- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow (ZG) Valuation Check After Recent 3‑Month Share Price Weakness

Reviewed by Simply Wall St

Zillow Group (ZG) has quietly drifted lower over the past 3 months, even as annual revenue and net income growth stay solidly positive. That disconnect is what makes the stock interesting now.

See our latest analysis for Zillow Group.

Over the past year, Zillow Group’s 1 year total shareholder return of negative 7.39 percent and 90 day share price return of negative 11.12 percent suggest momentum has cooled. However, its 3 year total shareholder return of 111.58 percent shows the longer term growth story is still very much intact.

If Zillow’s recent pullback has you comparing options, it might be a good moment to explore other real estate linked opportunities like fast growing stocks with high insider ownership and see what else is gaining attention.

With Zillow still posting double digit revenue growth and trading at a roughly 30 percent discount to analyst targets, is this recent weakness a mispricing investors can exploit, or is the market already factoring in its next leg of growth?

Most Popular Narrative: 23.2% Undervalued

Based on the most followed narrative, Zillow Group’s fair value of $88.46 sits notably above the last close at $67.96, framing a sizable upside gap.

The shift toward integrated, end to end digital transaction ecosystems (like Zillow 360 and Enhanced Markets) is enabling Zillow to capture more ancillary services revenue (mortgages, rentals, software), reducing dependence on advertising and expanding top line growth as well as supporting EBITDA margin expansion through operational efficiencies.

Want to see how this ecosystem story turns into hard numbers? The narrative leans on aggressive revenue expansion, rising margins, and a punchy future earnings multiple. Curious which assumptions really stretch the valuation, and which look surprisingly conservative? Read on to see what is built into that fair value.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside assumes housing activity holds up, as prolonged affordability pressures or tougher commission rules could still choke lead volumes and agent ad spend.

Find out about the key risks to this Zillow Group narrative.

Another Way to Look at Value

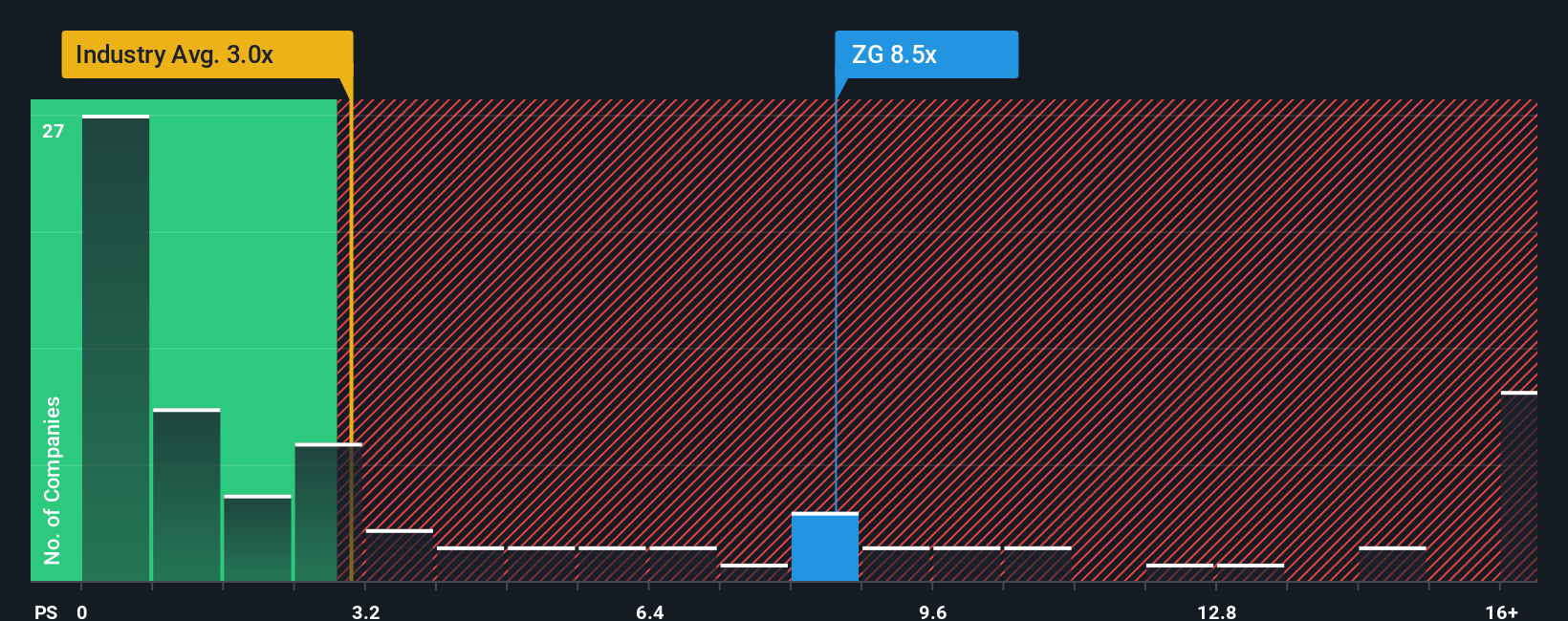

While the narrative points to meaningful upside, a simple price-to-sales check tells a tougher story. Zillow trades at about 6.6 times sales, far richer than the US real estate industry at 2 times, peers at 3.1 times, and even its own fair ratio of 4.7 times. That premium leaves less margin for error if growth stumbles, so is the market already paying up for the next chapter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zillow Group Narrative

If this framework does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Looking for more investment ideas?

Before you move on, you may wish to explore your next opportunity by using the Simply Wall St Screener to pinpoint stocks that match your strategy and risk appetite.

- Identify potential mispricings by targeting companies trading below their intrinsic worth through these 898 undervalued stocks based on cash flows and position yourself for a possible re rating.

- Focus on businesses with reliable payouts via these 10 dividend stocks with yields > 3% and aim to build a portfolio that generates consistent income each quarter.

- Scan equity names tied to blockchain innovation using these 79 cryptocurrency and blockchain stocks to find companies involved with digital asset themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion