- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow Group (ZG): Exploring Valuation After Subtle Share Price Rebound

Reviewed by Kshitija Bhandaru

See our latest analysis for Zillow Group.

Despite Zillow Group's recent 1% bump and some short-term volatility, the company’s longer view paints a distinctly different picture. While the 1-year share price return has been subdued, total shareholder return over the past 12 months sits at a solid 13.4%, with a remarkable 143% total return over three years. That momentum, though off its highs, suggests that investors are weighing Zillow’s rebound potential against evolving industry risks and opportunities.

If you're curious where momentum and insider confidence intersect elsewhere, now is a smart moment to discover fast growing stocks with high insider ownership

With shares still trading roughly 24% below analysts’ targets and recent revenue growth outpacing many rivals, the real question is whether Zillow Group is undervalued at today’s price or if future promise is already fully reflected.

Most Popular Narrative: 20.9% Undervalued

Zillow Group's most widely followed narrative places its fair value at $88.46, which is notably above the last close price of $69.96. The valuation reflects continued confidence in strong fundamental growth drivers and scalable business model enhancements.

The accelerated digital transformation of real estate, combined with Zillow's leading traffic, engagement, and product innovation, including AI-powered tools, integrated communication platforms (Follow Up Boss), and immersive experiences (SkyTour), positions the company to expand market share and drive higher user conversion rates. This is likely to result in above-industry revenue growth and higher monetization per transaction.

What is the secret behind this double-digit upside? Fierce product innovation, a relentless push for higher conversion rates, and strong growth expectations are at the heart of the narrative. Ready to uncover the pivotal financial forecasts and core assumptions fueling this valuation? Explore what could power Zillow's next leap.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low home affordability or additional real estate commission changes could quickly undermine Zillow's growth and cast doubt on this optimistic outlook.

Find out about the key risks to this Zillow Group narrative.

Another View: Multiples Tell a Cautionary Tale

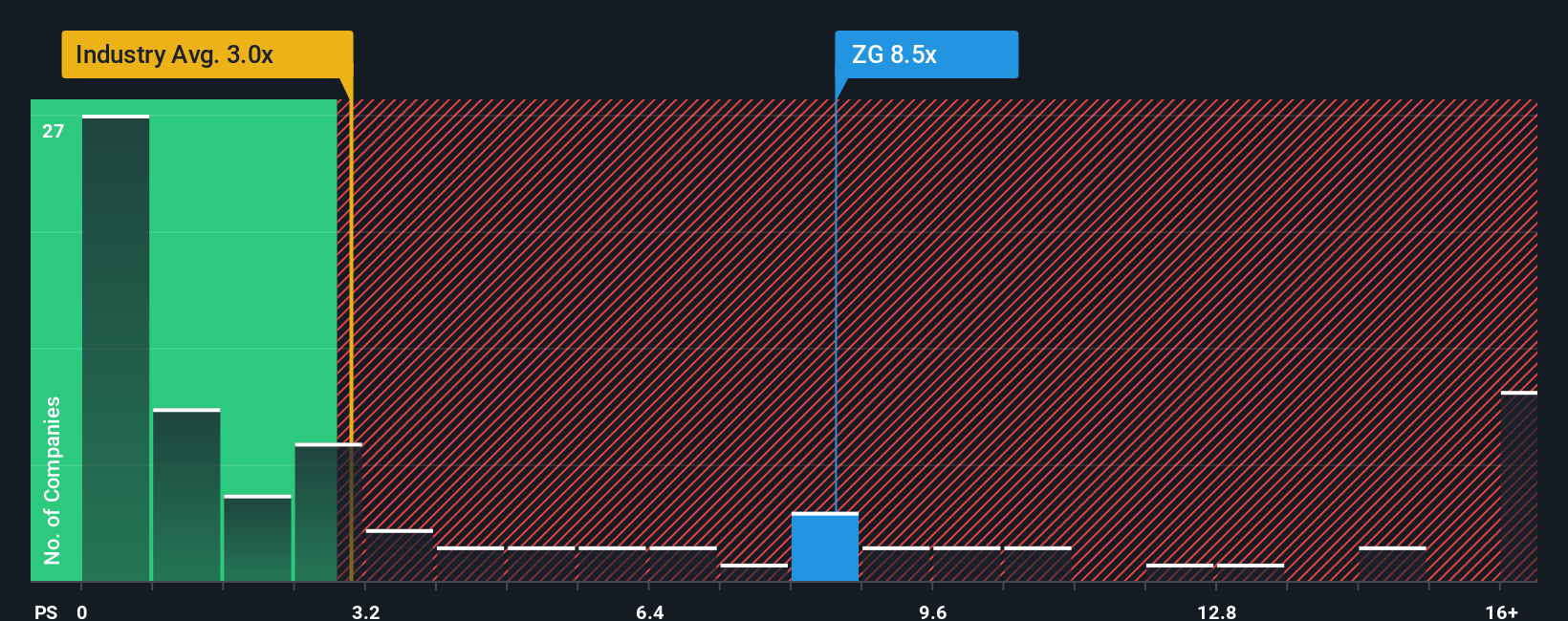

While fair value models see upside, Zillow Group’s price-to-sales ratio stands at 7.1x, which is well above its peer average of 3.6x and the industry average of 3x. The fair ratio points to 4.2x, suggesting the current market price may carry more risk than opportunity. Could a reversion to the mean change the landscape for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zillow Group Narrative

If you have a different perspective or want to dig into the numbers yourself, it takes just a few minutes to build your own view. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Looking for More Investment Ideas?

Smart investors always have fresh opportunities on their radar. Don’t miss out on tomorrow’s growth stories. These powerful screens highlight stocks primed for the next wave of gains.

- Pinpoint stocks with robust cash flows and major upside by tapping into these 870 undervalued stocks based on cash flows for undervalued opportunities others may be overlooking.

- Jump ahead of the innovation curve with exposure to cutting-edge health and artificial intelligence trends through these 33 healthcare AI stocks.

- Tap into digital finance disruption by tracking movers and shakers in the market via these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives