- United States

- /

- Real Estate

- /

- NYSE:COMP

Compass, Inc.'s (NYSE:COMP) Shares Leap 27% Yet They're Still Not Telling The Full Story

Despite an already strong run, Compass, Inc. (NYSE:COMP) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 109% in the last year.

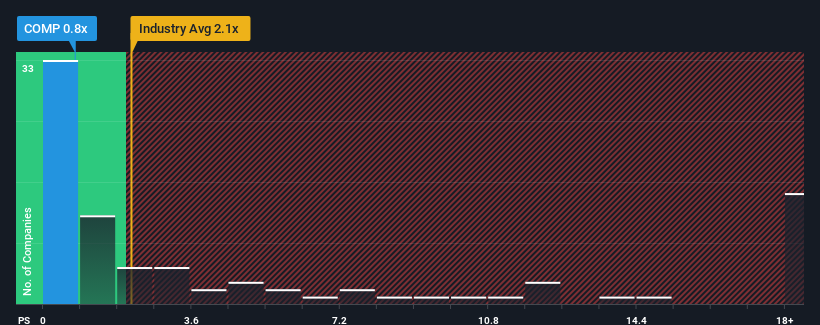

In spite of the firm bounce in price, Compass may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Real Estate industry in the United States have P/S ratios greater than 2.1x and even P/S higher than 10x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Compass

What Does Compass' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Compass has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Compass will help you uncover what's on the horizon.How Is Compass' Revenue Growth Trending?

In order to justify its P/S ratio, Compass would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.2% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 11% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 15% per annum over the next three years. That's shaping up to be materially higher than the 13% per year growth forecast for the broader industry.

In light of this, it's peculiar that Compass' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Compass' P/S

The latest share price surge wasn't enough to lift Compass' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Compass' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Compass that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COMP

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives