- United States

- /

- Real Estate

- /

- NasdaqGS:RDFN

Even With A 35% Surge, Cautious Investors Are Not Rewarding Redfin Corporation's (NASDAQ:RDFN) Performance Completely

Despite an already strong run, Redfin Corporation (NASDAQ:RDFN) shares have been powering on, with a gain of 35% in the last thirty days. But the last month did very little to improve the 50% share price decline over the last year.

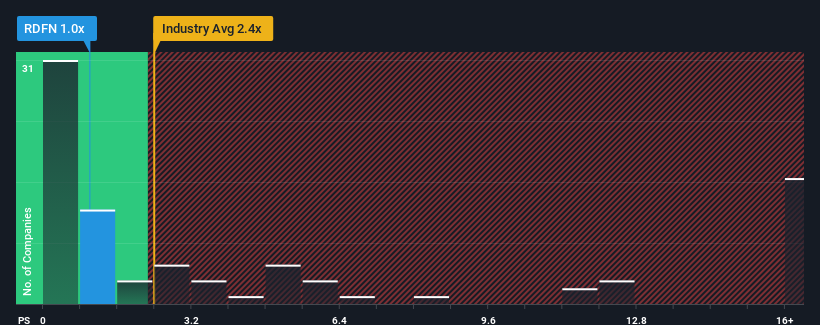

Even after such a large jump in price, Redfin's price-to-sales (or "P/S") ratio of 1x might still make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 2.4x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Redfin

How Redfin Has Been Performing

Redfin hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Redfin will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Redfin's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.4% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 11% each year, which is not materially different.

With this information, we find it odd that Redfin is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Redfin's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Redfin's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 3 warning signs for Redfin (1 can't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RDFN

Redfin

Operates as a residential real estate brokerage company in the United States and Canada.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives