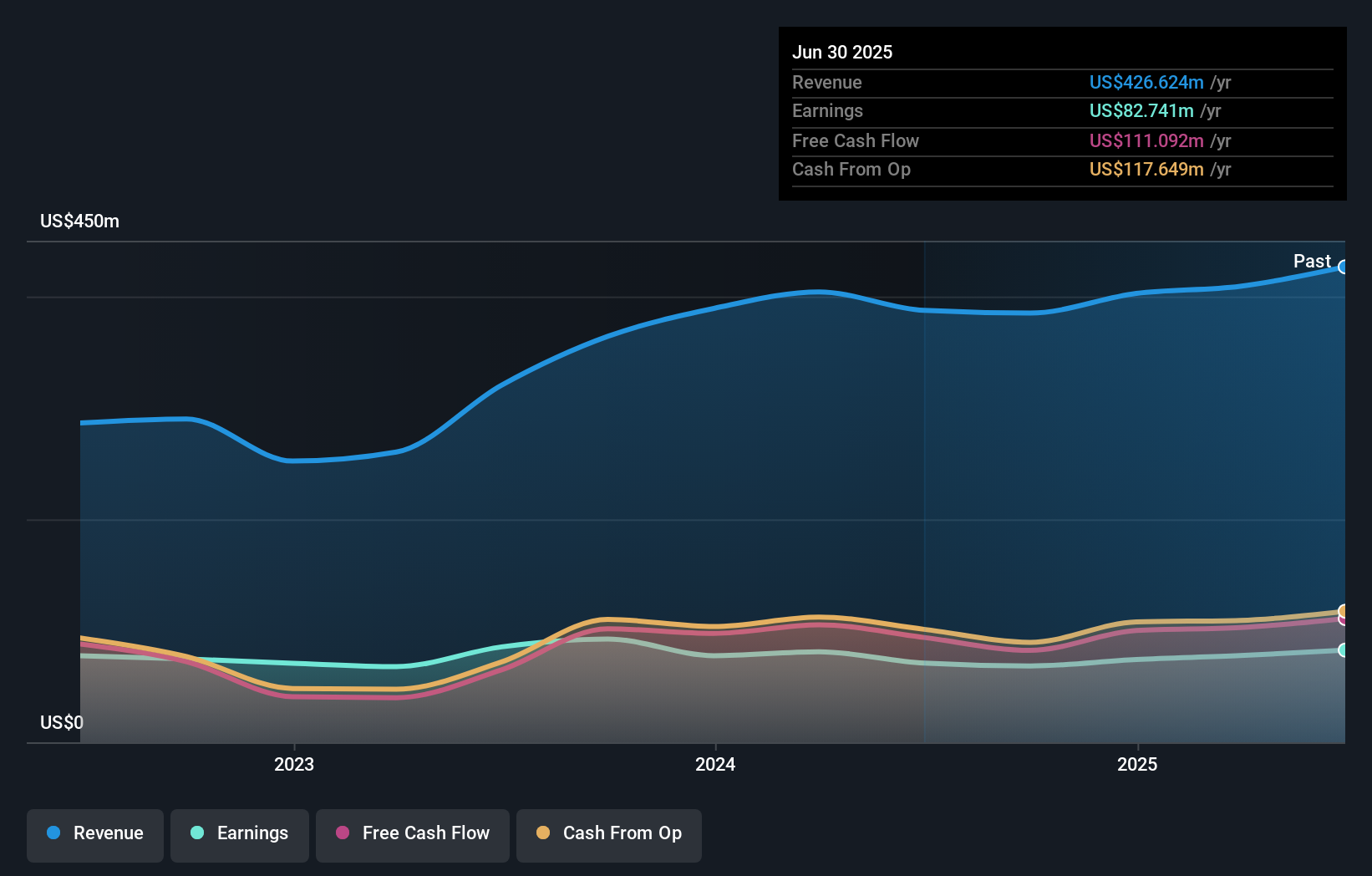

For investors considering The St. Joe Company, the underlying story centers on a belief in Florida’s ongoing population growth and the company’s unique ability to capture value from that trend by developing vibrant, desirable mixed-use communities. The recent surge in leasing at Watersound Town Center, now nearly fully occupied and featuring reputable national and regional tenants, directly addresses a key short-term catalyst: sustained commercial demand supporting residential expansion. While financials preceding this announcement already showed robust revenue and earnings momentum, the latest leasing update could further strengthen confidence in near-term cash flows and utility of retail assets, partially offsetting concerns around execution risk and high debt. That said, ongoing risks, such as economic downturns, community saturation, or overleveraging, remain important, and investors should watch how St. Joe manages further expansion amid rapid development in the region.

However, with growth comes the risk of overextending in a cyclical real estate market.

Exploring Other Perspectives

Explore another fair value estimate on St. Joe - why the stock might be worth as much as 36% more than the current price!

Build Your Own St. Joe Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St. Joe research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free St. Joe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St. Joe's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JOE

St. Joe

Operates as a real estate development, asset management, and operating company in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives