- United States

- /

- Real Estate

- /

- NYSE:JOE

St. Joe (JOE): Evaluating Valuation After New ESOP Share Registration

Reviewed by Simply Wall St

The St. Joe Company (JOE) just filed a shelf registration that could put over 1.35 million new shares into the market, largely tied to its Employee Stock Ownership Plan. For anyone watching the company, this kind of move is a flag. It often sparks debate about dilution and shifts in ownership. While ESOP-related offerings can signal a commitment to employees, investors are left weighing the immediate versus the long-term effects of added shares in circulation.

This registration comes after a year of mixed fortunes for St. Joe. The stock is up 18% year to date, showing momentum in the past three months, but has actually slipped 8% over the past year. Earlier multiyear gains are strong, but recent volatility suggests the market is recalibrating its view on what the company’s future might look like post-offering. Steady long-term returns are facing a real test as sentiment adjusts to news like this.

After a year with these ups and downs, is this fresh supply of shares a rare entry point for long-term investors, or has the market already adjusted its valuation in anticipation of future growth?

Price-to-Earnings of 36.8x: Is it justified?

St. Joe is currently trading at a price-to-earnings (P/E) ratio of 36.8x, which means the stock appears expensive when compared to the US Real Estate industry average of 26.2x.

The price-to-earnings ratio is a valuation metric that compares a company's current share price to its per-share earnings. For real estate companies, a higher P/E ratio may suggest the market is pricing in strong future earnings growth or rewarding higher profit quality. It can also be a sign of premium pricing not fully backed by fundamentals.

Given St. Joe's P/E stands notably above its industry peers, investors should consider whether the company's recent profit growth and business strategy are enough to justify paying a premium. If future profit acceleration is not sustained, the stock may struggle to maintain this elevated multiple.

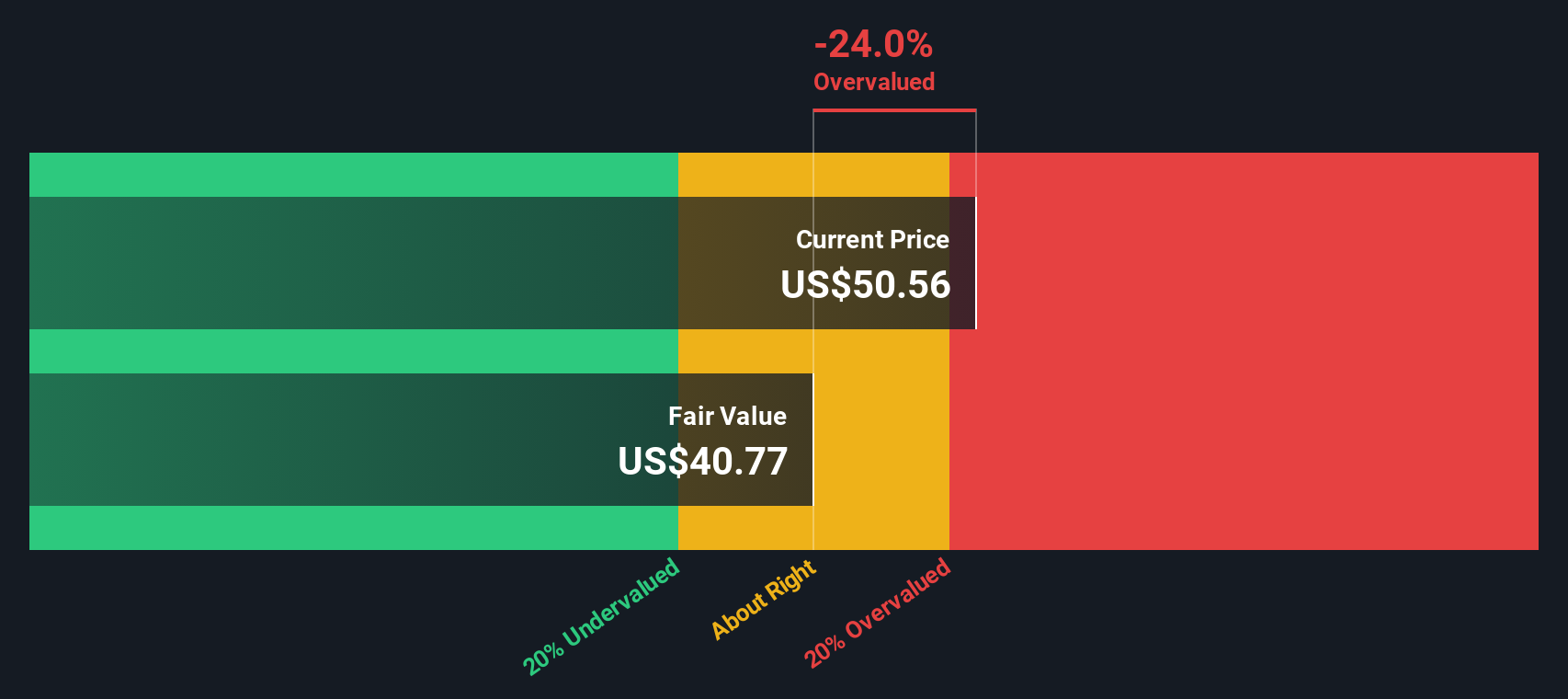

Result: Fair Value of $41.34 (OVERVALUED)

See our latest analysis for St. Joe.However, slowing revenue growth or a pause in recent profit acceleration could quickly reverse sentiment and put pressure on the current valuation narrative.

Find out about the key risks to this St. Joe narrative.Another View: What Does the SWS DCF Model Say?

While a price-to-earnings approach paints St. Joe as expensive, our DCF model offers an independent perspective and also suggests the shares may be trading above what fundamentals support. Are markets pricing in too much optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own St. Joe Narrative

If you see the story differently, or like to dig into the numbers on your own terms, you can shape your narrative in just a few minutes, Do it your way.

A great starting point for your St. Joe research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your strategy further and uncover fresh opportunities. The right tools could help you spot a winning trend before the crowd catches on.

- Unlock hidden value by searching stocks that could be overlooked by the market with our undervalued stocks based on cash flows.

- Kickstart your earnings potential by zeroing in on shares offering impressive yields with our dividend stocks with yields > 3%.

- Catch the next technological wave by focusing on companies pioneering quantum breakthroughs. Check them out through our quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:JOE

St. Joe

Operates as a real estate development, asset management, and operating company in the United States.

Solid track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives