- United States

- /

- Real Estate

- /

- NYSE:CWK

Investors Don't See Light At End Of Cushman & Wakefield plc's (NYSE:CWK) Tunnel

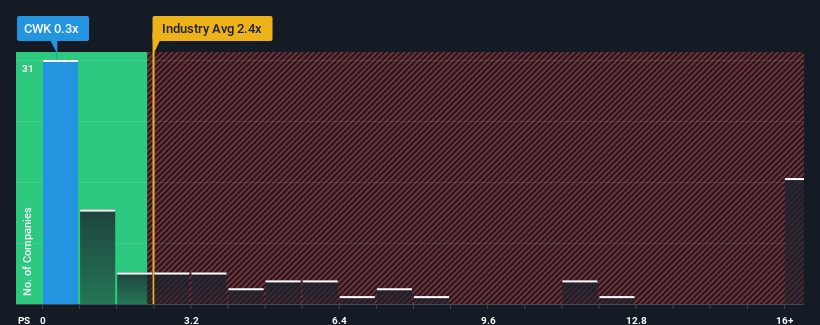

With a price-to-sales (or "P/S") ratio of 0.3x Cushman & Wakefield plc (NYSE:CWK) may be sending very bullish signals at the moment, given that almost half of all the Real Estate companies in the United States have P/S ratios greater than 2.4x and even P/S higher than 8x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cushman & Wakefield

What Does Cushman & Wakefield's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Cushman & Wakefield's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Cushman & Wakefield will help you uncover what's on the horizon.How Is Cushman & Wakefield's Revenue Growth Trending?

Cushman & Wakefield's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 5.9% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 20% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.6% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 12% each year growth forecast for the broader industry.

With this information, we can see why Cushman & Wakefield is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Cushman & Wakefield's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Cushman & Wakefield maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Cushman & Wakefield (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWK

Cushman & Wakefield

Provides commercial real estate services under the Cushman & Wakefield brand in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives