- United States

- /

- Real Estate

- /

- NYSE:DOUG

Smart Sand And 2 Other Intriguing Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. market navigates a mix of tech rallies and ongoing declines in major indices like the S&P 500 and Nasdaq, investors are keeping a close eye on potential opportunities amid economic uncertainties. Penny stocks, often associated with smaller or newer companies, present intriguing prospects despite their reputation as a throwback term. By focusing on those with strong financials and growth potential, these stocks can offer compelling opportunities for investors seeking to explore beyond well-known market giants.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81 | $5.99M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.43 | $75.55M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $145.67M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.75 | $397.36M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.40 | $74.92M | ★★★★★★ |

| Cango (NYSE:CANG) | $3.30 | $346.49M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8515 | $78.16M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.25 | $442.2M | ★★★★☆☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.73 | $12.53M | ★★★★☆☆ |

Click here to see the full list of 767 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Smart Sand (NasdaqGS:SND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Sand, Inc. is an integrated company that excavates, processes, and sells sand for hydraulic fracturing in the U.S. oil and gas industry, with a market cap of $96.47 million.

Operations: The company generates revenue primarily from its Sand segment, which accounts for $303.59 million, and its Smartsystems segment, contributing $7.78 million.

Market Cap: $96.47M

Smart Sand, Inc., with a market cap of US$96.47 million, has shown some financial recovery with fourth-quarter 2024 revenue at US$91.36 million and net income of US$3.74 million, reversing a previous loss. Despite this improvement, earnings have declined by 25.2% annually over the past five years and profit margins remain low at 1%. The company’s debt management is strong with a reduced debt-to-equity ratio and operating cash flow covering its debt well. However, its return on equity is low at 1.2%, and interest coverage remains below optimal levels, indicating ongoing financial challenges amidst its operational improvements.

- Take a closer look at Smart Sand's potential here in our financial health report.

- Learn about Smart Sand's historical performance here.

Douglas Elliman (NYSE:DOUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Douglas Elliman Inc. operates in the United States, focusing on real estate services and property technology investments, with a market cap of approximately $164.96 million.

Operations: Douglas Elliman Inc. has not reported any specific revenue segments.

Market Cap: $164.96M

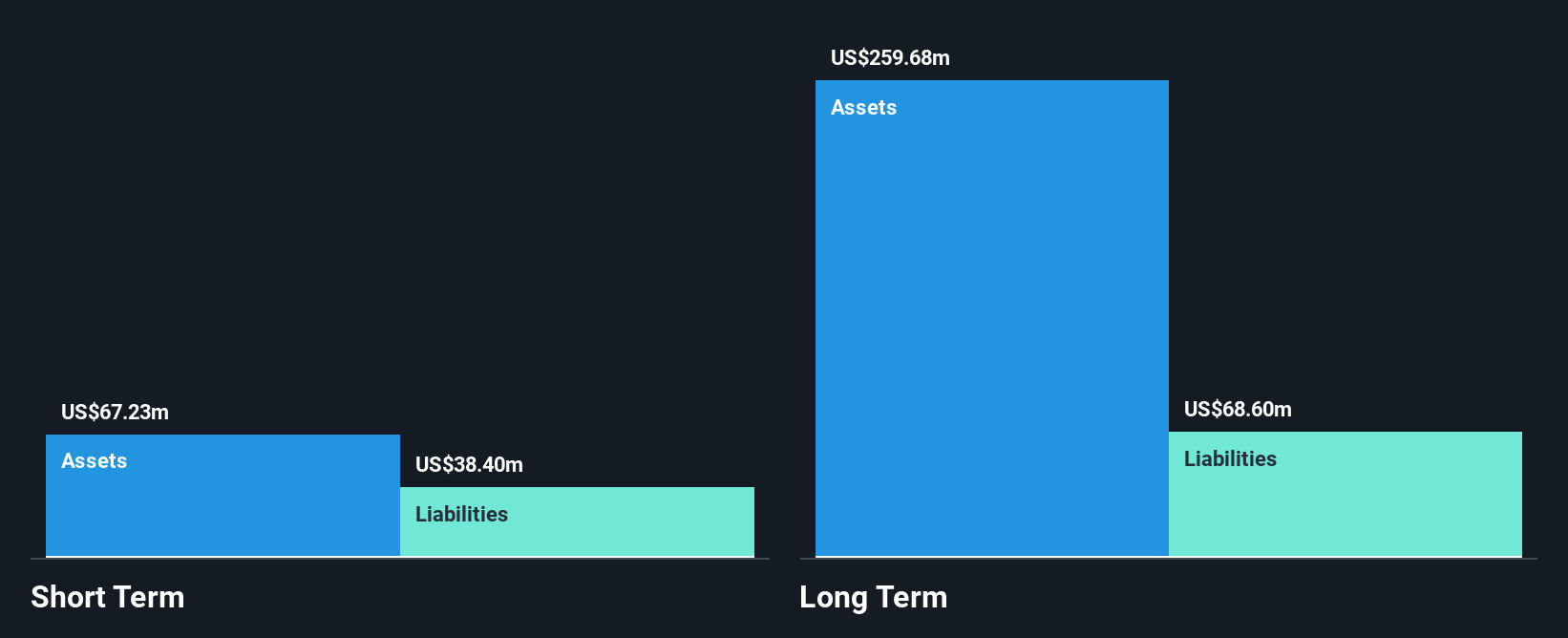

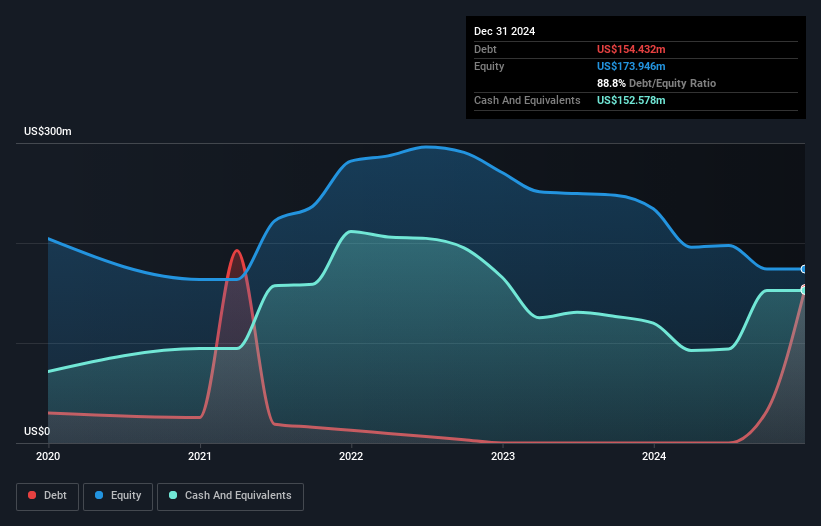

Douglas Elliman Inc., with a market cap of US$164.96 million, has faced financial challenges despite recent revenue growth. For the fourth quarter of 2024, revenues increased to US$243.32 million from US$214.14 million year-over-year, yet the company remains unprofitable with a net loss of US$6 million compared to last year's loss of US$14.84 million. Although its short-term assets exceed short-term liabilities by a significant margin, long-term liabilities remain uncovered by these assets. The management and board are experienced but face hurdles as earnings have declined significantly over five years amidst stable weekly volatility and no shareholder dilution recently reported.

- Unlock comprehensive insights into our analysis of Douglas Elliman stock in this financial health report.

- Gain insights into Douglas Elliman's past trends and performance with our report on the company's historical track record.

Oil States International (NYSE:OIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oil States International, Inc. operates through its subsidiaries to provide engineered capital equipment and consumable products for the energy, industrial, and military sectors globally, with a market cap of $310.66 million.

Operations: Oil States International generates revenue through three segments: Downhole Technologies ($130.79 million), Offshore/Manufactured Products ($397.90 million), and Completion and Production Services ($163.90 million).

Market Cap: $310.66M

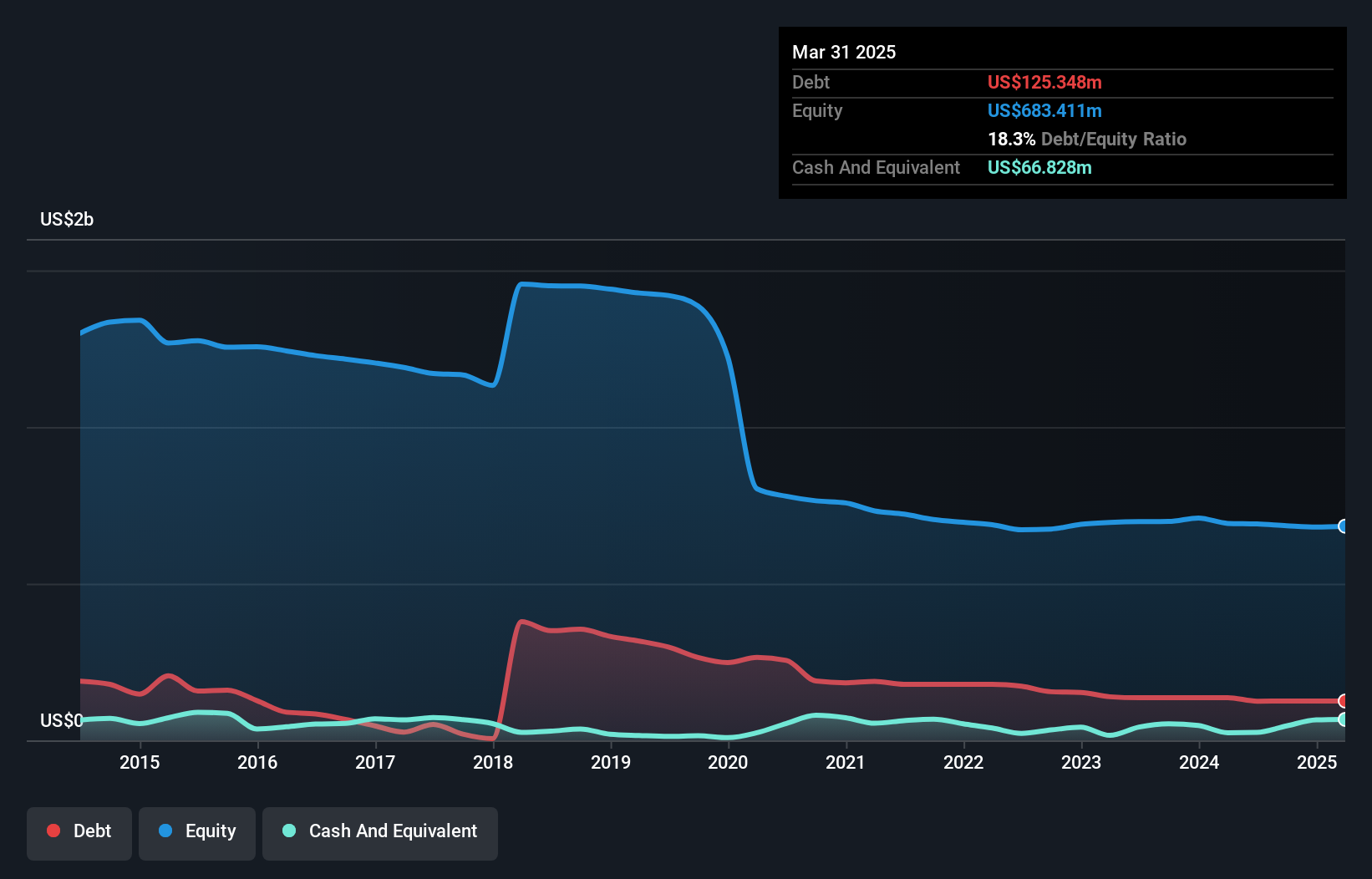

Oil States International, Inc., with a market cap of US$310.66 million, operates across three revenue-generating segments. Despite being unprofitable, the company has shown improvement by reducing losses at 74.5% annually over five years and maintaining a positive free cash flow with a sufficient cash runway for over three years. Recent earnings reveal net income growth to US$15.16 million from US$5.96 million year-over-year, despite a decline in quarterly revenue to US$164.6 million from US$208.27 million previously reported. The company's short-term assets cover both short and long-term liabilities comfortably while its debt levels have decreased over time.

- Dive into the specifics of Oil States International here with our thorough balance sheet health report.

- Explore Oil States International's analyst forecasts in our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 767 US Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOUG

Douglas Elliman

Engages in the real estate services and property technology investment business in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives