- United States

- /

- Real Estate

- /

- NYSE:JLL

Will JLL's (JLL) New London Leadership Reinforce Its Position in Prime Office Leasing?

Reviewed by Sasha Jovanovic

- In recent news, Jones Lang LaSalle appointed Alex Browning as head of its West End office agency team, and named Freddie MacGregor and Rory Paton as co-leads of its City office agency team, following key executive changes in its London operations.

- These leadership shifts highlight JLL's focus on retaining experienced talent with deep market knowledge to guide its central London leasing business.

- Next, we'll explore how these executive appointments could influence JLL’s investment narrative, especially in light of its ongoing operational momentum.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Jones Lang LaSalle Investment Narrative Recap

To own Jones Lang LaSalle (JLL), an investor must have conviction in the resilience and long-term opportunity of global real estate advisory services, especially the steady progression of annuity-like revenues from workplace and project management contracts. The recent executive appointments in JLL’s London office agency teams are not expected to significantly affect the company’s most immediate catalysts, namely, rising activity in project management and leasing advisory, or shift the current risk profile, which centers on ongoing moderation of office leasing growth.

One of the more relevant recent developments is the expansion of JLL’s leadership bench in London, reflected in the appointments of Alex Browning, Freddie MacGregor, and Rory Paton. Their combined experience aligns with the continued push to capture higher advisory revenues in prime markets, a catalyst that remains important as JLL looks to defy sector-wide challenges around office leasing and transactional volume.

However, investors should also be aware that, in contrast, persistent softness in office leasing demand continues to represent a potential headwind for revenue growth...

Read the full narrative on Jones Lang LaSalle (it's free!)

Jones Lang LaSalle's outlook anticipates $31.5 billion in revenue and $1.0 billion in earnings by 2028. This requires 8.4% annual revenue growth and an increase in earnings of about $436 million from the current $563.9 million.

Uncover how Jones Lang LaSalle's forecasts yield a $345.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

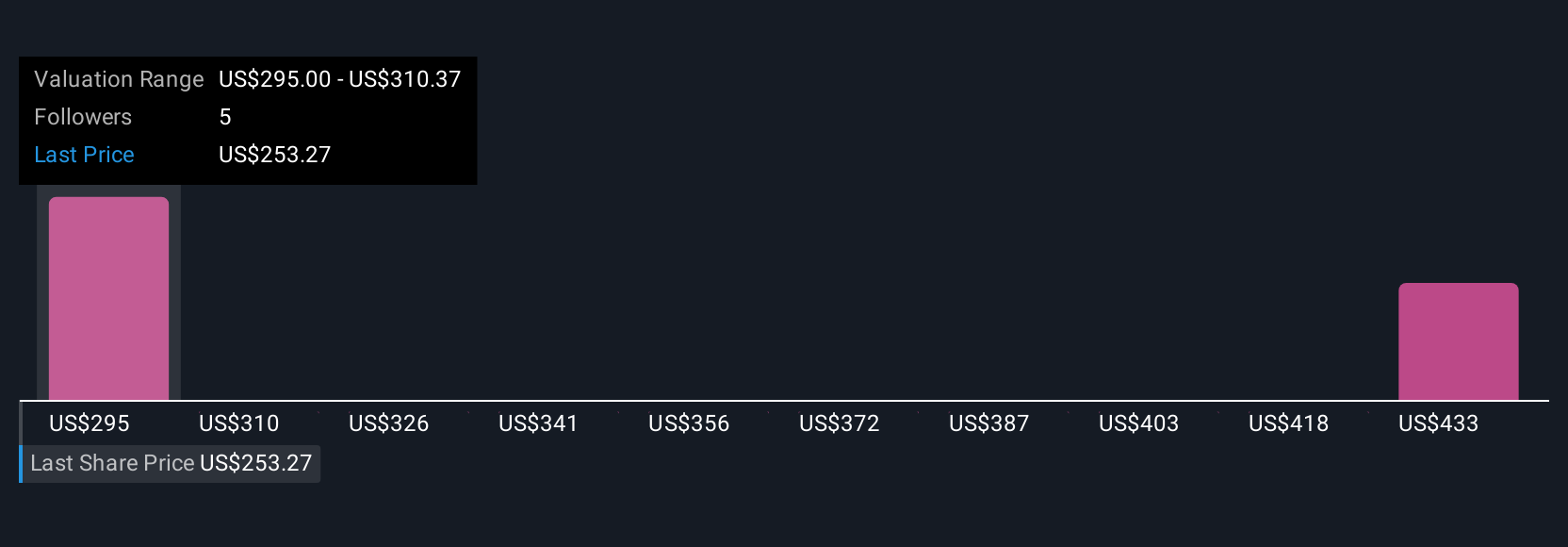

Private investors in the Simply Wall St Community have published fair value estimates for JLL ranging from US$345 to US$402.54, based on two submitted forecasts. Amid ongoing moderation in office leasing growth, opinions on future resilience and upside potential can differ, so you may want to compare several perspectives before making any conclusions.

Explore 2 other fair value estimates on Jones Lang LaSalle - why the stock might be worth as much as 22% more than the current price!

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JLL

Jones Lang LaSalle

Operates as a commercial real estate and investment management company.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success