- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

Zillow Group (ZG): Assessing Valuation Following Strong Q3 Earnings and Upbeat Guidance

Reviewed by Simply Wall St

Zillow Group (ZG) just posted its third-quarter earnings, revealing a swing to profitability and double-digit revenue growth compared to last year. The company also reaffirmed full-year guidance and shared a positive outlook for the upcoming quarter.

See our latest analysis for Zillow Group.

After a year marked by new features and steady innovation, Zillow Group’s financial momentum appears to be catching the market’s eye. The stock is now trading at $70.81, with a modest 2.79% share price return over the past month, while the latest earnings are fueling talk of an uptick in longer-term growth. Despite some choppy periods, Zillow’s three-year total shareholder return stands out at 88.9%, which is well ahead of its five-year track record and hints that momentum may be rebuilding after earlier setbacks.

If you’re sizing up what else is gaining traction after strong earnings seasons, now could be the moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and recent financial results beating expectations, investors now face a crucial question: is Zillow Group undervalued with more room to run, or has the market already priced in all of its future growth?

Most Popular Narrative: 20% Undervalued

Zillow Group’s most followed narrative pegs its fair value at $88.46, well above the recent $70.81 close. This strong upside view hinges on the company’s ability to convert digital innovation into real financial gains over the coming years and suggests significant growth potential if ambitious new initiatives deliver results.

“The accelerated digital transformation of real estate, combined with Zillow's leading traffic, engagement, and product innovation, including AI-powered tools, integrated communication platforms, and immersive experiences, positions the company to expand market share and drive higher user conversion rates. This is likely to result in above-industry revenue growth and higher monetization per transaction.”

Curious how Zillow Group’s high fair value is justified? Underneath the bullish outlook are bold assumptions about rising conversion rates, expanding profit margins, and a lucrative shift toward new revenue streams. Discover which financial leaps analysts are betting on, and read the full narrative for the provocative details behind this premium valuation.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory challenges in real estate commissions and fierce competition from alternative tech platforms could quickly alter Zillow’s growth outlook.

Find out about the key risks to this Zillow Group narrative.

Another View: Multiples Tell a Different Story

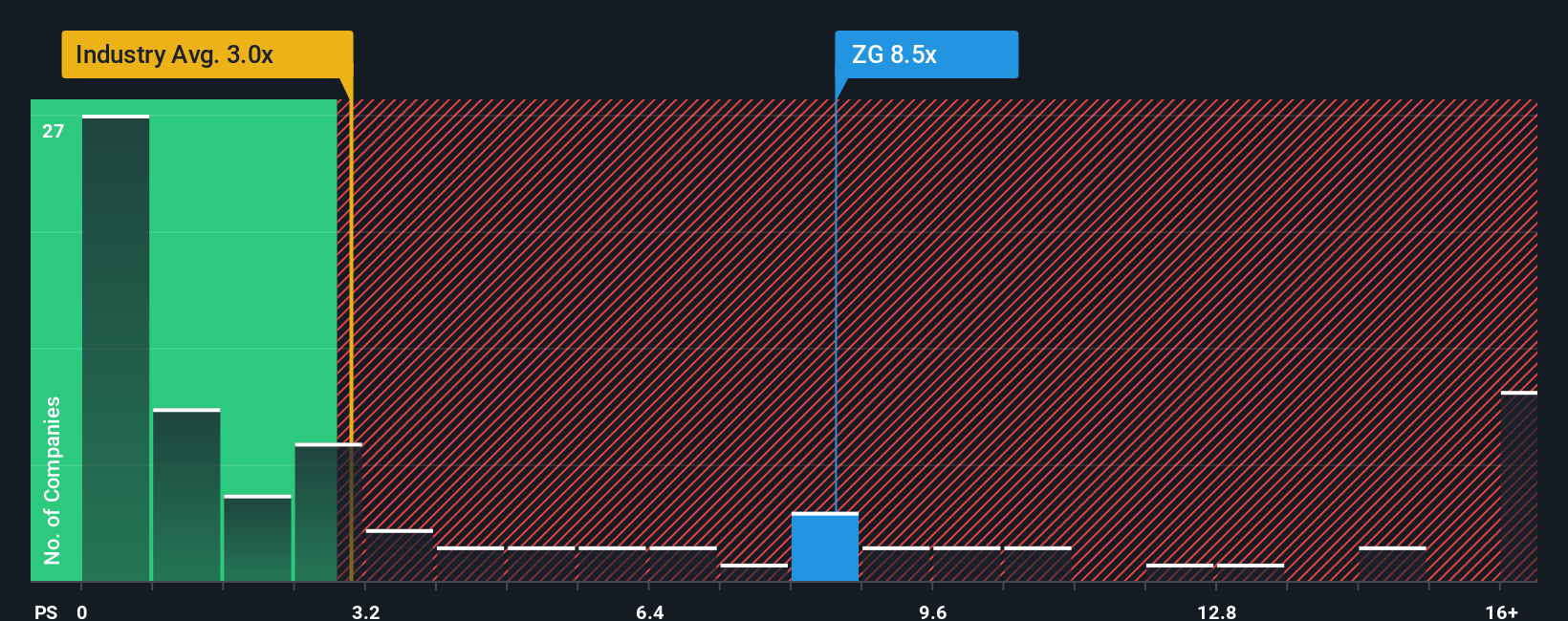

While many see Zillow Group as a bargain based on fair value models, its current price-to-sales ratio sits high at 6.9x. That is sharply above both its peer average of 3.1x and the US real estate industry average of 2.7x, and even higher than a so-called fair ratio of 4x. Such a premium could signal valuation risk if investor expectations falter, raising the question: is the market too optimistic about Zillow’s future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zillow Group Narrative

If you have a different take or want to go hands-on with the numbers and insights, it's easy to build your own view and see where it leads. You can do it yourself in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Looking for more investment ideas?

Smart investing means spotting fresh opportunities before the crowd. Why settle for just one great pick when you could discover new winners ready for attention?

- Uncover high-yield potential by scanning these 16 dividend stocks with yields > 3% with solid returns and strong payouts for informed investors.

- Ride the next wave of innovation by targeting these 24 AI penny stocks that are reshaping industries with machine learning and advanced automation breakthroughs.

- Tap into attractive valuations and seize opportunities by seeking out these 870 undervalued stocks based on cash flows that the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives