- United States

- /

- Real Estate

- /

- NYSE:JLL

Could JLL’s $255 Million Journal Squared Deal Signal a Shift in Its Urban Strategy?

Reviewed by Simply Wall St

- In late July 2025, Jones Lang LaSalle’s Capital Markets group secured a US$255 million, 12-year fixed-rate refinancing for Journal Squared III, a newly constructed 58-story luxury high-rise in Jersey City, on behalf of a venture between Kushner Real Estate Group and National Real Estate Advisors.

- This transaction underscores JLL’s influence in arranging large-scale, long-term real estate financings and highlights its role in revitalizing rapidly developing urban areas through high-profile projects.

- With the successful refinancing of a major multifamily tower highlighting JLL’s capabilities, we’ll assess how this may strengthen its broader investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Jones Lang LaSalle Investment Narrative Recap

To own Jones Lang LaSalle (JLL), you need conviction in the value of high-quality real estate services, technology-enabled workflow efficiencies, and the company's ability to secure impactful financings. The recent US$255 million refinancing of Journal Squared III is evidence of JLL’s solid execution within capital markets, but it does not fundamentally change the biggest near-term catalyst, real estate debt demand, or address the key risk, which remains the unpredictability of transaction volumes amid macroeconomic and policy uncertainty.

Among the latest announcements, JLL’s debt financing for the Lower Terra Industrial Portfolio also highlights its scale in arranging large, long-term property transactions. These executions reinforce JLL’s position as a leading debt intermediary in the industry, a factor closely tied to rising demand for real estate debt services, a core driver many investors are watching.

Yet, investors should not overlook the contrasting risk: while transactional activity can spur revenue growth, periods of economic or policy uncertainty have a tendency to suppress deal flow, and...

Read the full narrative on Jones Lang LaSalle (it's free!)

Jones Lang LaSalle's narrative projects $29.1 billion in revenue and $984.8 million in earnings by 2028. This requires 6.6% yearly revenue growth and a $448.8 million earnings increase from $536.0 million today.

Uncover how Jones Lang LaSalle's forecasts yield a $301.56 fair value, a 12% upside to its current price.

Exploring Other Perspectives

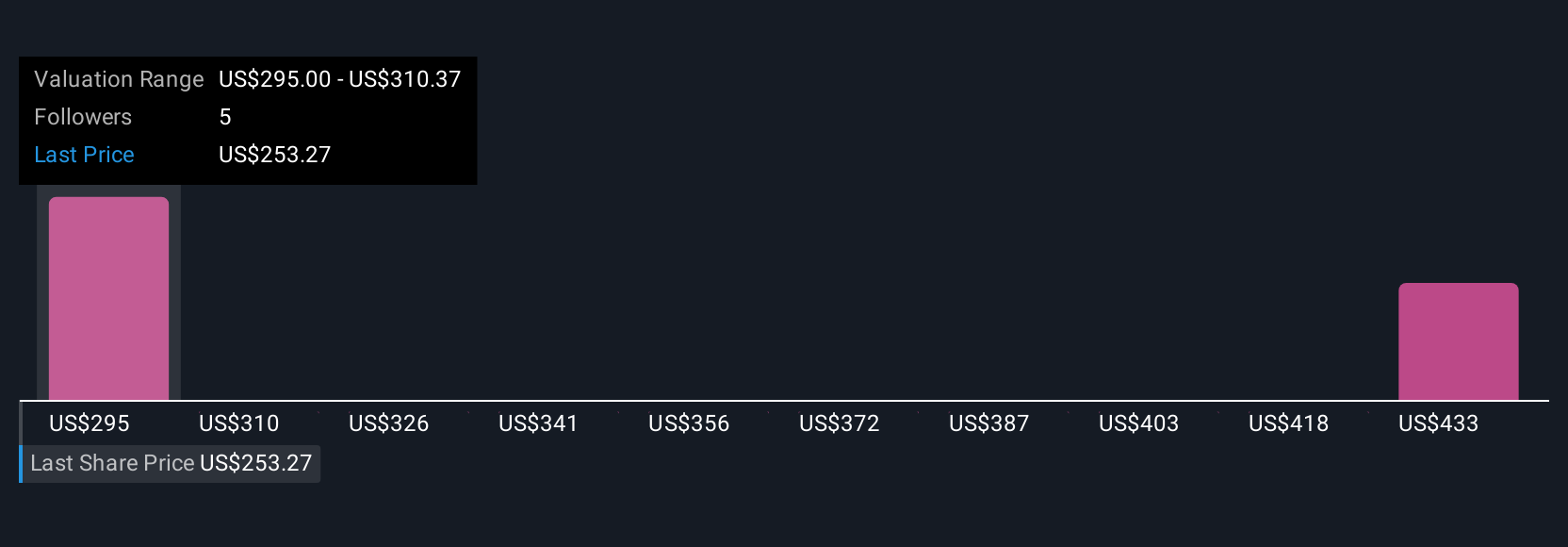

Simply Wall St Community members provided two fair value estimates for JLL ranging from US$301.56 to US$447.77 per share. While you might see opportunity in this spread, keep in mind that a challenging macro environment remains the most critical concern for JLL's revenue reliability, making it essential to weigh multiple perspectives before forming your view.

Explore 2 other fair value estimates on Jones Lang LaSalle - why the stock might be worth as much as 66% more than the current price!

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JLL

Jones Lang LaSalle

Operates as a commercial real estate and investment management company.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives