- United States

- /

- Real Estate

- /

- NYSE:JLL

A Look at JLL’s Valuation as Leadership Shifts Toward AI-Driven Growth in Valuation Services

Reviewed by Simply Wall St

Jones Lang LaSalle (JLL) is making headlines with the appointment of Alexandra Bryant as CEO of Value & Risk Advisory, marking a clear push toward AI-enhanced valuation services. This leadership change signals a fresh chapter for the company’s strategic direction.

See our latest analysis for Jones Lang LaSalle.

The buzz around JLL’s leadership shakeup and major refinancing deal seems to have caught investors’ attention, as momentum has clearly been building. The company’s share price has climbed 27.2% year-to-date, while its total shareholder return hit an impressive 16.1% over the past year. This caps off a robust three- and five-year run that underscores long-term confidence in JLL’s evolution.

If proactive leadership changes at JLL spark your curiosity about market movers, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below analyst targets but boasting double-digit gains this year, are investors looking at an undervalued opportunity, or is the market already factoring in JLL’s next chapter of innovation-led growth?

Most Popular Narrative: 7.7% Undervalued

Jones Lang LaSalle’s most followed narrative suggests a fair value that sits above its last close, highlighting a valuation that is not yet priced in by the market. The narrative’s math brings analyst expectations and business potential into sharp focus.

“Growth in recurring revenue streams and demand for integrated, sustainable real estate solutions are improving revenue visibility, margin stability, and advisory fee potential. Investments in technology, platform efficiency, and targeted M&A strategies are driving operational improvements, margin expansion, and enhanced shareholder returns.”

Curious what’s fueling this bullish perspective? This fair value calculation banks heavily on disciplined growth, surprising efficiency gains, and profit multiples usually seen in fast-moving industries. Want to see the bold forecasts and the real drivers behind this price target? Don’t miss out. Go deeper to uncover what’s anchoring this valuation.

Result: Fair Value of $343.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing exposure to volatile transactional markets and continued moderation in office leasing could present challenges to JLL’s growth story in the near term.

Find out about the key risks to this Jones Lang LaSalle narrative.

Another View: What Do the Numbers Really Suggest?

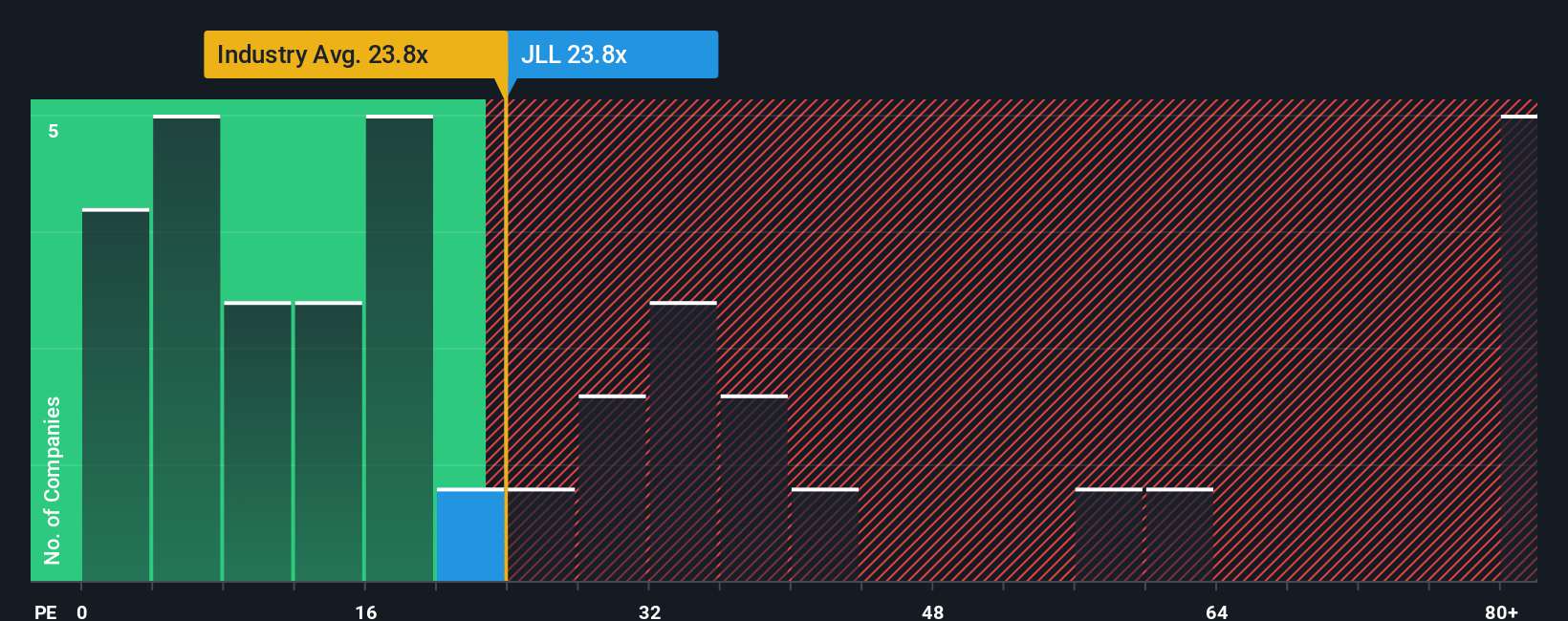

Looking at how the market is pricing JLL using its earnings multiple, we find the shares trading at 26.6 times earnings, higher than both the US real estate industry average of 25.3x and its peer average of 35.5x. However, this remains above the fair ratio of 23.2x, raising valuation risk for investors if the market shifts closer to that number. Do these premiums reflect justified optimism, or could sentiment reverse?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jones Lang LaSalle Narrative

If you have a different perspective or want to chart your own course, you can explore the numbers and craft your personal thesis in just a few minutes with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Jones Lang LaSalle.

Looking for More Investment Ideas?

Smart investors always have their eye on new opportunities. Don’t limit your strategy to just one company. Fresh growth stories are just a click away.

- Lock in steady income by targeting attractive yields with these 17 dividend stocks with yields > 3%, tailored for those who want more from their portfolio.

- Accelerate your potential gains by zeroing in on market favorites with these 872 undervalued stocks based on cash flows, backed by robust fundamentals and promising price points.

- Tap into incredible innovation by investigating breakthrough technology leaders via these 27 AI penny stocks, driving tomorrow’s biggest advances.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JLL

Jones Lang LaSalle

A commercial real estate and investment management company, engages in the buying, building, occupying, managing, and investing in commercial, industrial, hotel, residential, and retail properties in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives